What Is The Size Of Global Polyamide Industry?

Global Polyamide market is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028F.

The Polyamide Market is largely driven by increase in demand from the construction and coating industries, growing demand from other end-use industries, and the waterproof characteristics of polyamide.

Polyamide is being increasingly adopted in different industries for its waterproof nature and ability to withstand moisture. Waterproof polyamide textiles are being used by several industries to create various goods. Due to its waterproof qualities, it is frequently used to produce athletic and outdoor clothes. During the projected period, increasing demand for sports apparel, home textile materials, swimsuits, backpacks, and hiking apparel is anticipated to fuel the demand for polyamides.

The increasing threat from substitute products like polypropylene and polyvinylidene fluoride (PVDF), is anticipated to slow the rate of expansion of the global polyamide market. When compared to its counterpart, PVDF is a non-reactive thermoplastic that possesses finer qualities.

Furthermore, conversely, polyamide has a lesser degree of elasticity, a higher degree of wear resistance, a tougher surface, and a higher degree of UV resistance. In contrast, polypropylene is easier to handle and has higher elasticity, tensile strength, and smoothness, along with a lower elongation percentage. In recent years, PVF is significantly being used as a replacement for polyamide fishing lines.

For more information, request a free sample

Global Polyamide Market By Product

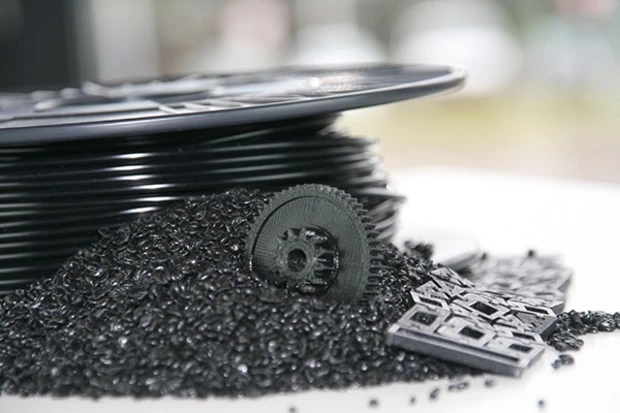

The Global Polyamide market is segmented by Product into Polyamide 6, Polyamide 66, Bio-based Polyamide, Specialty Polyamide and Others.

The Polyamide 6 product segment held the largest share of the Global Polyamide Market in 2022.

PA 6's special qualities make it a suitable product substitution for materials like bronze, gunmetal, steel, brass, aluminum, and plastics, among others. The producers of electrical protection devices are promoting segmental expansion.

During the projection period, the demand for polyamide 6 is also estimated to rise as a result of the incorporation of PA 6 for its tensile strength. It is adopted in the premium carpet industry, fishing nets, and travel accessories. To make automobiles lighter and more fuel-efficient, polyamide is used to replace metal parts.

Global Polyamide Market By Application

The Global Polyamide Market is segmented by Application into Engineering, Plastics, Textiles, Electronics and Electrical, Sports Equipment, Automotive, Consumer Goods & Appliances and Others.

Automotive application segment held the largest market share in the Global Polyamide Market in 2022.

The increased use of polyamide in place of metal in the automobile industry to create the interior, structural, and technical parts of vehicles can be attributed to the growing demand for polyamide in the industry.

The production of cooling systems, rock valve covers, and structural elements made of glass-reinforced plastic based on polyamides is a significant driver driving the market's expansion.

Visit this Link Request for custom report

Key Topics Covered in the Report

Snapshot of Global Polyamide MarketIndustry Value Chain and Ecosystem AnalysisMarket size and Segmentation of the Global Polyamide MarketHistoric Growth of the Overall Global Polyamide Market and SegmentsCompetition Scenario of the Market and Key Developments of CompetitorsPorter’s 5 Forces Analysis of the Global Polyamide MarketOverview, Product Offerings, and SWOT Analysis of Key CompetitorsCOVID-19 Impact on the Overall Global Polyamide MarketFuture Market Forecast and Growth Rates of the Total Global Polyamide Market and by SegmentsMarket Size of Product / Application Segments with Historical CAGR and Future ForecastsAnalysis of the Polyamide Market in Major RegionsMajor Production / Consumption Hubs in the Major RegionsMajor Country-wise Historic and Future Market Growth Rates of the Total Market and SegmentsOverview of Notable Emerging Competitor Companies within Each Major RegionsMajor Players Profiled in the Report

Honeywell International Inc.BASF SEEvonik Industries AGDuPont de Nemours Inc.Teijin LimitedLANXESS AGInvistaSolvay SAKoninklijke DSM NVDomo Chemicals GmbHMitsubishi Chemical HoldingsEmerging Companies Mentioned in the Report

Toray Industries, Inc.Premier Chemical IndustriesTer Chemicals Distribution GroupNorelemViscofan GroupFor More Information on the Research Report, refer to below links: –

0