Adam Huntley, CEO and Founder of Aiming High Solutions

Last Updated: April 2025

At Aiming High Solutions, we've helped hundreds of Dallas-Fort Worth business owners understand their financial statements and make better business decisions. One financial statement that often causes confusion—yet provides critical insights—is the cash flow statement.

This comprehensive guide will walk you through everything you need to know about cash flow statements, including why they matter, how to create them, and how to use them to make strategic business decisions.

What Is a Cash Flow Statement?

A cash flow statement is a financial document that shows the flow of cash into and out of your business during a specific period. Unlike other financial statements, the cash flow statement focuses exclusively on cash movements—giving you a clear picture of your liquidity position.

For DFW small business owners, understanding your cash flow is essential for survival and growth. It answers the critical question: "Do I have enough cash to operate my business today, tomorrow, and in the coming months?"

The Three Main Financial Statements: How They Work Together

Before diving deeper into cash flow statements, let's look at how they fit with your other essential financial reports:

- Income Statement (Profit & Loss): Shows your revenue, expenses, and profitability over time

- Balance Sheet: Provides a snapshot of your assets, liabilities, and equity at a specific point in time

- Cash Flow Statement: Reveals how cash moved in and out of your business during a specific period

While all three statements are interconnected, they each serve a distinct purpose in your financial analysis toolkit.

Cash Flow Statement vs. Income Statement

Many Dallas entrepreneurs mistake high profits for strong cash flow, but they're not the same thing. Here's why:

If you use accrual accounting (as most growing businesses do), your income statement records transactions when they're earned or incurred—not when cash changes hands. For example:

- You might show $50,000 in revenue on your income statement after invoicing several customers, but if they haven't paid yet, that money isn't in your bank account

- You could record $10,000 in depreciation expenses without any cash leaving your business

The cash flow statement adjusts for these timing differences, showing you the actual cash position of your business.

Cash Flow Statement vs. Balance Sheet

While your balance sheet shows what you own (assets) and owe (liabilities) at a specific moment, it doesn't track the movement of cash over time. The cash flow statement fills this gap by showing exactly how cash entered and exited your business during the reporting period.

For example, your balance sheet might show $100,000 in equipment assets, but doesn't reveal if those purchases strained your cash reserves this quarter. Your cash flow statement would show this impact clearly.

Why Do DFW Business Owners Need Cash Flow Statements?

In the competitive Dallas-Fort Worth business environment, cash flow statements are essential for several reasons:

1. Assess Your Business Liquidity

Cash flow statements show exactly how much operating cash you have available. This helps determine if you can:

- Meet payroll obligations

- Pay vendors on time

- Cover unexpected expenses

- Take advantage of growth opportunities

2. Identify Cash Flow Patterns

Regular cash flow analysis helps you spot seasonal trends, allowing you to:

- Prepare for known slow periods in the DFW market

- Capitalize on busy seasons

- Plan inventory purchases strategically

- Time major expenses appropriately

3. Make Informed Financial Decisions

With accurate cash flow information, you can confidently:

- Determine if you can afford to hire additional staff

- Decide when to purchase new equipment

- Plan facility expansions or relocations

- Evaluate potential investments

4. Secure Financing When Needed

Local DFW banks and lenders typically require cash flow statements as part of loan applications. Strong, positive cash flow demonstrates your ability to repay debt and makes you a more attractive borrower.

5. Detect Problems Early

Cash flow statements can reveal issues before they become crises:

