A new generation of roll-your-own electric cigarette machine has been spreading like wildfire across the U.S. at upstart tobacco shops capitalizing on tax loopholes to deliver low-priced smokes.

Now lawmakers, backed by Big Tobacco and convenience-store chains, want to declare such shops to be manufacturers. That would subject them to the same taxes and regulations as the broader cigarette industry, likely snuffing them out.

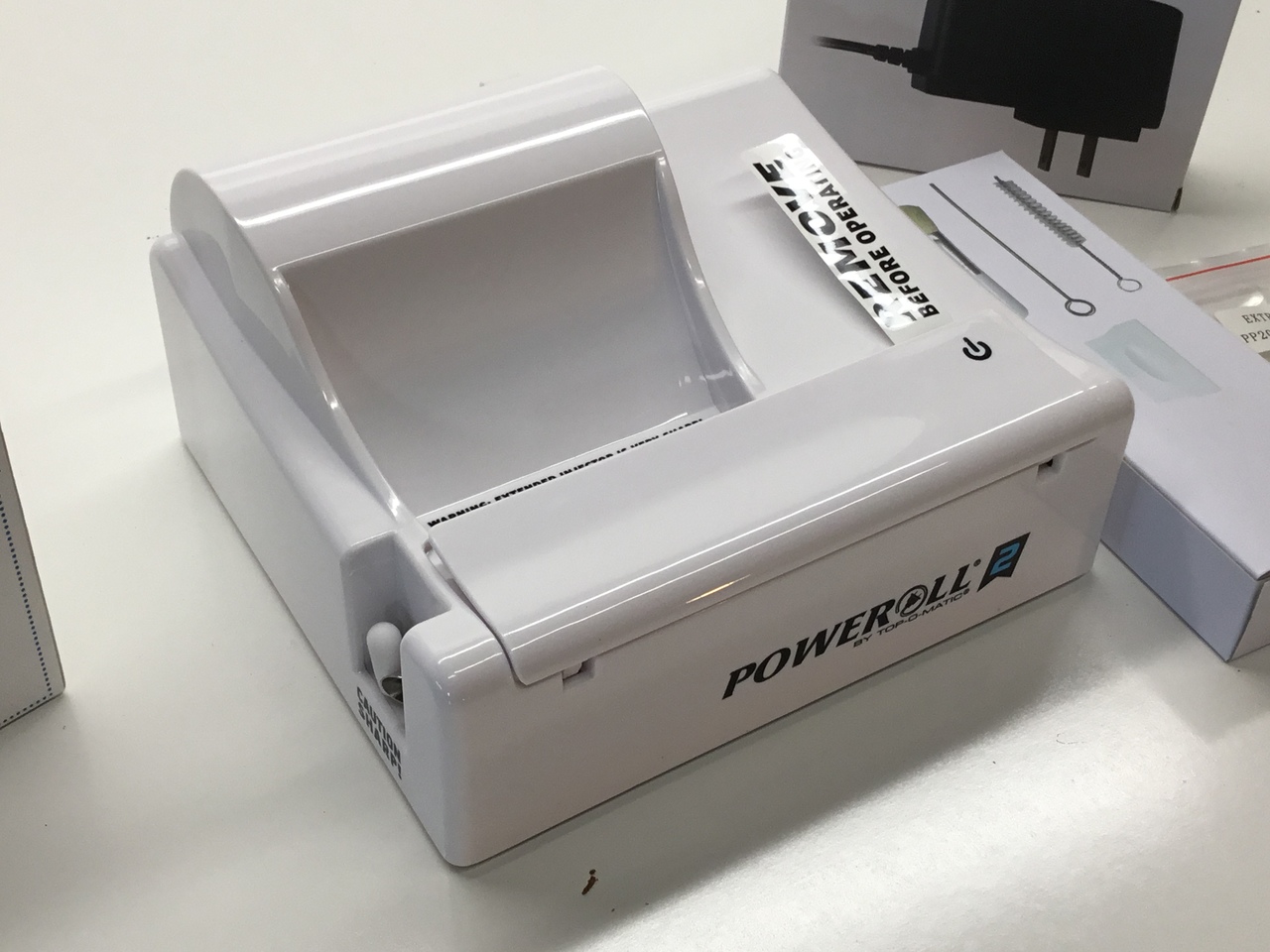

Instead of buying ready-made cigarettes like Marlboros or Camels, the shops' customers purchase loose tobacco and pour it into an ATM-sized machine that rolls 200 cigarettes in less than 10 minutes.

