With its stunning Gulf Coast views, vibrant community, and luxurious lifestyle, Naples, Florida, is a prime location for condominium living. However, owning a condo in this beautiful city comes with responsibilities, including securing the right insurance coverage. Understanding the intricacies of Naples condominium insurance and Naples condo association insurance and how they intersect is crucial for every condo owner.

Understanding Naples Condominium Insurance

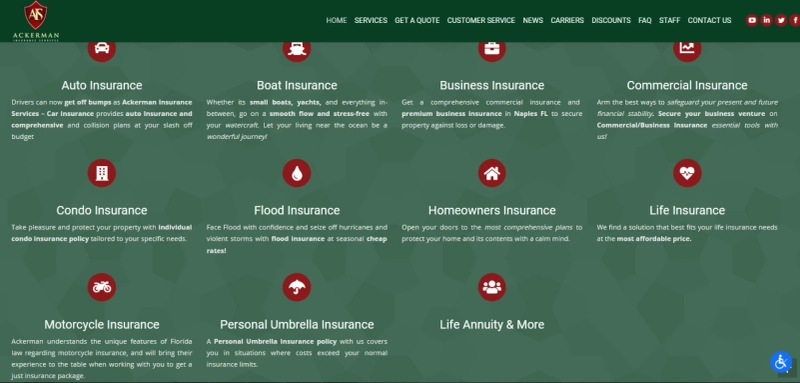

Condominium insurance, often called HO-6 insurance, is designed for individual condo units. Naples condominium insurance covers personal property, interior walls, flooring, and other elements within the unit not covered by the condo association's master policy. The association's other severe weather events in Naples are a concern, so having a robust HO-6 policy is essential.

Critical Components of HO-6 Insurance

Dwelling Coverage: This part of the policy covers the interior structure of your unit, including walls, floors, and ceilings. It's crucial in Naples due to the potential of hurricane damage.

Insurance Naples FL protects your belongings, such as furniture, electronics, and clothing. Given the high value of properties in Naples, ensuring adequate coverage for personal possessions is essential.

Liability Coverage offers protection if someone is injured within your unit and decides to sue. It's precious in Naples, a community-oriented environment where daily social gatherings occur.

Loss of Use Coverage: If your condo becomes uninhabitable due to a covered peril, this coverage helps pay for additional living expenses while repairs are made.

Loss Assessment Coverage: This covers your share of losses assessed by the condo association, often due to damage to joint areas or insufficient coverage by the association's policy.

Naples condo association insurance is held by the condo association and covers common areas and the building. In Naples, FL, the building includes roofs, hallways, elevators, and amenities like pools and gyms.

Types of Master Policies

Bare Walls-In Coverage: This policy covers only the bare structure of the condo complex, including walls, floors, and ceilings. Unit owners ensure everything within their walls, including fixtures and appliances.

Single Entity Coverage: Extends beyond bare walls, including built-in property like original fixtures and appliances. It does not cover improvements or upgrades made by individual unit owners.

All-In Coverage: This is the most comprehensive option. It covers all fixtures, installations, and additions within the units and common areas, except for the personal property of the unit owners.

Coordinating Coverage between Individual and Association Policies

For condo owners in Naples, understanding the overlap and gaps between individual HO-6 policies and the condo insurance Naples FL is the association's step to ensure the coverage you need for your policy.

Assess Your Personal Property: Inventory your belongings and evaluate their replacement costs to ensure adequate personal property coverage.

Consider Additional Coverage’s: In Naples, where hurricane risk is significant, consider adding hurricane and flood insurance if not included in your master or HO-6 policy.

Conclusion

Condominium living in Naples' FL, offers a blend of Naples' community, but it is responsible for securing the right insurance. By understanding the distinctions between Naples condominium insurance and Naples condo association insurance, condo owners can ensure they are fully protected against potential risks. Regularly reviewing and updating your insurance policies in consultation with knowledgeable professionals can provide peace of mind, allowing you to enjoy Naples's coastal lifestyle.