Have you ever been in a situation where you feel financially unstable? Have you felt stressed because of some uncertain financial crisis? Don't know what to do? Relax back and scroll down to know about the personal loan and how the EMI is calculated on these loans. With the increase in digitalization, personal loans have gained huge popularity. The introduction of loan apps has made it extremely easy for borrowers to avail of personal loans during times of emergency. Be it buying a house, paying medical expenses, or paying off debts, instant loans play a vital role in everyone's life.

When you talk about the personal loan, you need to calculate the EMI or Equated Monthly Installment that affects the borrower's amount to pay back. EMI refers to the monthly repayment that the borrower has to make on the loan amount. It includes the contribution of both the principal and interest on the loan amount.

A loan amortization schedule refers to the tabular representation of the loan amount with the EMI payment. It shows the break-up between the interest and principal component. This tabular schedule helps the investor understand important information like the time period of payment, EMI, interest, principal payment, and the outstanding loan.

How is Quick Personal Loan EMI Calculated?

The basic formula for calculating an EMI payment is P*r*(1+r)n/((1+r)n-1).

Here, P= Loan amount

r= Interest rate

n= Number of months

The payments of EMI are directly proportional to the loan amount and interest rate, whereas it is inversely proportional to the number of months of the loan tenure. The higher the loan amount or interest rate, the higher will be EMI amount, and the inverse is for loan tenure.

Factors Affecting an EMI

The EMI payment of loan depends upon various factors, which includes:

Loan amount: it is the total amount that an individual has borrowed.Interest rate: it is the rate that is charged on the amount of loan you borrow.Loan tenure is the agreed loan repayment time frame between the borrower and the lender.The other factors that affect the EMI payment include the type of interest rate. If you apply for a fixed interest rate, the interest rate will remain the same over the repayment period. In contrast, if you apply for a floating interest rate, the interest rate will keep changing over the repayment period, as will your EMI payment amount.

Ways to Reduce Personal Loan EMIs

Below mentioned are some of the ways through which you can reduce your EMI payments:

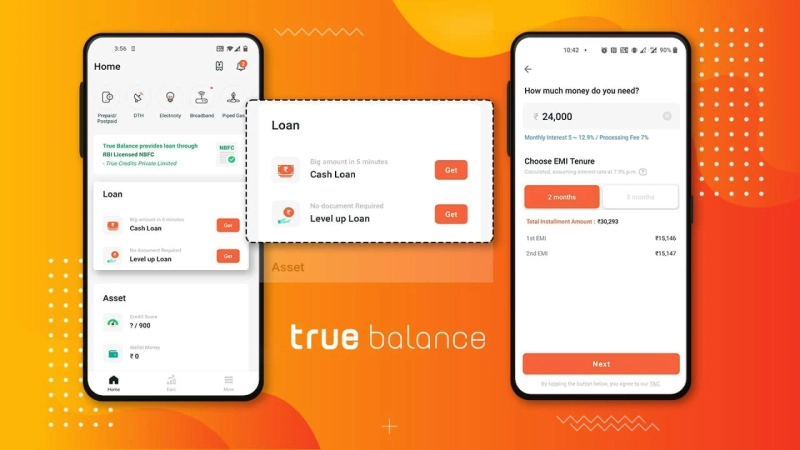

Opt for longer repayment tenure so that you can pay back in smaller installments.Negotiate with lenders for less interest rates.Maintain a high CIBIL score to avail the best possible benefits on a personal loan.Shop around the best deals and opt for the one that fulfills all your needs at easy terms and conditions.In case you want to enhance your credit score to have low EMI payments or if you are a first-time borrower, you can apply for a 'Level Up Loan' from the TrueBalance loan app. It is the best loan app that lets borrowers avail of personal loans at easy terms and conditions without any delay. It helps the borrower avail of instant loans at low personal loan interest rates. You can download the app from Google Play Store and apply for a loan through 5 easy steps. So what are you waiting for? Download the TrueBalance app and live a stress-free life!