The cigarettes typically are made with leaves labeled “pipe tobacco” and can sell for half what major brands cost, depending on state taxes.

Hundreds of such shops—mostly or entirely focused on the roll-your-own machines— have opened since 2009, when Congress increased the federal excise tax on a carton of 200 cigarettes to $10.066 from $3.90 and hiked the tax on a pound of roll-your-own cigarette tobacco to $24.78 from $1.0969. The tax for a pound of pipe tobacco rose only to $2.8311 from $1.0969.

Under a Senate bill passed Wednesday, any retailers making roll-your-own machines available to customers would be treated like mainstream cigarette manufacturers. The provision was included in a rural school financing amendment tucked inside the federal surface transportation bill, which still needs House approval.

“Roll-your-own automatic electric cigarette rolling machine take advantage of an unintended tax loophole, and that isn't right,” said Sen. Max Baucus (D., Mont.), who chairs the Senate Finance Committee and sponsored the amendment. Rep. Diane Black (R., Tenn.) introduced a separate bill earlier this month classifying the shops as manufacturers.

Major tobacco companies such as Altria Group Inc., MO -4.21% the country's largest, and the National Association of Convenience Stores have lobbied for such measures, which are finding support on both sides of the aisle. Governors in Virginia, South Dakota and Wyoming have signed similar bills this month, and legislatures in roughly 20 other states are weighing action. In New York, state and city authorities filed lawsuits this week against a handful of roll-your-own retailers for allegedly circumventing taxes and regulations. Ready-made cigarettes still have a market share of more than 95%, according to industry estimates.

RYO Machines LLC, the largest maker of the machines, has hired its own lobbyists and lawyers to try and turn the tide. The company and affected tobacco shops say they have no way of complying with the regulatory requirements of being a cigarette manufacturer. They say they haven't broken any laws and that large tobacco companies are trying to extinguish competition.

“I'm David fighting Goliath,” said Phil Accordino, part-owner of Girard, Ohio-based RYO Machines, which began manufacturing the nearly five-feet-high machines in 2008. The company has sold about 1,900 machines to tobacco shops in more than 40 states, including roughly 1,000 last year. Stores pay a bit more than $30,000 for each machine, which takes two to three seconds to roll a cigarette. That is several times faster than smaller table-top versions, but still roughly a thousand times slower than machines at big cigarette manufacturing plants.

The Alcohol and Tobacco Tax and Trade Bureau declared in 2010 that retailers with roll-your-own machines are manufacturers, but RYO secured a preliminary injunction in a federal court in Ohio. Oral arguments in that case are expected to begin next month. RYO also has won injunctions in a handful of states, including Connecticut and Wisconsin.

In the meantime, roll-your-own shops continue to spread in places like Smyrna, Ga., where Tobacco Road opened its doors last November with four machines in a converted KFC fast-food restaurant. A steady stream of smokers filed in this week, drawn by signs touting cigarette cartons for $23.80, which includes the fee to use a machine.

Customer Charlotte Johnston poured 8 ounces of labeled “Kentucky Select pipe tobacco” leaves into the top of a machine after inserting a cartridge with 200 empty cigarette tubes, pressed a few buttons on a computer screen, and sat back in a leather chair as the machine began spitting cigarettes into a bin. “It's not all that hard. It reminds me of sitting in front of a slot machine,” said Ms. Johnston, a 65-year-old retiree. She said the cigarettes taste roughly the same as Marlboros, which she had smoked for years, but which sell for $40 or more per carton in area stores.

Critics say such shops unfairly avoid hefty taxes and fees levied on cigarette manufacturers. They also say shops use cigarette tobacco that's been mislabeled as pipe tobacco to gain a further price advantage. Pipe tobacco traditionally is moister than cigarette tobacco with a wider cut.

“We want to see a level playing field,” said Ronald Bernstein, chief executive of Liggett Group LLC, part of Vector Group Ltd., VGR 0.15% a large U.S. cigarette company.

Sales of pipe tobacco that end up in pipes have been declining for decades, shrinking by about two-thirds between 1990 and 2008, according to industry estimates. “When was the last time you saw someone smoking a pipe?” said Craig Williamson, head of the Pipe Tobacco Council, an industry trade group.

Article Source: https://www.wsj.com/articles/SB10001424052702303863404577285694208319820