The Indian fintech landscape is flourishing, fueled by a tech-savvy population and a growing appetite for new financial solutions. However, for aspiring entrepreneurs, the initial excitement of developing a groundbreaking idea can be dampened by the crucial question: how to secure the funds to make it a reality?

The fundraising journey for any business owner can be lengthy and demanding, involving countless pitches and emails. But fear not! This guide explores effective strategies specifically tailored to raise funds and find potential finance investors for your fintech startup in the Indian market.

Navigating the Funding Landscape

India offers a diverse range of funding avenues to consider. Here\'s a breakdown of the most common options:

- Venture Capital (VC): VC firms are ideal for high-growth startups with the potential to disrupt the market. They provide substantial funding in exchange for equity in your company.

- Angel Investors: These are wealthy individuals who invest in promising early-stage ventures. Often, they bring valuable mentorship alongside their financial backing.

- Bootstrapping: This self-reliant approach involves funding your startup using personal savings, loans, or revenue generation.

- Crowdfunding: Online platforms connect you with a large pool of individual investors, allowing you to raise capital in smaller increments.

- Government Grants: Schemes exist to support specific sectors or promote innovation, and some may align with your fintech solution.

Tailoring Your Funding Strategy

The optimal path to funding depends on your specific needs and the stage of your startup\'s development. Here are some key factors to consider when making your decision:

- Startup Stage: Are you in the initial stages of ideation, developing a Minimum Viable Product (MVP), or ready for rapid scaling?

- Funding Requirements: Determine the amount of capital you need to achieve your growth goals.

- Investor Expectations: Each funding source has its own expectations regarding return on investment and the level of control they will have in your company.

Crafting a Pitch that Compels

Today\'s investors look beyond simply good ideas. They seek transformative solutions that disrupt the status quo in the financial industry. To capture their attention, develop a compelling pitch that resonates with their interests. Here are some essential elements to include:

- A Clear Problem & Solution: Define the specific financial pain point your fintech solution addresses and how it offers a unique remedy.

- Market Validation: Demonstrate a deep understanding of your target market, its size, and its growth potential.

- The Dream Team: Showcase the expertise, experience, and passion of your team members who are driving the fintech revolution.

- Financial Projections: Provide a clear roadmap for generating revenue, project your growth trajectory, and outline a path to profitability.

- Exit Strategy: Explain how investors can expect to see a return on their investment in your company.

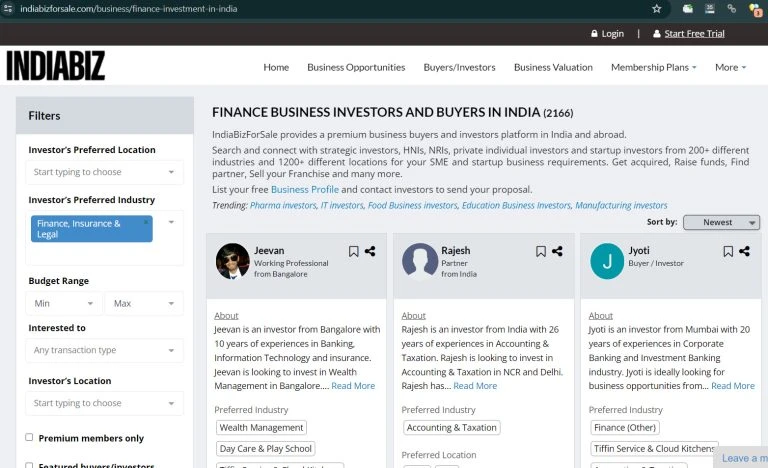

Leveraging IndiaBizforSale

IndiaBizforSale provides a platform that connects you with a vast network of pre-vetted financial investors actively seeking promising opportunities in the Indian fintech space. Here\'s how it can benefit you:

- Showcase Your Business/Startup: Present your compelling narrative and innovative solution to a targeted audience of potential investors aligned with your goals.

- Streamline the Process: Connect directly with relevant fintech investors, saving you valuable time and resources in your search.

- Maximize Funding Potential: Increase your chances of securing the funding required to propel your fintech startup towards success.

Tailoring Your Pitch for Targeted Impact

Remember, financial investors come from diverse backgrounds with specific investment preferences. Conduct thorough research on potential investors beforehand and tailor your pitch to resonate with their interests. Highlight aspects of your fintech startup that align with their investment goals and risk tolerance.

By implementing these strategies, you can effectively attract the right investors and secure the funding necessary to propel your fintech startup to new heights. Remember, a compelling story, data-driven validation, a strong team, and a transparent business plan are the keys to unlocking the potential of your innovative fintech solution.

If you require assistance during the fundraising process, don\'t hesitate to contact the IndiaBizForSale team at info@indiabizforsale.com.