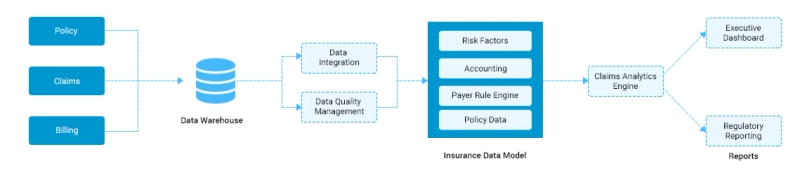

Big data is a massive volume of data that includes organized and unorganized data that a business receives on a large scale. It can be mined for knowledge and insight that will lead to improved judgments and smart business-related decisions. A health insurance policy jumps in the scenario when the insured gets hospitalized and incurs fees-related expenses. It is considered a health insurance analytics if the health insurance plan reimburses the hospitalization or medical expenditures. The healthcare industry has been facing issues related to data management due to Big Data factors such as volume, velocity, diversity, and validity. Hence, health systems have increasingly embraced technology to collect, store, and analyze this data to provide meaningful insights. Big data is used in the digital health industry to describe data science approaches used to collect and analyze big and complex datasets to enhance patient care outcomes and optimize Insurance Claims-related operations. Increased operational performance, enhanced care and treatment, determining the best therapy for illnesses, tailored and integrated communication and improved access to critical information influence the big data industry in the healthcare sector. Here\'s why the healthcare sector must adopt Insurance Claim Analytics Solutions to manage the existing big data : Predictive Analysis: Predictive analytics in insurance analytics would allow for the real-time exchange of settlement information. This analyzes previous claims\' data from several insurance provider firms and generates reliable statistics of the generated claims to aid traders in decision-making. Digital Interface: Insurance claim analytics solutions can help with digitalization and data-driven projects that aim to enhance operations, customer interactions, and regulatory compliance. With the assistance of insurance analytics, all of this data can be evaluated and utilized to produce reports. Contributory Database: A contributory database in insurance claim data refers to the health informatics collection provided by insurance market participants to a central repository shared among the contributors. Medical insurance claim businesses contain data, policies, terms, and conditions, and market trends, which may be further used to analyze company issues and acquire raw insights that previously appeared challenging to address. Fraud Detection: Health insurance fraud is defined as a circumstance in which an insured or a medical service provider provides the insurer with incorrect or misleading information to gain benefits under a policyholder\'s policy. Insurance analytics solutions may forecast probable fraud using fraud detection software, allowing essential measures to be done on time, thereby enhancing insurance claim analytics. Medical Loss Ratio: The loss ratio is the ratio of healthcare claims paid to premiums received. The insured must maintain an appropriate loss ratio or face non-renewal of insurance, or increase the price for the cover. Insurance analytics put insurance companies in a stronger position for self-assessment, allowing them to calculate losses or prospective losses in their policies utilizing our proprietary medical claim analytics. CONCLUSION: The volume of health data is expected to skyrocket in the coming years; even though analytics adds a lot to the table, healthcare companies must ensure that their data is handled correctly. Big Data in healthcare has unique features such as diversity, adequacy, promptness and endurance, confidentiality, and administration. Unfortunately, these qualities present various obstacles to data storage, processing, and sharing to support health-related studies. Thus, the healthcare business must exercise extreme caution whenever dealing with sensitive data, including patient data. Not only may information leaking be costly to healthcare organizations, but it is also immoral to divulge data without prior consent.

5 Ways Big Data Analytics can help improve Insurance Claims Data