- Declining operating cash flows might indicate problems with collections

- Consistently negative cash flow may signal unsustainable business practices

- Heavy cash outflows in investing activities could indicate overexpansion

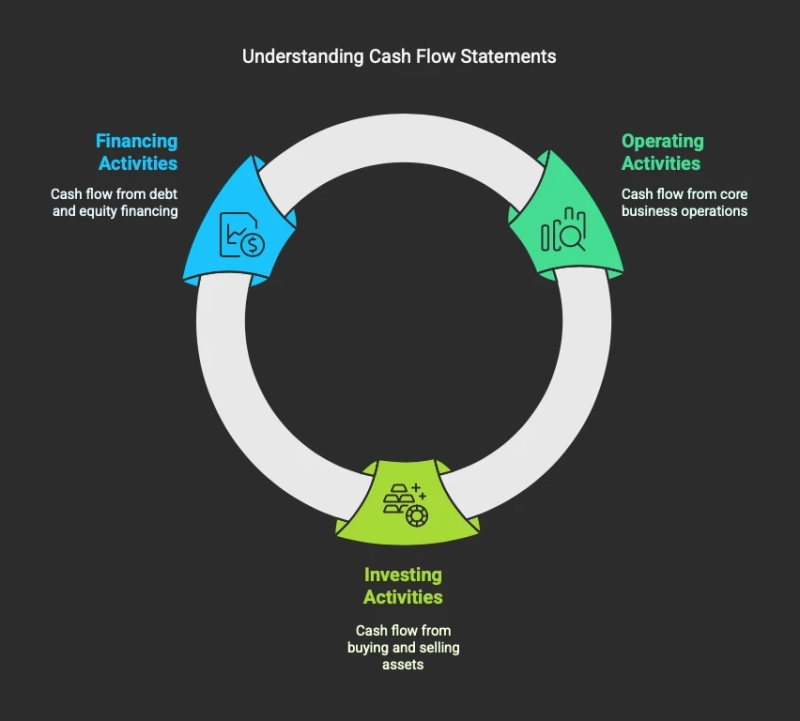

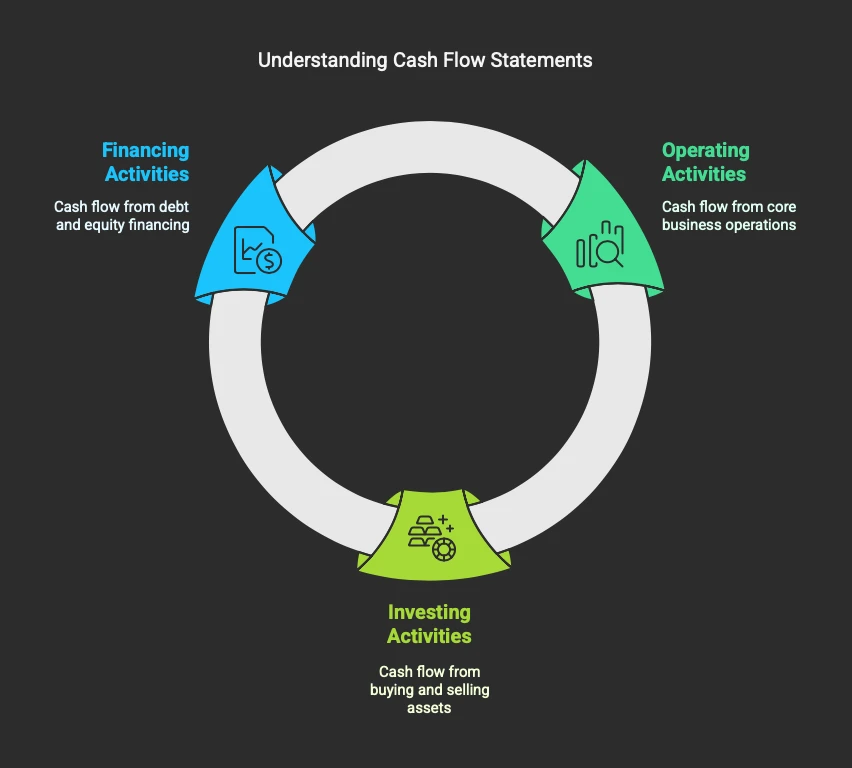

The Three Sections of a Cash Flow Statement

A standard cash flow statement is divided into three distinct sections, each tracking a different type of cash activity:

1. Cash Flow from Operating Activities

This section shows cash generated or used through your core business operations. For most DFW small businesses, this represents the largest and most important section of the cash flow statement.

Examples include:

- Cash received from customers

- Cash paid to suppliers and vendors

- Cash paid for salaries and wages

- Cash paid for rent and utilities

- Cash paid for insurance premiums

- Cash paid for taxes

2. Cash Flow from Investing Activities

This section records cash used for long-term investments or generated from selling those investments.

