Download QuickBooks Direct Deposit Form

You can otherwise download quickbooks direct deposit forms . The data you’ve saved in the software can be used to fill in the form directly. This is handy, especially if you want to enable direct deposit for multiple employees.

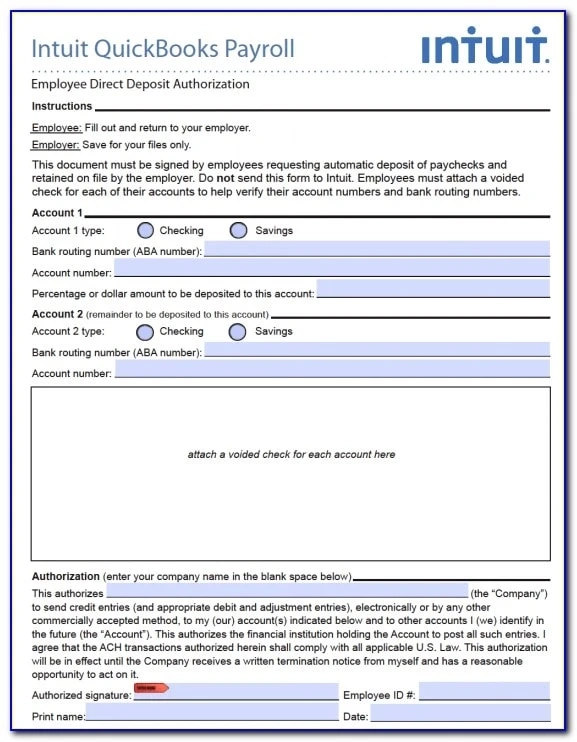

Understanding QuickBooks Direct Deposit Authorization:

As a legal document, quickbooks direct deposit form enables an employer to transfer money from his or her own bank account to that of an employee’s. Through this form, you can select which account the money will be transferred from as well as which account the money will be transferred to. The employee will have to submit a blank voided check, which can be attached directly to the form.

For more information, the employee can discuss the paperwork and procedure with the department of the company.

How to Write QuickBooks Direct Deposit Form:

Before filling in the form, go through the instructions. First of all, you don’t need to send the document to Intuit. Instead, the employee must fill in the form and attach a voided check for each bank account. The voided checks will be used for verifying each of the account numbers and bank rounding numbers.

Step 1: Start with Labeled Area Account 1

✱ Select Checking or Savings in account type on direct deposit forms quickbooks

✱ Enter the Bank Routing Number (ABA number.) It is a nine-digit code depending on the location of your bank in which you opened your account.

✱ Enter your Account Number

✱ Enter the ‘Percentage or Dollar amount to be deposited to this account.’

✱ If the payment amount is to be deposited in two separate accounts, then enter a percentage less than 100%.

✱ If you don’t provide details for a second account, then a check form will be issued for the same.

Step 2: Repeat Same Steps, if Want to Add Second Account

Repeat the same steps, if you want to add a second account. The percentage of the amount that did not go to the first account will go to the second account.

✱ Select the Type of Account: Checking or Savings

✱ Enter the Bank Routing Number (ABA Number)

✱ Enter the second account number

Step 3: Attach a Voided Check for Each Account

✱ Attach a voided check for each account.

✱ This will be used for verifying both the account number and the Bank Routing Number (ABA number).

You must attach the voided checks after taking a print out of the entire form.

Read also:- Check how to quickbooks file doctor direct download in just one click

Step 4: Enter your Company Name in the Space

Write direct deposit authorization form quickbooks

✱ Enter your company name in the space provided.

✱ This is an authorization that the company can electronically deposit money into your account and deduct any amount that may have been deposited through an error.

Step 5: For Authorization Fill all Required Details

For Authorization Fill all Required Details

For authorization purposes, enter the rest of the information like:

✱ Authorized Signature

✱ Employee ID#

✱ Print Name

✱ Date

Once you’ve filled out the form and taken a print out of the same, attach the voided checks for each account. Then, submit the complete form to your HR department. Thereafter, your employer will process the application and set up direct deposit of wages to your account.

How to Set up Direct Deposit for Employees:

In order to deposit wages directly into the account of your employees, you need to set up direct deposit in QuickBooks . Once you’ve configured direct deposit, you can automate the payment process for each employee through this accounting software.

To set up direct deposit form quickbooks , you need to do the following:

Gather bank information of employees through the QuickBooks Direct Deposit Authorization Form.

Enter the bank information of employees in the online account.

Here are the steps for gathering bank information of employees:

Fill in and print an intuit direct deposit form

Print the form through QuickBooks Online Enhanced through the following steps:

2.1. Open Taxes

2.2. Click on Tax

2.3. Click on Employee Setup

2.4. Select Bank Verification

2.5. Select View

2.6. Click on Print

Once you’ve gathered the bank information from your employees, you need to enter their bank details in QuickBooks . To do so, you can follow the steps provided below”

In the Workers/ menu, select Employees

Select the name of the employee

Click on Edit Employee

From ‘How do you want to pay this employee,’ select the method of payment. You have the following options:

Direct Deposit

Direct Deposit with Balance as a Check

Direct Deposit to Two Accounts

Enter the account number and routing number of the employee’s bank account.

Click on Done.

0