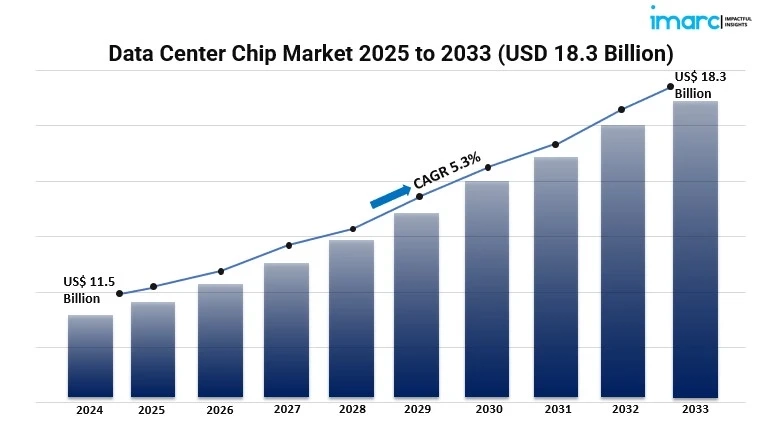

The global data center chip market is experiencing robust growth, driven by the escalating demand for high-performance computing, energy-efficient processing, and advanced semiconductor technologies. In 2024, the market was valued at USD 11.5 billion and is projected to reach USD 18.3 billion by 2033, exhibiting a CAGR of 5.3% from 2025 to 2033. Key factors propelling this growth include the expansion of the IT industry, continuous technological advancements, extensive R&D efforts by leading players, and the introduction of the five-nanometer process for semiconductor manufacturing.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Data Center Chip Market Key Takeaways

- The data center chip market is projected to grow from USD 11.5 billion in 2024 to USD 18.3 billion by 2033, at a CAGR of 5.3% from 2025 to 2033.

- GPUs represent the largest segment by chip type, widely used for AI, data analytics, machine learning, and scientific simulations.

- Large-sized data centers hold the largest market share, driven by the need for robust infrastructure to handle extensive data processing.

- The BFSI sector dominates the industry verticals, leveraging data center chips for enhanced security, transaction processing, and data management.

- North America leads the market regionally, attributed to advanced technological adoption and significant investments in data center infrastructure.

- Continuous R&D and the introduction of advanced semiconductor processes, such as the five-nanometer technology, are enhancing chip performance and efficiency.

- The integration of specialized hardware accelerators, including GPUs, TPUs, and FPGAs, is optimizing AI workload performance in data centers.

What Are the Key Factors Driving the Growth of the Data Center Chip Market?

Expansion of the IT Industry and Cloud Computing Services

The data center chip market’s growth is being propelled by a few core drivers. First and foremost, the ongoing expansion of the IT landscape-especially with everyone migrating to cloud-based infrastructure-has made high-performance data center chips absolutely critical. Modern enterprises depend on cloud storage, seamless computing, and high-speed networking, all of which rely on advanced chips to manage demanding workloads with efficiency and reliability. Flexibility and scalability remain key concerns, prompting organizations to regularly upgrade their infrastructure and, in turn, fueling consistent demand for next-generation chips across industries, from healthcare to finance.

Advancements in Semiconductor Manufacturing Technologies

On the technology side, recent advances in chip manufacturing are making a serious impact. Processes at five nanometers and beyond are now mainstream, allowing for much denser, faster chips that also consume far less energy. These benefits align perfectly with enterprise needs-higher performance, improved cost-efficiency, and lower power draw all translate to a stronger bottom line and a smaller environmental footprint. Innovation from leading semiconductor manufacturers means data centers can stay ahead of the curve in both sustainability and computational power.

Integration of Specialized Hardware Accelerators

Additionally, there’s been a marked increase in the integration of specialized hardware accelerators-GPUs, TPUs, FPGAs, and other application-specific chips. These are designed to optimize intensive tasks such as AI, machine learning, and big data analytics, rather than general-purpose processing. As demand intensifies for real-time insights and artificial intelligence, organizations are increasingly adopting these specialized solutions, directly contributing to market momentum.

Market Segmentation

Breakup by Chip Type

- GPU: Widely used for AI, data analytics, machine learning, and scientific simulations due to their ability to handle complex computations efficiently.

- ASIC: Application-specific integrated circuits designed for particular tasks, offering high performance and energy efficiency in data centers.

- FPGA: Field-programmable gate arrays that provide flexibility and can be customized for specific applications, beneficial for evolving data center needs.

- CPU: Central processing units that handle general-purpose processing tasks, forming the backbone of data center operations.

- Others: Includes emerging chip types and technologies catering to specialized data center requirements.

Breakup by Data Center Size

- Small and Medium Size: Data centers that cater to localized or specific organizational needs, requiring efficient and scalable chip solutions.

- Large Size: Extensive data centers supporting vast computational tasks, necessitating high-performance and energy-efficient chips.

Breakup by Industry Vertical

- BFSI: Banks and financial institutions utilizing data center chips for secure transactions, data processing, and risk management.

- Manufacturing: Industries employing data center chips for automation, supply chain management, and process optimization.

- Government: Public sector organizations leveraging data center chips for data storage, security, and citizen services.

- IT and Telecom: Companies relying on data center chips for network management, data processing, and service delivery.

- Retail: Retailers using data center chips for inventory management, customer analytics, and e-commerce operations.

- Transportation: Logistics and transportation firms implementing data center chips for route optimization and fleet management.

- Energy and Utilities: Organizations in this sector utilizing data center chips for grid management, monitoring, and predictive maintenance.

- Others: Includes various other industries adopting data center chips for specialized applications.

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Which Region Leads the Global Data Center Chip Market?

Regionally, North America stands out as the primary market leader. This is due to significant investment in technology infrastructure, the presence of top-tier semiconductor producers, and a strong focus on rapid cloud adoption. The region’s leadership is underpinned by both capital and expertise, making it the benchmark for global expansion.

What Are the Latest Innovations and Trends in the Data Center Chip Market?

In terms of trends and innovation, the market is characterized by continued adoption of advanced manufacturing processes and accelerated implementation of AI-optimized hardware. As data center requirements grow more complex each year, the shift toward specialized high-efficiency chips is only expected to intensify.

Who Are the Key Players in the Data Center Chip Market?

Achronix Semiconductor Corporation, Advanced Micro Devices Inc., Arm Limited, Broadcom Inc., Fujitsu Limited, GlobalFoundries Inc., Huawei Technologies Co. Ltd., Intel Corporation, Marvell Technology Inc., Nvidia Corporation, Taiwan Semiconductor Manufacturing Company Limited. etc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyzes, pricing and cost research, and procurement research.