In the recent past, several companies have collaborated with other industry players / research institutes to develop novel RNAi based products. According to our research, most of the deals inked in this upcoming field of research were observed to be associated with the development of adequate delivery systems and technology platforms for RNAi based interventions.

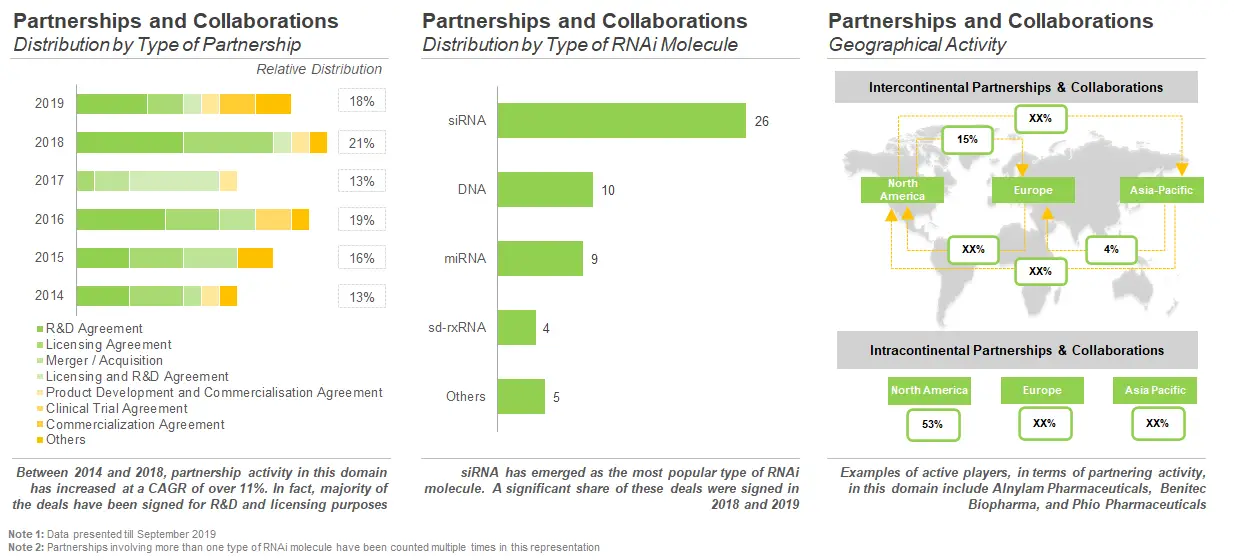

R&D agreements were the most common type of partnership model adopted by players in the RNAi therapeutics domain, representing 32% of the total number of deals established in the given time period. This is followed by licensing agreements and mergers and acquisitions. Recent examples of licensing agreements include (in reverse chronological order) collaboration between Phio Pharmaceuticals and Helmholtz Zentrum München (August 2019), Silence Therapeutics and Genomics England (May 2019), Phio Pharmaceuticals and Glycostem Therapeutics (March 2019), and Alnylam Pharmaceuticals and CAMP4 Therapeutics (January 2019).

Most of the partnerships (48%) were observed to be focused on developing drugs based on siRNA molecule. This can be attributed to the fact that the aforementioned technology offers high specificity with one mRNA target. Recent examples of agreements signed for siRNA include (in reverse chronological order) those signed between Alnylam Pharmaceuticals and Ironwood Pharmaceuticals (August 2019), Silence Therapeutics and Mallinckrodt Pharmaceuticals (July 2019), Alnylam Pharmaceuticals and GENESIS Pharma (July 2019), Alnylam Pharmaceuticals and Regeneron Pharmaceuticals (April 2019) and Alnylam Pharmaceuticals and Medison Pharma (January 2019). Further, it is important to highlight that significant number of collaborations (17%) have been signed for derivatives of siRNA, the self-deliverable molecules.

Most of the agreements (60%) were signed between industry players located in the same region (53% in North America, 3% in Europe and 4% in Asia-Pacific). Furthermore, in most of the intercontinental agreements, the leading partner was observed to be based in North America, while its collaborator was a player based in Europe (15%). This is followed by agreements, wherein companies (leading partner) from Asia Pacific have collaborated with players based in North America (15%). A similar observation was made across 3% of instances, wherein players based in North America entered into deals with companies headquartered in the Asia Pacific.