Banks, like every other country, play an important role in our country's economy as most transactions take place through the banks. India's central banking agency and the sole monetary authority is the Reserve Bank of India. There are three types of commercial banks, the State / Government Bank, the Private Sector Bank, and the Foreign Sector Bank. It was no surprise when Finance Minister Nirmala Sitharam announced on 30 August 2019 a series of mergers involving public sector banks.

Government Banks (Banks of the public sector)

These banks have a government interest of more than 50% and there is no differentiation between the Nationalized Bank and the Bank of the Public Sector. They've both got the same sense.

The 27 former banks of the government were:

- Allahabad Bank

- Andhra Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- Indian Bank

- Indian Overseas Bank

- Oriental Bank of Commerce

- Punjab & Sind Bank

- Punjab National Bank

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

- IDBI Bank((77.79% government stake)

- SBI+and it’s five associate banks

- Bharatiya Mahila Bank

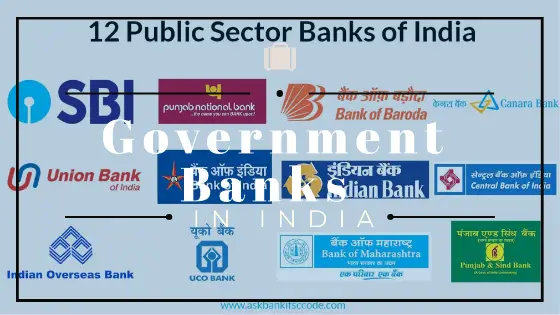

The number of public sector banks (government banks) has fallen from 27 in 2017 to 12 with the announcement made on 30 August 2019.

The mergers of the Public Sector Banks as announced are

1. Punjab National Bank, Oriental Bank of Commerce, and United Bank (2nd largest Public Sector

Bank)

2. Canara Bank and Syndicate Bank (4th largest Public sector Bank)

3. Union Bank, Andhra Bank, and Corporation bank (5th largest Public Sector Bank)

4. Indian Bank and Allahabad Bank (7th largest Public sector Bank)

12 Public Sector Banks (Government Banks) Existing List

1) The State Bank of India was previously referred to as the Imperial Bank of India and remains India's largest public sector bank to date. Its headquarters in Mumbai, Maharashtra, was established in 1955. Earnings are INR 2,110 billion. SBI has a presence in 36 other countries, where about 195 + offices have been set up. It was found that SBI has around 59,291 ATMs and 26,340 branches in a survey conducted in the year 2017.

2) Punjab National Bank’s new name of amalgamated 3 is Punjab National Bank, Oriental Bank of Commerce, and United Bank. It is India's second-largest public-sector bank founded in 1894. The headquarters is in New Delhi, Delhi and its revenue are INR 774.22 billion. PNB ranks # 717 in Forbes Global and # 6 in Forbes Indian banks, and # 26 in Fortune (Indian) 500 as well. PNB has over 7,000 branches and 3,766 ATMs in India and PNB was named the best bank in the public sector in 2012. PNB's earned USD 8.3 billion as of December 19. On the 1st of April, the United Bank of India and the Oriental Commerce Bank merged into the Punjab National Bank, becoming the second largest bank in the public sector.

Read more about Indian Government Banks