Most small and medium businesses may be trying to discover the most powerful secret weapon of large-scale businesses or successful entrepreneurs. So, in this article, learn about the secret weapon of successful companies. This article delves into how successful businesses use automated bookkeeping as their most powerful and secret weapon in managing all their financial data. Discover the power of automated bookkeeping solutions and how to use limited budgets and resources for long-term business growth. The swift advancement in technology is increasing the competition between so many businesses, so it’s essential to utilize AI-powered software smartly in financial management.

News Report:

According to a report of USA accounting statistics, 75% of financial management tasks can be automated by using cloud-based software or outsourcing automated bookkeeping services. The global market of automated bookkeeping and accounting software can be estimated to have a value of 12 billion dollars by 2026, which means every year it’s growing at the expansion rate of 8.6%.

Why Automated Bookkeeping Is The Most Powerful Weapon?

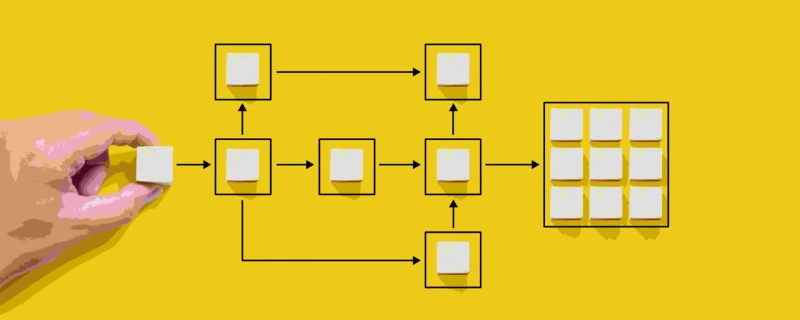

An automated bookkeeping system is the most powerful weapon for large-scale industries and successful entrepreneurs in many ways. AI-powered software and automated bookkeeping is more adaptable than traditional bookkeeping processes. Automated bookkeeping solutions can adapt to changes in financial management with business growth and help create up-to-date financial data reports and records. The following are the benefits that most of the smart business owners take from automated bookkeeping and tax services:

Creates more reliable financial data records and reportsDirects access to financial management data Helps with enhancing data securitySmart ReconciliationHelps with better decision-makingImproved Reliability In The Data

Nowadays, it’s really essential to have reliability in businesses. For this reason, the first priority of that company should be reliability by winning the trust. Now, businesses would be wondering how to win the client’s trust. The answer to this question is that they can win their client’s trust and manage their finances with the most innovative method: outsourcing automated bookkeeping solutions.

Why Should Businesses Outsource The Automated Bookkeeping Solutions?

Businesses can manage their finances internally by training the employees, but that can be more risky, It requires more time, resources and budget to train the employees for financial management. There are also chances that they do not know about the proper working automated bookkeeping system or cloud-based software, which can generate errors and result in tax penalties.

However, outsourcing the automated bookkeeping service providers from a reputable firm can be beneficial. Those firms have teams of highly skilled professionals in financial management who know how to manage finances and the proper use of cloud-based software. This means more reliability in the financial data, reports and records with fewer or no errors in it. So, that’s how investing in outsourcing the automated bookkeeping service providers can help with long-term business growth.

Direct Access To Financial Data

Entrepreneurs and customers must have direct access to financial management and personal financial data, respectively. Having this kind of transparency with proper security can give more reliability, which is only possible by embracing an automated invoicing and bookkeeping system.

Financial Data Security

Businesses can face significant loss without proper security for their financial data, records and reports. Traditional bookkeeping accounting processes, in which all the financial tasks are manually operated, can be more threatful regarding data security. With an automated bookkeeping system, this threat can be reduced with more security measures by using AI-powered cloud-based software.

Smart Reconciliation

Automated bookkeeping solutions help with creating more accurate and up-to-date reconciliation reports. It includes payrolls, tax and transaction reconciliation reports and records according to the required formats.

Improves Decision Making

By getting more accuracy and reliability in the financial management data, reports and records, it gets easier for entrepreneurs to improve or make better decisions for their company, which can be helpful in making more profits with fewer investments.

Conclusion

By empowering automated bookkeeping solutions, small-medium businesses can make themselves the competitors of large-scale industries or big companies. Successful entrepreneurs or businesses also use automated invoicing and bookkeeping systems as their powerful secret weapon to manage their organization’s finances. Not only this, in fact, most of the business owners or finance managers have outsourced the automated bookkeeping services. To get more reliability by reducing errors and earning more profits by investing fewer resources and budget for long-term business growth.