Examples include:

- Purchase of property or equipment

- Purchase of investment securities

- Acquisition of other businesses

- Sale of property or equipment

- Sale of investment securities

- Collection of principal on loans

3. Cash Flow from Financing Activities

The financing section tracks cash flowing between your business and your investors/lenders.

Examples include:

- Proceeds from loans or lines of credit

- Repayment of loan principal

- Owner investments or draws

- Dividend payments

- Proceeds from issuing stock (for corporations)

- Repurchase of company shares

Direct vs. Indirect Methods of Calculating Cash Flow

There are two accepted approaches to preparing cash flow statements: the direct method and the indirect method.

The Direct Method

The direct method tracks actual cash receipts and payments during the period. While straightforward in concept, it requires detailed record-keeping of every cash transaction.

Example of direct method reporting for operating activities:

- Cash collected from customers: $150,000

- Cash paid to suppliers: ($60,000)

- Cash paid for operating expenses: ($45,000)

- Cash paid for taxes: ($15,000)

- Net cash from operating activities: $30,000

The Indirect Method

The indirect method starts with net income from your income statement and adjusts for non-cash items and changes in balance sheet accounts. This is the more common approach for small businesses because:

- It's less time-consuming

- It requires less detailed record-keeping

- It helps explain the difference between net income and cash flow

- It's generally preferred by financial statement users

At Aiming High Solutions, we typically recommend the indirect method for our Dallas-Fort Worth clients unless they have specific reasons to use the direct method.

A Comprehensive Cash Flow Statement Example

Let's look at a practical example for a hypothetical DFW construction company:

XYZ Construction Company

Cash Flow Statement for Year Ended December 31, 2024

Cash Flow from Operating Activities:

- Net Income: $250,000

- Adjustments for non-cash items:

- Depreciation: $35,000

- Loss on sale of equipment: $5,000

- Changes in working capital:

- Increase in accounts receivable: ($45,000)

- Decrease in inventory: $15,000

- Increase in accounts payable: $20,000

- Decrease in prepaid expenses: $10,000

- Increase in accrued expenses: $5,000

- Net cash provided by operating activities: $295,000

Cash Flow from Investing Activities:

- Purchase of equipment: ($120,000)

- Proceeds from sale of old equipment: $25,000

- Purchase of short-term investments: ($50,000)

- Net cash used in investing activities: ($145,000)

Cash Flow from Financing Activities:

- Proceeds from bank loan: $100,000

- Repayment of loan principal: ($85,000)

- Owner's withdrawals: ($75,000)

- Net cash used in financing activities: ($60,000)

Net increase in cash: $90,000 Cash at beginning of period: $110,000 Cash at end of period: $200,000

Understanding Positive vs. Negative Cash Flow

When analyzing cash flow statements, it's important to interpret the numbers in context:

Positive Cash Flow

Positive cash flow means you have more cash coming in than going out during the period. While generally considered good, there are nuances:

- Sustainable positive operating cash flow indicates a healthy core business that generates more cash than it uses.

- Positive investing cash flow might mean you're selling assets—potentially shrinking your business rather than growing it.

- Positive financing cash flow often means you're taking on debt or equity investment, which increases obligations to lenders or shareholders.

Negative Cash Flow

Negative cash flow means you're spending more cash than you're bringing in. This isn't always bad:

- Temporary negative operating cash flow might result from seasonal fluctuations or one-time expenses.

- Negative investing cash flow often indicates growth through asset purchases.

- Negative financing cash flow typically means you're paying down debt or returning money to owners—potentially strengthening your financial position.

At Aiming High Solutions, we help DFW business owners assess these nuances to understand the true health of their cash flow situation.

