Introduction: In an era of rapid technological evolution, the automotive and tech industries are increasingly intersecting. This convergence is largely facilitated by mergers and acquisitions (M&A), driving innovation and reshaping market dynamics. This blog explores how M&A is uniting these two pivotal sectors, with a focus on M&A advisory services and automotive inventory management.

1. The Catalysts for M&A in Automotive and Tech: The primary drivers of M&A activity between the automotive and tech sectors include the need for advanced technology in vehicle manufacturing, such as AI-driven automation, electric vehicle (EV) technology, and connected car features. As automotive companies strive to keep up with these tech advancements, acquiring tech companies becomes a strategic move to gain competitive edge and expertise quickly.

2. Role of M&A Advisory Services: M&A advisory services are crucial in navigating the complexities of these high-stakes transactions. Advisors provide expert guidance on due diligence, valuation, and negotiation strategies, ensuring that deals align with strategic goals. Their insights are vital in assessing tech firms’ capabilities, potential synergies, and integration challenges, thus facilitating smoother mergers or acquisitions.

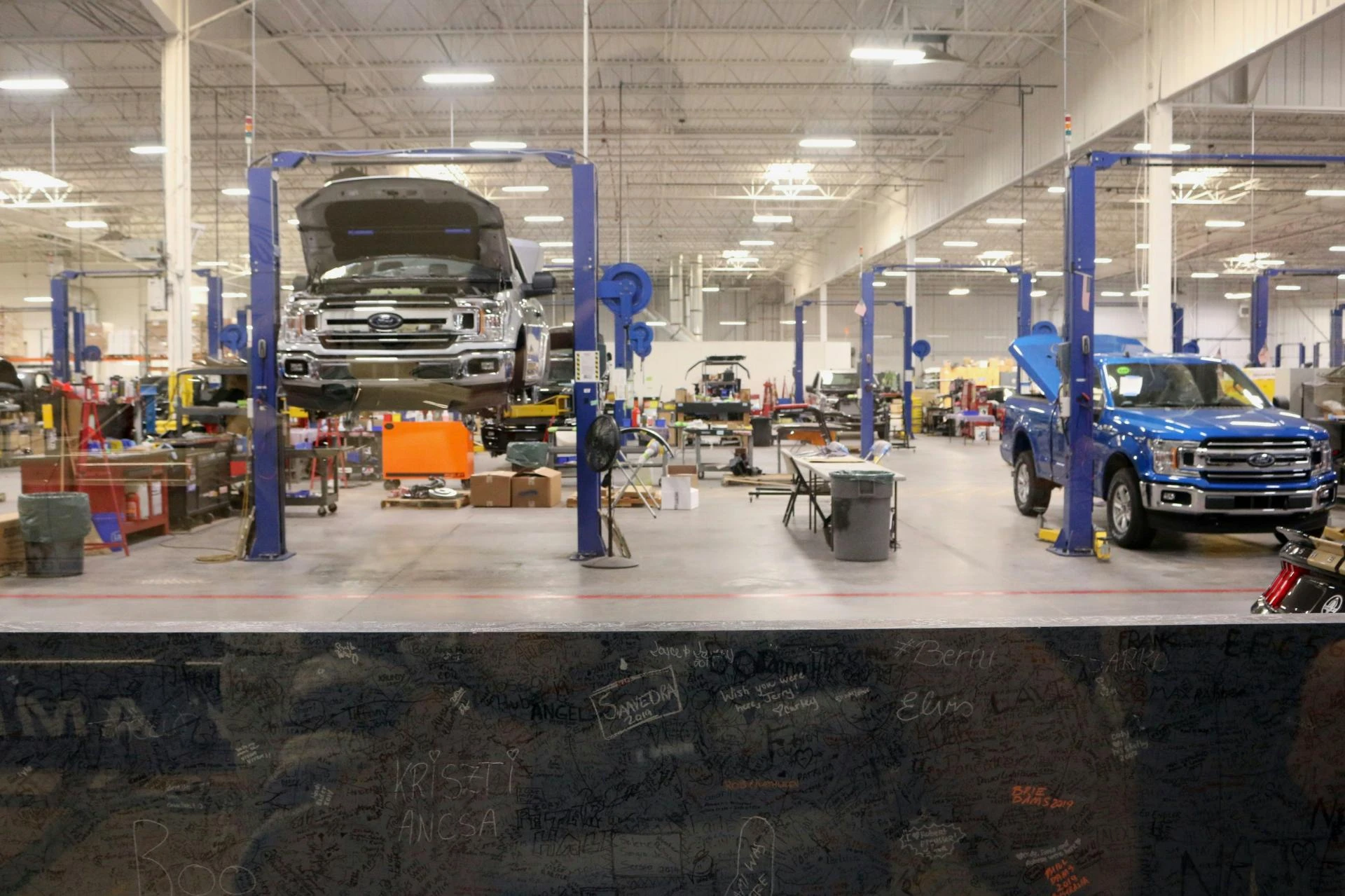

3. Impact on Automotive Inventory Management: Integrating tech solutions through M&A allows automotive companies to revolutionize their inventory management systems. By leveraging technologies like IoT, AI, and blockchain, companies can achieve greater transparency, efficiency, and accuracy in inventory tracking and management. This not only reduces overhead costs but also enhances supply chain responsiveness, crucial for meeting consumer demands in a fast-evolving market.

4. Case Studies: Several successful mergers highlight the trend:

- Example 1: A major automotive firm acquired a tech startup specializing in AI-based inventory management solutions, resulting in a 30% reduction in logistic costs and improved parts availability.

- Example 2: Another case involved a tech company known for its advanced analytics platforms merging with an automotive leader to enhance data-driven decision-making processes in inventory management.

5. Challenges and Considerations: Despite the benefits, merging tech and automotive entities comes with challenges, such as cultural integration, aligning IT systems, and managing expectations. Companies must address these potential hurdles head-on to ensure that the merged entities can operate harmoniously and realize the full potential of their combined capabilities.

Conclusion: The fusion of automotive and tech sectors through M&A is not just about acquisition but a strategic evolution. As companies continue to embrace these opportunities, the role of M&A advisory services becomes more critical in ensuring successful integrations. With advanced automotive inventory management systems powered by tech, the future of automotive is set to be more efficient, responsive, and innovative. The synergy between these industries heralds a new era of automotive excellence, driven by technology and strategic mergers and acquisitions.