If you manage a subscription-based business, then “churn” is always on your mind. Churn is the rate at which you are losing subscribers over a given period of time, and the results of your churn calculation can help you stay up to date on your business’ overall performance. There are two types of churn: voluntary and involuntary. While many people focus on voluntary churn, involuntary churn is just as important. Here are some essential things you need to know about involuntary churn and strategies for reducing it.

Why You Should Focus on Involuntary Churn

Involuntary churn occurs when you lose a customer due to a transaction failure and their subscription is not renewed as a result. This can happen because of an expired card, a payment decline, or a subscriber’s bank blocking the transaction. It is important to focus on involuntary churn because these customers aren’t intentionally choosing to end their subscriptions. They might not even know the renewal failed and their payment was declined. That’s why you need a subscription management platform that can help you reduce the amount of involuntary churn your business faces. Unmitigated involuntary churn can cost your business a lot of money, but implementing the right strategies can help you reduce unnecessary overhead.

Ways You Can Reduce Involuntary Churn

When you partner with the right subscription management platforms, you will have access to various involuntary churn reduction techniques. Here are three of the main strategies and how they can help your business.

Intelligent Retries

Sometimes, all it takes is a second try. The right subscription management platform will automatically retry renewal payments under certain conditions. With access to years of data from thousands of transactions, an intelligent retry system can draw upon past failures and predict how and when to retry the current card the subscriber has on file. This can automatically reduce the amount of involuntary churn your business experiences.

Dunning Campaigns

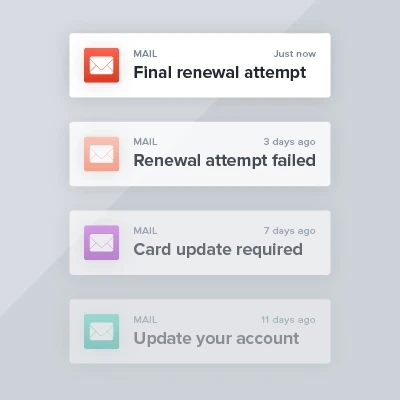

A customized and personal dunning campaign can help bring subscribers back into the fold after multiple failed retries. Dunning simply refers to the process of contacting customers to notify them that their payment was not processed. This is key when a subscriber is unaware that their payment failed. Even if they were aware, your personalized dunning campaign could help remind them to update their card information so they don’t lose the benefits of their subscription.

Prevention Measures

Preventing involuntary churn can be just as effective as addressing it after the fact. An account updater tool can do wonders for your prevention strategy. A subscription management platform that works with major card companies to keep payment information up to date with every change can help prevent payment declines and decrease involuntary churn.

The Opportunity Involuntary Churn Presents

It makes sense to focus on voluntary churn—you want to understand why customers choose to cancel their subscriptions and how you can solve that problem. However, you don’t have to neglect addressing involuntary churn at the same time. The opportunity that involuntary churn presents is hard to deny. It’s a simple and straightforward way to increase your growth and revenue. If you can prevent transaction failures and card declines, you can help improve the overall success of your business.

About Recurly

With more businesses introducing subscription-based models every day, you need help standing out. That’s why you should consider partnering with Recurly. With over a decade of experience, Recurly is a subscription management and billing platform that can help you streamline and grow your business. They can help you keep up with the latest innovations in the world of recurring billing. With all their smart tools, you can successfully implement and manage a dynamic subscription system for your business. Recurly has helped manage over 40 million subscriptions across a wide variety of industries. Whether you own a growing SaaS company or want to introduce a subscription option to your beauty brand, Recurly can help. From testing alternative pricing models to payment gateway integrations, Recurly makes it easier than ever to build a thriving subscription-based business.

Get access to the tools you need to address involuntary churn at https://recurly.com/

Original Source: https://bit.ly/3HysoUv

3 Important Aspects of Reducing Involuntary Churn