Mediclaim and Health Insurance are two terms, often used interchangeably in healthcare finance. Though both are similar in their functionality, they are different in many ways. They play distinct roles in safeguarding you from medical expenses.

Here, we differentiate between the two, discussing the importance of each in healthcare coverage. Learning about both and the differences between them should help you choose the right healthcare plan.

For detailed information regarding which one you should choose, consider talking to a health insurance advisor in Kolkata.

What is Mediclaim Insurance?

Mediclaim is a type of healthcare plan that covers your medical expenses incurred from illnesses or injuries. It covers a variety of expenses and costs associated with medical treatment. A mediclaim will provide you with reimbursement of your medical expenses, whichever applicable under its terms up to the given limit.

However, to make the claim, the policyholder will have to submit the medical bills that detail the actual expenses, and a successful claim can be made. You can make the claim directly to the healthcare provider or the insurance company who will verify your claims and provide you with reimbursement.

Advantages of Mediclaim

Hospitalization protection: Mediclaim offers you coverage from hospitalization expenses incurred from illness or injury.

Family coverage: A single mediclaim policy often covers expenses for the entire family, including spouse, children, and dependent parent, simplifying healthcare for your loved ones.

Cashless hospitalization: Many policies have a network of hospitals where you need not make an upfront cost making the healthcare process even more streamlined.

Tax benefits: Mediclaim premiums are tax-deductible in many countries, making healthcare more affordable.

What is Health Insurance?

Health insurance is more elaborate coverage, a complete financial plan for a vast range of medical expenses and healthcare services.

Individuals and families have to pay regular premium amounts to an insurance company. In exchange, you get coverage for a large range of medical and healthcare expenses like doctor’s visits, preventive care, hospital stays, surgeries, prescription medicine, and more, depending on the selected plan.

A health insurance advisor in Kolkata can help you with detailed knowledge about the various types of health insurance and plans.

Advantages of Health Insurance

Comprehensive financial protection: Health insurance covers a wide range of medical expenses, including hospitalization, daycare products, home-based care, and ambulance fees, taking the financial burden off your head.

Critical illness coverage: Critical illness plans, available as standalone policies or add-ons, protect against severe conditions like limb loss, kidney failure, strokes, bone marrow transplant, and more, providing financial security during critical healthcare challenges.

Hassle-free claims: Many insurers have cashless claim services, in which you do not have to pay any upfront costs in hospitalization.

Tax advantages: Health insurance premiums qualify for tax exemptions under Section 80D of the Income Tax Act, 1961.

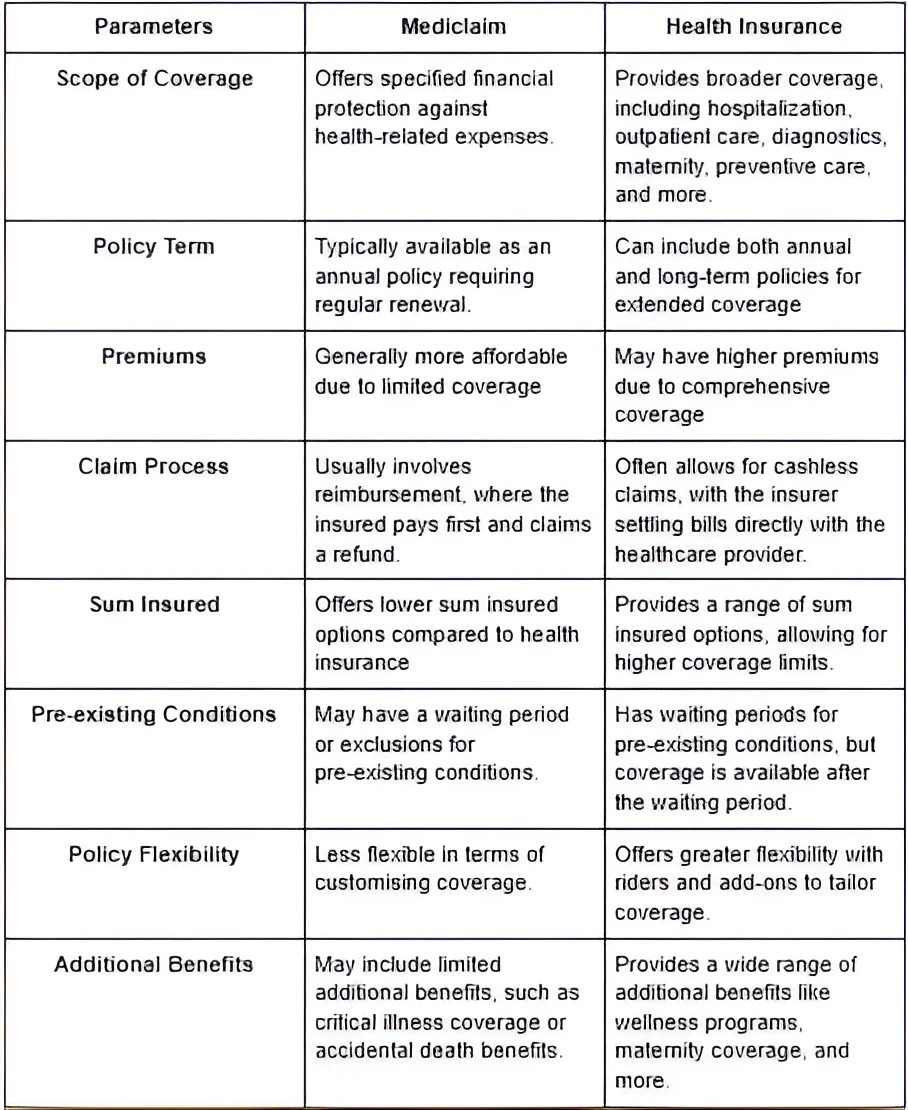

Difference Between Mediclaim and Health Insurance

Differences between Mediclaim and Health Insurance:

How to Choose Between Mediclaim and Health Insurance

When choosing between mediclaim and health insurance, you must consider the following:

Extent of coverage: Assess the coverage provided by each. Health insurance typically provides better and broader coverage than mediclaim.

Family needs: Consider your family’s healthcare needs. Health insurance policies often allow you to include your spouse, children, and sometimes your dependent parents under a single plan.

Premium costs: Compare the premium costs associated with both the products. Health insurance typically has higher premium amounts.

Cashless service: Check if the provider of your mediclaim or health insurance provides cashless service. If you want, you can opt for a suitable policy.

Critical illness coverage: If you need coverage for critical illnesses like cancer or heart disease, you can choose a policy that provides insurance for that.

Tax benefits: Evaluate the tax benefits associated with each option.

For a more detailed discussion on the various aspects of mediclaim and health insurance, you can always approach a qualified health insurance advisor in Kolkata.

Conclusion

Both mediclaim and health insurance have distinct features and advantages, and the choice between the two depends solely on your preferences and needs.

If you want a more elaborate coverage plan, you can choose health insurance. But in that case, be prepared to pay a greater premium amount than mediclaim. Other than that, health insurance offers greater flexibility in terms of customizing coverage and offers cashless facilities that mediclaim may or may not offer.

So, weigh your options carefully and make an informed decision based on your requirements.