Disclaimer: This is a user generated content submitted by a member of the WriteUpCafe Community. The views and writings here reflect that of the author and not of WriteUpCafe. If you have any complaints regarding this post kindly report it to us.

With the introduction of online lending apps, it has become extremely easy and hassle-free to apply for an instant loan. Also, there was a drastic increment in digital transactions in the past two years of the deadly virus. While availing of loans online is fast and convenient, it is also associated with many types of fraud and cheating. The below-mentioned information will help you understand online frauds and how to protect yourself from these frauds.

Red Flags that Tell You About the Fraud Loan App

To stay safe from frauds, you must check for the red flags like:

- Calls, messages, and WhatsApp communication are the most common ways in which fraudsters can gain personal information from customers.

- The fraudsters’ main concern is to avail personal and financial details. Therefore, they focus less on inquiring about the customer's credit history or credit score.

- They will demand various fees and advances before starting the loan application process. Moreover, these fees are charged after the loan application is approved. Thus, you must ensure that you do not pay these charges well in advance of loan application acceptance.

- The fraudsters will not give you time to think with their limited period offer. For applying for an online personal loan, you must take due time and think properly.

- They will deny sharing the registered address or any other information.

Techniques to Prevent online Loan Scam

- Do not disclose your private information. Banks or NBFCs will never ask about your financial details over the phone calls; therefore, never disclose them on calls.

- To apply for a personal loan, use only verified apps and websites. Before applying for a loan, you must check whether the loan app is registered with RBI or not. Always use a verified platform.

- Beware of phishing calls, SMS, or emails containing fraudulent links, as these can cause you huge financial loss and can breach your privacy.

- Using an unsecured internet connection is not recommended as these can record your details, PINs, and passwords for the loans that will help scammers.

Are you wondering how to stay alert from these online scams? If yes, keep scrolling:

- You must understand the loan fraud reports in detail and stay alert from all such mishaps that can occur with you.

- Never share personal information like PIN or passwords or OTP over chat, calls, or emails.

- Keep changing your pin and password after a certain interval.

- You must check your credit score once a month to know if someone exploits your details for any financial advantages. The details will be reflected in that credit report, and you can correct them.

- Permit two-step verification for all your accounts.

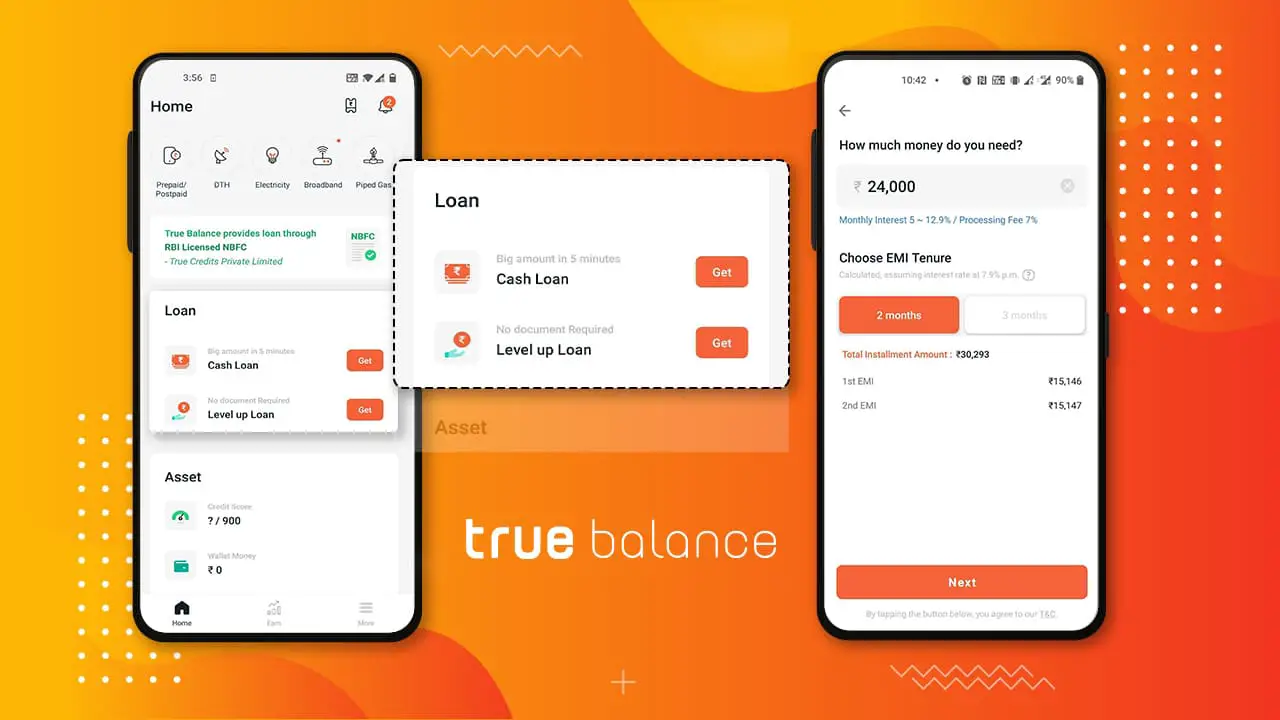

- If you are looking for a secured and reliable personal loan online, you must choose top lenders like TrueBalance to stay away from fraud. The app is registered with RBI and follows its rules and regulations. The loan application process of TrueBalance is short and simple; thus, anyone can apply for an instant personal loan at any hour of the day from this loan app. So don't just beat around the bush; download the TrueBalance loan app and stay safe and stress-free.