Four Key Rules for Creating Your Cash Flow Statement

When preparing a cash flow statement using the indirect method, remember these fundamental rules:

- Increases in assets decrease cash flow (you spent cash to acquire them)

- Decreases in assets increase cash flow (you received cash by selling or collecting them)

- Increases in liabilities increase cash flow (you received cash by taking on obligations)

- Decreases in liabilities decrease cash flow (you spent cash to reduce obligations)

Cash Flow Analysis: Key Ratios and Metrics

Beyond simply tracking cash movements, sophisticated cash flow analysis involves calculating ratios that provide deeper insights:

Operating Cash Flow Ratio

Formula: Operating Cash Flow ÷ Current Liabilities What it measures: Your ability to cover short-term obligations with cash generated from operations Target: Generally, a ratio above 1.0 is considered healthy

Cash Flow Margin

Formula: Operating Cash Flow ÷ Revenue What it measures: The percentage of sales revenue that converts to cashTarget: Higher percentages indicate stronger cash generation efficiency

Cash Flow Coverage Ratio

Formula: Operating Cash Flow ÷ Total Debt What it measures: Your ability to pay total debt with operating cashTarget: Higher is better; below 0.2 may indicate potential solvency issues

Cash Burn Rate

Formula: Cash Balance ÷ Monthly Cash Outflow What it measures: How many months your business could operate without additional cash inflows Target: Startups typically aim for 12+ months; established businesses may need less buffer

Common Cash Flow Challenges for DFW Businesses

Based on our experience serving hundreds of Dallas-Fort Worth small businesses, these are the most common cash flow challenges we see:

Seasonal Fluctuations

Many local businesses experience seasonal sales patterns. For example, retail businesses see surges during holiday seasons, while HVAC contractors have peak demand during extreme temperature periods. Managing cash during slow periods requires careful planning.

Growth-Related Cash Constraints

Expanding businesses often face cash shortages despite strong sales. The costs of hiring, inventory expansion, and new facilities typically come before the resulting revenue increases.

Delayed Collections

Extended payment terms from clients, especially larger corporations, can strain cash flow for service-based businesses. We've seen many DFW contractors face challenges when working with clients who pay in 45-90 days.

Tax Obligations

Quarterly estimated tax payments and annual tax bills can create significant cash outflows. Without proper planning, these can catch business owners unprepared.

10 Strategies to Improve Your Cash Flow

If your cash flow statement reveals potential issues, consider these improvement strategies:

- Accelerate receivables by implementing upfront deposits, offering early payment discounts, or streamlining your invoicing process

- Extend payables when possible—without damaging vendor relationships

- Manage inventory more efficiently to reduce cash tied up in unsold products

- Lease rather than purchase equipment to spread costs over time

- Establish a line of credit before cash flow emergencies occur

- Regularly review pricing to ensure adequate margins

- Identify and eliminate unprofitable products or services that drain resources

- Consider factoring invoices for immediate cash when necessary

- Implement cash flow forecasting to anticipate and prepare for future needs

- Work with cash flow experts who understand the unique DFW business environment

Cash Flow Forecasting: Planning For The Future

While historical cash flow statements are valuable, forward-looking cash flow projections are equally important. A cash flow forecast estimates your future cash position based on:

- Expected sales and collections

- Planned expenses and payments

- Anticipated investments or financing activities

- Seasonal patterns specific to your industry

At Aiming High Solutions, we help DFW business owners create rolling 13-week cash flow forecasts, giving them clear visibility into their short-term cash position while also developing annual projections for longer-term planning.

How Aiming High Solutions Can Help

Managing cash flow isn't just about tracking numbers—it's about making strategic decisions that support your business goals. As Dallas-Fort Worth's premier bookkeeping service, Aiming High Solutions offers:

- Monthly cash flow statement preparation to give you regular insights into your liquidity

- Cash flow analysis and interpretation that goes beyond the numbers to provide actionable advice

- Cash flow forecasting to help you anticipate and prepare for future needs

- Cash management strategies tailored to your specific business situation

- Integration with other financial statements for comprehensive financial management

Don't let cash flow challenges limit your business potential. Schedule a consultation with our team today to learn how we can help your DFW business achieve sustainable cash flow management.

Conclusion

Cash flow statements provide critical insights that other financial reports simply can't offer. By understanding where your cash comes from and where it goes, you can make more informed decisions about your business's future.

While profits are important, cash is what keeps your doors open day-to-day. That's why at Aiming High Solutions, we emphasize the importance of regular cash flow monitoring and analysis for all our Dallas-Fort Worth clients.

Ready to gain clarity on your business's cash position? Contact Aiming High Solutions today and take control of your financial future.