Leases stipulate how long a party has access to a property or item in return for a payment, typically cash or other assets. Operating and finance (or capital) leases are the two forms of leases that are used in accounting the most frequently.

What Is an Operating Lease?

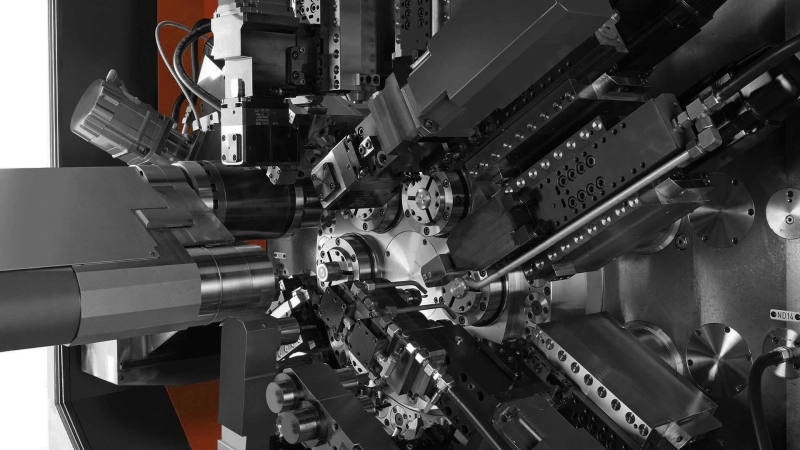

An operational lease is a contract for the use and management of property without a change in ownership. Real estate, cars, planes, and large machinery are commonly leased assets. Operational leases allow businesses to avoid recognizing an asset on their balance sheets by allowing it to be treated as operating costs, not ownership.

Features Of Operating Lease

Equipment is made available through an operating lease for a brief time. This lease may be an option for a business whose needs for equipment or asset are short-term. Especially when the sector is changing, businesses choose operational leases when they wish to replace their assets. The firm may choose this lease if it has no financial assistance but plans to continue with its regular business operations.What Is A Capital Lease?

In a capital lease, the lessor commits to hand over ownership of the leased asset to the lessee at the end of the lease term. Long-term, non-cancelable capital or finance leases are the norm. An asset is legally sold by one client, known as the lesser, to the buyer, known as the lessee, in a capital lease, a lease arrangement for any commercial property or equipment.

Features Of A Capital Lease

The lease's term exceeds 75% of the anticipated economic life of the asset. An option to acquire the item for less than its fair market value is included in the lease. After the lease period, the lessee receives ownership of the asset.Capital Lease Vs. Operating Lease

So how do these different lease kinds impact your balance sheet and income statement? Operating and capital leases have substantially distinct accounting appearances.

The rent-to-buy scenario, which begins with capital leases, causes the asset to act as if it were a fixed component of the company's property. You record the asset's current market value on the balance sheet at the moment of purchase. The asset's depreciation is then calculated as a loss over time.

Operating leases make accrual accounting a bit simpler. There is less to keep track of because you are only renting the asset, and it is not a company asset. Your running expenditures are the lease payments. It can be shown on your income statement under the relevant cost category. The asset is not listed at all on your balance sheet. The asset and the rent-to-own arrangement are not yours, unlike with a capital lease. Operating leases are simple rental contracts.

If you are looking for a trusted loan provider, machinery equipment finance, leasing, and loans are Equipment Finance Group's areas of expertise. Our goal is to provide goods and services that support growth so that our client's financial outcomes and ease of acquisition improve.