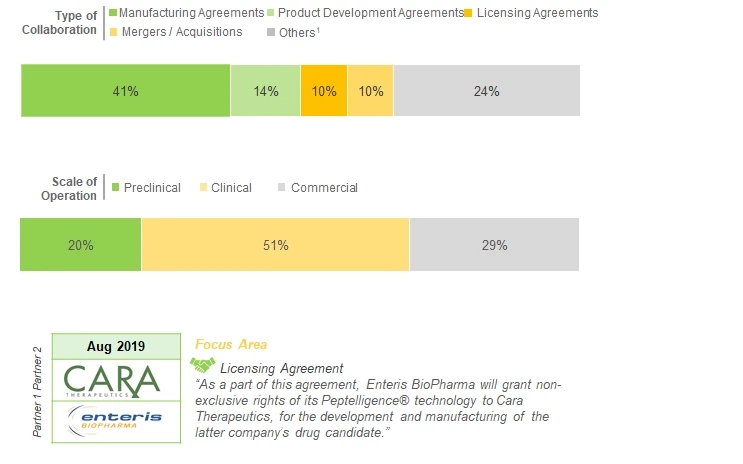

During our research, we came across several partnerships and collaborations that have been inked, during the period 2014-2019, between various stakeholders involved in the peptide therapeutics contract manufacturing domain. Of which, the manufacturing and supply agreements emerged as the most popular type of partnership model adopted by companies engaged in this domain, representing 35% of the total number of deals. This was followed by instances of mergers / acquisitions (13%) and product development and manufacturing agreements (10%). Additionally, a few licensing agreements were reported in given time period; examples include (in reverse chronological order) deals signed between Enteris BioPharma and Cara Therapeutics (August 2019), NUMAFERM and PEPDesign (July 2019) and Enteris BioPharma and Ferring Pharmaceuticals (February 2017). Whereas, most of the agreements were signed for clinical stage molecules (48%), followed by those inked for the production of peptide therapeutics at commercial (28%), and preclinical scales (24%).

The maximum number of partnerships were signed by stakeholders based in the US. Within Europe, most of the international agreements were inked by Switzerland and Sweden based companies. Furthermore, in Asia Pacific, majority of the local partnerships were signed by companies based in China, while most of the international deals were signed by players headquartered in India.

Moreover, we were able to identify various other development initiatives, such as opening of new facilities, and expansion of manufacturing facilities and capacity focused on peptides, which have recently been undertaken by companies in this domain, during the period of 2014-2019.

Furthermore, the domain features the presence of recent peptide synthesis technologies that have made an impact on the peptide manufacturing process, such as chemo-enzymatic peptide synthesis technology, continuous flow technology and green chemistry.

Chemo-enzymatic technology: Manufacturing of long peptides (amino acids > 30) via solid or liquid phase chemical synthesis is a cumbersome task. As the length of the peptide increases, the synthetic yield of the product decreases significantly. The recent discovery of peptiligase has enabled enzymatic ligation of peptide fragments synthesized through solid / liquid phase synthesis, thereby ensuring assembly of linear and cyclic peptides. Therefore, peptiligase plays a key role in the chemo-enzymatic peptide synthesis (CEPS) technology.

Continuous Flow Technology: Conventional peptide synthesis technologies and equipment require a large number of amino acids or their equivalents, resulting in increased coupling time, thereby leading to rise in the the overall reaction time. Continuous flow (CF) technology requires only 1.5 amino acids or its equivalents, thus expediating the overall reaction process. In addition, this technology uses pre-heated and activated amino acids to ensure fast and efficient reaction.

Green Chemistry: Peptides are synthesized by formation of amide bond between amino acids, which are protected by Fmoc (solid phase synthesis) and Boc (liquid phase synthesis) protecting groups. Further, deprotection and coupling of amino acids is performed in the presence of dichloromethane (DCM) and dimethylformamide (DMF). However, these chemicals are highly toxic and generate huge amounts of waste during peptide synthesis. Thus, substituting these chemicals with propylene carbonate, a green polar aprotic solvent, in both solution and solid phase peptide synthesis forms the basis of green chemistry.