Having a solid financial future depends on making prudent investments. Section 54EC Bonds are one such investment option that has attracted much interest recently. Those wishing to invest in a safe and dependable financial product while avoiding capital gains tax will find these bonds very appealing. We will go into great detail about Section 54EC bonds in this extensive guide, including their definition, advantages, qualifying requirements, and potential investment portfolio suitability.

What are Section 54EC Bonds?

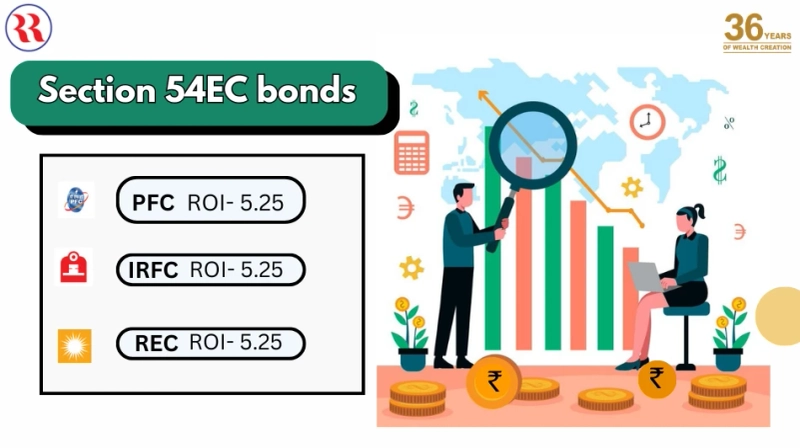

A particular kind of fixed-income investment called Section 54EC bonds is made to assist people in reducing their capital gains tax obligations. The Indian Income Tax Act states that a person must pay capital gains tax on the profit they make on the sale of a long-term capital asset, such as real estate or shares. However, by investing the gains in designated bonds issued by organizations like the Rural Electrification Corporation (REC) or the National Highways Authority of India (NHAI), Section 54EC offers a mechanism to postpone or avoid paying this tax.

Key Features of Section 54EC Bonds

1. Exemption from Long-Term Capital Gains Tax: This is the main advantage of purchasing Section 54EC bonds for investors. It’s a tax-efficient investment strategy because investors can postpone paying taxes by reinvesting capital gains in these bonds.

2. Tenure: There is a five-year lock-in period for the bonds. This indicates that the investment will be locked for five years after the purchase date, during which it will not be able to be redeemed.

3. Interest Rate: The interest rate for Section 54EC bonds is normally between five and six percent annually. Annually due and completely taxable in the investor’s name, the interest is payable.

4. Investment Limit: In a fiscal year, an individual may invest a maximum of Rs. 50 lakhs in Section 54EC bonds. This cap guarantees that investors will be able to seek a tax exemption on significant capital gains.

5. Transferability: Before the expiration of the lock-in term, these bonds cannot be sold or transferred to another person because they are neither tradeable nor transferable.

Visit our website to learn about the 54EC Capital Gain Bonds

Eligibility Criteria for Investing in Section 54EC Bonds

Section 54EC bonds are available for purchase by any individual or Hindu Undivided Family (HUF) who has realized long-term financial gains from the sale of assets like shares, real estate, or gold. To take advantage of the tax exemption, investments in these bonds must be made within six months after the capital asset transfer date.

Benefits of Investing in Section 54EC Bonds

1. Tax Savings: The capacity to reduce long-term capital gains tax is the main benefit of Section 54EC bonds. They are therefore a desirable choice for people trying to reduce their tax obligations.

2. Safety and Security: These bonds have a high level of safety and security because they are issued by government-backed organizations like REC and NHAI. As a result, the investment’s risk is decreased.

3. Fixed Returns: Section 54EC bonds give investors a steady revenue stream because they have a fixed interest rate. For individuals looking for a steady and dependable return on their investment, this might be quite helpful.

4. Easy Investment Procedure: Purchasing Section 54EC bonds is a simple procedure. Investors can easily obtain them because they can be bought through approved banks and post offices.

Considerations Before Investing in Section 54EC Bonds

Although Section 54EC bonds have many advantages, investors should be aware of the following:

1. Lock-In term: Your investment will be locked in for a considerable amount of time during the five-year lock-in term. Your liquidity and financial flexibility may be impacted by this.

2. Taxable Interest: These bonds’ interest is subject to full taxation. For this reason, while figuring up the total returns on your investment, you must account for the tax implications.

3. Interest Rate: Compared to alternative investment options, Section 54EC bonds may have a lower interest rate. It’s critical to determine if the tax savings justify the possibility of lesser profits.

4. Limited Investment Amount: For individuals who have made significant capital gains, the Rs. A 50 lakh investment limit might not be enough. Higher-gain investors might need to look into other tax-saving options.

How to Invest in Section 54EC Bonds

Purchasing Section 54EC bonds is an easy and straightforward procedure. The steps to begin going are as follows:

1. Name of Issuer: REC and NHAI are the issuers of Section 54EC bonds. Depending on your availability and preferences, select the issuer.

2. Approach Licensed Banks or Post Offices: Licensed banks and post offices are the places where you can buy these bonds. To begin the investment procedure, go to the closest branch or office.

3. Fill out the application: Complete the application form by providing the necessary information, such as your PAN, personal details, and the specifics of the capital gains.

4. Provide Required Documents: You must submit the application form and any necessary supporting documentation, including a copy of the capital gains computation and evidence of identification and address.

5. Make the Payment: A demand draft or check can be used to cover the investment amount. Make sure the money is transferred within six months of the capital asset’s transfer date.

6. Get a Bond Certificate: As evidence of your investment, you will receive a bond certificate after your application has been processed successfully.

Final Thoughts:

A special and beneficial method of avoiding long-term capital gains tax while investing in a safe financial product is through Section 54EC bonds. These bonds have the potential to be a vital component of a well-diversified investment portfolio due to their safety, tax advantages, and consistent returns. Before choosing an option, it is imperative to take the lock-in time, taxable interest, and investment limitations into account. Through comprehension of the characteristics and advantages of Section 54EC bonds, investors can make well-informed decisions that correspond with their financial aspirations.

Our goal at RR Finance is to guide you through the challenges of investing and financial planning. Please contact our team of specialists if you have any concerns or need help investing in Section 54EC bonds. Our top goal is your financial well-being, and we are here to support you at every turn.