Effective use of the online marketplace is vital for the growth of your business. Still, the digital landscape is rife with threats, including fraud rings and other bad actors who work daily to take advantage of organizations just like yours. With seemingly endless account opening fraud and other attacks occurring every day, it can feel like a serious challenge to keep your company out of the line of fire. However, investing in a high-quality fraud detection system based on behavioral analytics can help you stay ahead of fraudsters. Read on to learn how real-time fraud detection can help insulate your business from fraud attempts.

Understanding the Digital Identity Crisis

Traditional identity verification software relies on PII to determine whether a user is a genuine customer or a bad actor with nefarious intent. Unfortunately, the vast troves of compromised PII available for purchase online means that PII-reliant verification software is susceptible to a wide variety of fraud, including new account fraud and account takeover fraud. It’s bad enough that individuals are capable of defrauding businesses online, but with evolving fraud ring attacks and increasingly cunning tactics, it’s become clear that your fraud detection strategies must go beyond PII.

Getting to Know Behavioral Analytics

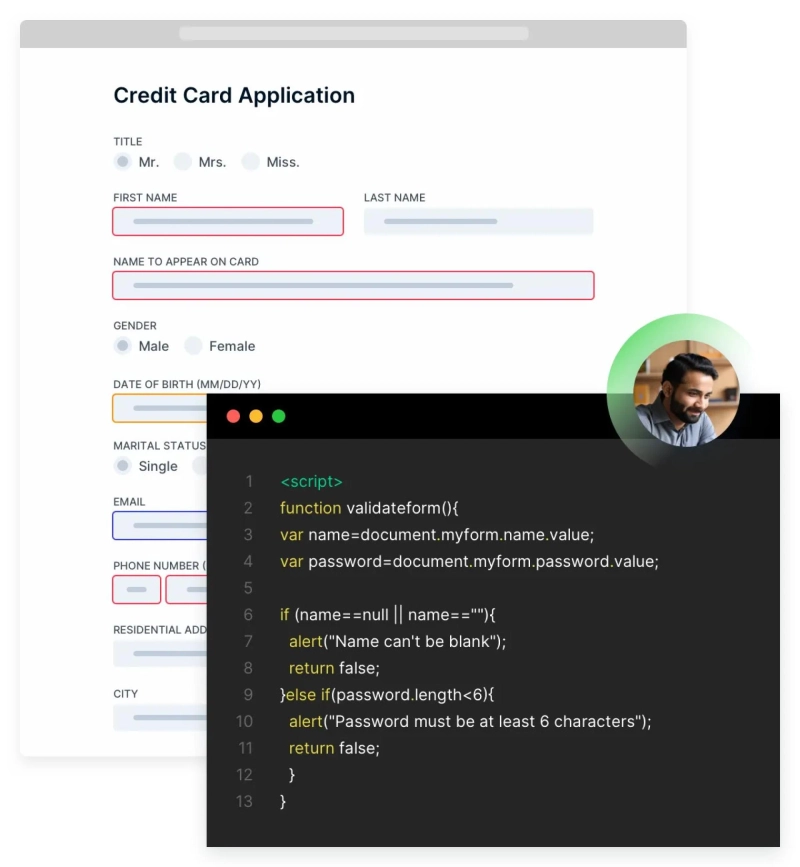

Where PII-based verification systems fall short, behavioral analytics take fraud detection to a new level. Instead of relying on details like a user’s name, home address, and phone number—all of which can be stolen or fabricated—behavioral analytics software performs ID verification based on pre-submit data. In essence, this software monitors a user’s activity as they fill out a form on your site. If a user is hesitating over a field that should be an easy answer for a real person—like their email address—or repeatedly retyping answers, their behavior is flagged as a potential indicator of a user with fraudulent intent.

Taking a Proactive Approach to Fraud Detection

Synthetic identities created using compromised PII are difficult or impossible to detect using traditional PII-dependent, post-submit software. However, such fraud techniques can’t fool behavioral analytics. Instead, behavioral analytics look only at pre-submit data gathered from the user’s clicks, taps, and keystrokes to discern which users are genuine customers and which are would-be perpetrators. High-end behavioral analytics technology monitors crowd-level behavior to spot signs of activity such as fraud ring attacks. Once identified, this behavior is rapidly referred to your step-up verification systems to take action before attacks start.

Reducing False Positives

Your company’s digital security doesn’t have to come at the cost of a pared-down user base. With the power of behavioral analytics and identity orchestration, your verification systems can avoid incorrectly designating users as risky, thereby preventing false declines of genuine customers. Behavioral analytics offer a next-level response that optimizes your capacity to detect threats without closing the gate on actual users.

About NeuroID

The growth of your business starts with trust: the ability to conduct business confidently and securely in our ever-changing digital world. But with the Digital Identity Crisis in full effect, how do you strike the right balance between growth and security? NeuroID stands for the future of identity authentication online. They use groundbreaking technology to passively analyze behavior, discerning between genuine users and bad actors, including fraud rings and bots. These aren’t the same outdated, easily-fooled PII-based measures you may have seen before—NeuroID analyzes digital body language to offer cutting-edge fraud detection. NeuroID visualizes crowd activity at scale and makes critical judgments in real time, rapidly referring risky users to your organization’s step-up verification so you can detect fraud before it starts.

See how innovative solutions from NeuroID can help you secure growth at https://www.neuro-id.com/

Original Source: https://bit.ly/3CyqVNj