Blockchain Insurance Market – Key Trends, Drivers, Product Benchmarking, and Competitive Landscape.

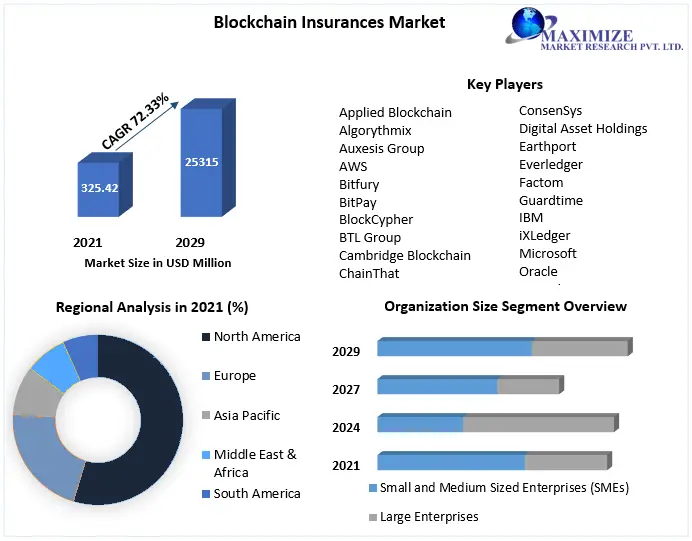

was valued at USD 325.42 Million in 2021, and it is expected to reach USD 25315.55 Million by 2029, exhibiting a CAGR of 72.33% during the forecast period (2022-2029)

The study looks at 34 countries that travel industry experts believe to be desirable travel destinations. Based on their expected investment needs, dominance in certain geographic industries, and worldwide reach, top corporations are chosen for benchmarking and profiling. The entire market impact of each regional, global, and local rival has been considered.

Request for free broacher: https://www.maximizemarketresearch.com/request-sample/11489

Blockchain Insurance Market Overview:

The Blockchain Insurance Market report offers a thorough analysis of the opposition, together with information on market share and company profiles for the leading foreign rivals. The scope of the study includes a full examination of the Blockchain Insurance Market as well as the factors influencing regional variations in the growth of the sector.

It was possible to calculate the total market size by segments and nations by performing a micro level analysis of each country. Using a bottom-up approach, the sizes of the regional and global markets are estimated. It is possible to ascertain what percentage of the overall market the unorganised market makes up by micro-analysing each nation. The market's drivers, restrictions, and possibilities must be thoroughly investigated by the business structure. After that, the findings are verified by talking to well-known local businessmen. The secondary inquiry and analysis of the same uses data from both for-profit and open-source sources. Data about each player's output and consumption is gathered from a variety of sources, such as open and closed registries and, in the case of publicly traded companies, the company's financial reports. You could get in touch with the tax division of your local government if financial records are not made public.

Dynamics :

Smart contracts powered by blockchain might be adopted by customers and insurers to manage claims in a transparent, speedy, and unchallengeable manner, expediting the claims processing process and improving consumer satisfaction. Smart contracts, for instance, can be set up to gather data from telematics devices, file insurance claims, and start paying out in the event of an accident. They can also recommend reliable petrol stations in the area and, if necessary, call for assistance.

Blockchain Insurance Market Segment:

During the projected period, it is anticipated that the application and solution provider segment will dominate the end-user landscape. Blockchain technology uses a platform that is spread out over a company's network and records business transactions indeliblely. By decentralising credential ownership, blockchain technology makes it possible to implement a universal method for authenticating users' records in an immutable data chain. The digital economy could undergo a transformation thanks to blockchain technology, which could have disruptive effects.

Regional Analysis:

The five primary geographical regions of the Blockchain Insurance Market are North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Blockchain Insurance Market Key players:

- • Ziglu Limited (US)

• Circle Internet Financial Limited (US)

• ConsenSys (US)

• Digital Asset Holdings (US)

• Symbiont (US)

• AlphaPoint (US)

• AWS (US)

• BitPay (US)

• BlockCypher (US)

• BTL Group (US)

• IBM Technology (US)

• Microsoft (US)

• Oracle (US)

• BTL Group (Canada)

• ChainThat Limited (UK)

• Applied Blockchain (UK)

• Everledger (UK)

• Bitfury (Netherlands)

• Lykke AG (Switzerland)

• Guardtime (Switzerland)

• SAP SE (Germany)

• Horizon state Pty Ltd. (Australia)

• Auxesis Group (India)

• Algorythmix (India)

• L&T Finance Holdings Linited (India)

• Tata Group (India)

Speak with our research analyst: https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/

Research methodology:

- Top-down and bottom-up methods are used to estimate and validate the size of the global Blockchain Insurance Market. Participants diligently adhere to the many classification requirements set forth by the firm to compile a comprehensive list of notable and active players. The businesses that are most relevant to the market under consideration are chosen after a thorough validation procedure.

- Preference lists are arranged using commercial databases like Factiva, Bloomberg, and others in accordance with the revenue generated in the most recent quarter.

- In addition, the questionnaire was created expressly to meet all requirements for appointment-only primary data collection based on the key target categories. This facilitates our ability to gather data on a variety of topics, including player earnings, operating costs, profit margins, and the expansion of various commodities and services. The World Bank, associations, business websites, SEC filings, OTC BB, USPTO, EPO, annual reports, press releases, and other sources are used to verify about 70-80% of the data before usage.

Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

3rd Floor, Navale IT Park Phase 2,

Pune Banglore Highway,

Narhe, Pune, Maharashtra 411041, India.

Email: sales@maximizemarketresearch.com

Phone No.: +91 9607365656

Website: www.maximizemarketresearch.com

0