In a world where health uncertainties loom large, insurance has become an indispensable shield against the financial implications of medical crises. While health insurance is a familiar term for most, there exists another player in the field - critical illness insurance. Both serve the overarching goal of safeguarding one's well-being but differ significantly in scope, coverage, and purpose. The following article discusses the same in detail to help individuals make an informed choice.

Understanding Health Insurance Plan

Best health insurance plans are a versatile financial tool designed to cover a range of medical expenses incurred due to illness or injury. Individuals pay premiums to an insurance provider as part of these plans. In return, the insurer is responsible for covering medical expenses up to the policy's limits. Health plans typically encompass a variety of healthcare services, including hospital stays, surgeries, prescription medications, preventive care, and sometimes, even maternity care.

The primary purpose of health plans is to provide financial protection against the costs associated with routine and unforeseen medical needs.

Understanding Critical Illness Insurance

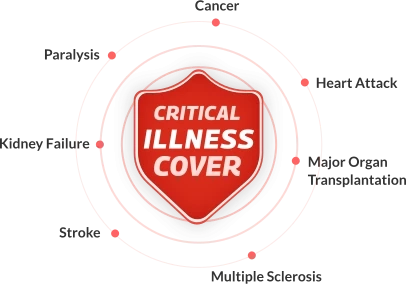

Critical illness plans, on the other hand, offer a specialised form of coverage that targets a predefined list of severe and life-threatening illnesses. Unlike health plans, a critical illness plan does not aim to cover all medical expenses. Instead, it pays a lump sum benefit upon diagnosing a qualifying critical illness, irrespective of the actual medical costs incurred.

Critical illnesses typically covered by such policies include major heart attacks, strokes, certain types of cancer, organ transplants, and other severe medical conditions. The payout from critical illness plans provides policyholders with financial support during a critical illness. It allows them to cope with the associated expenses, such as loss of income, specialised treatments, or adjustments to living arrangements.

Key Differences

The following table summarises the comparison between these two policies to help policy buyers devise the right strategy for safeguarding their health and financial well-being:

Aspect

Health Insurance Plan

Critical Illness Policy

Scope of Coverage

Broad coverage of a wide range of medical services, from routine check-ups to major surgeries

Limited coverage focused on specific critical illnesses listed in the policy.

Payout Structure

Reimburses actual medical expenses up to policy limits.

Provides a lump sum payout upon diagnosis, regardless of the actual medical costs.

Purpose of Coverage

Comprehensive protection for various healthcare needs, emphasising preventive care and routine medical expenses.

Targeted financial support during a critical illness, aiming to alleviate the financial burden associated with severe health conditions.

Factors Affecting the Choice Between Health and Critical Illness Insurance

The decision between health and critical illness plans depends on various interrelated factors. Some of them are discussed below:

Factor

Health Insurance Plan

Critical illness Insurance

Health Priorities

Suited for those seeking comprehensive coverage for routine healthcare needs, preventive services, and unpredictable medical expenses.

Appeals to individuals who prioritise protection against specific life-threatening illnesses and the associated financial repercussions.

Financial Considerations

Involves ongoing premium payments in exchange for a broader range of medical coverage.

Requires premiums as well, but offers a lump sum payout upon the diagnosis of illness. It may be seen as a more targeted and immediate financial solution for specific health crises.

Existing Health Conditions

Generally accommodates individuals with pre-existing conditions, offering coverage for various medical needs. However, some pre-existing conditions may lead to higher premiums or exclusions.

It may be more challenging to secure for individuals with pre-existing conditions, as the focus is on specific severe illnesses. The individual's health history can influence the eligibility criteria and premiums.

Income Protection

Provides a safety net for ongoing medical expenses, aiming to prevent a sudden financial strain. However, it may not directly address the loss of income accompanying a critical illness.

Offers a lump sum payout that can serve as income replacement during the treatment and recovery phases of a critical illness, providing a buffer against the potential economic impact.

Make the Right Choice

Both critical illness insurance and normal health insurance plans play crucial roles in healthcare coverage. While health plans provide a broad safety net for a variety of medical needs, critical illness plans offer specialised protection against the financial challenges associated with life-altering health conditions.

The choice between health and critical illness policies is a nuanced decision influenced by individual priorities, health considerations, and financial goals.

Niva Bupa offers a range of healthcare insurance as well as critical illness plans that can help policy buyers achieve the right balance. With Niva Bupa's comprehensive policies, individuals can ensure a robust safety net for routine healthcare along with targeted protection against the financial shocks of critical illnesses. For more information, head on to Niva Bupa's website and choose the plan that aligns with specific health and financial objectives.