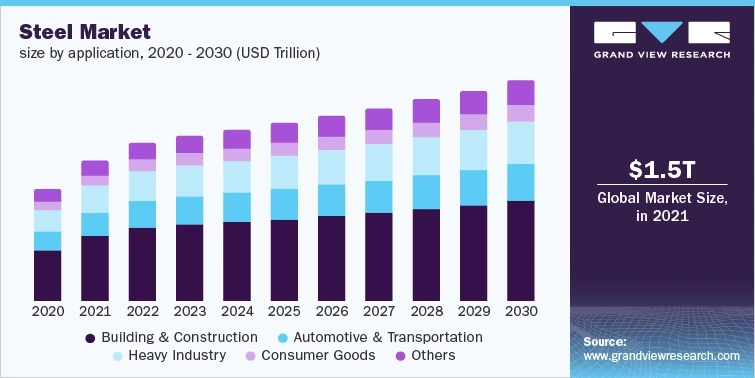

The global steel industry size will witness promising growth in the wake of affordable housing, expanding public infrastructure and solar manufacturing, according to the "Steel Industry Data Book, 2023 - 2030" published by Grand View Research. Bullish construction activities across emerging economies, including China and India, will steer infrastructure projects to propel post-COVID economic recovery. Investments in green construction and a less carbon-intensive future pose a stiff challenge for stakeholders. According to the World Steel Association, every ton of steel produced in 2020 emitted an average of 1.89 tons of CO2 into the atmosphere. Demand for carbon-friendly steel products is poised to redefine the global outlook.

Decarbonization, a trend that has become prevalent in various industries, has spurred a wave of innovation in carbon steel. With the EU and the U.K. committing to carbon neutrality and other nations pledging to minimize their carbon footprint, manufacturers and suppliers have injected funds into sustainable steel. The IEA's Sustainable Development Scenario notes that total direct emissions from the iron and steel sector should dip by over 50% by 2050 to meet the energy and climate goals. Green construction and the penetration of environmentally friendly products in the automotive sector will provide an impetus to the demand for cost-effective and eco-friendly solutions.

Order your copy of the Free Sample of "Steel Industry Data Book - Stainless Steel, Carbon Steel, Electrical Steel, Weathering Steel, Sintered Steel Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030" Data Book, published by Grand View Research

Stakeholders have furthered investments in the construction sector and automotive production, alluding to the robust growth of stainless steel. According to the European Automobile Manufacturers' Association, around 85.4 million motor vehicles were produced globally in 2022. Furthermore, infrastructure development plans across emerging and advanced countries have added a fillip to the growth forecast. Till May 12th 2023, the Biden-Harris Administration announced more than USD 220 billion in funding with over 32,000 projects. The global stainless steel market size stood at USD 104.23 billion in 2021 and will exhibit an 8.9% CAGR from 2022 to 2030.

Trends and opportunities poised to influence the industry outlook are elucidated below:

Structural steel will gain ground on the back of expanding sustainability trends. Residential, commercial and industrial sectors are expected to depict strong product demand.

Bullish investments in grid expansion projects have expedited the market penetration of electrical steel.

The North America market will observe notable investments in light of surging steel production in the U.S. The World Steel Association infers that the U.S. produced 6.6 Mt steel in April 2023, behind China, India and Japan.

Go through the table of content of Steel Industry Data Book to get a better understanding of the Coverage & Scope of the study

Buoyant steel production across the Asia Pacific offers compelling growth potential for manufacturers, suppliers and end-users. In April 2023, China produced around 92.6 Mt, while India and Japan produced 10.7 Mt and 7.2 Mt, respectively. Infusing funds into modern economies and sustainable projects will bring a paradigm shift in the regional outlook. For instance, in September 2022, Steel Authority of India Limited (SAIL) reportedly supplied 30,000 tons of the DMR grade specialty steel for INS Vikrant, the country's first indigenously built Aircraft Carrier. Further, expanding railway and automobile sectors across China and India will underpin Asia Pacific steel industry growth.

The competitive landscape suggests organic and inorganic strategies will impel brand reputation, customer retention and augment RoI. In doing so, innovations, technological advancements, product offerings, R&D activities, geographical expansion, partnerships and mergers & acquisitions could reshape the industry dynamics. To illustrate, in June 2023, Germany's Economy Minister contemplated providing approximately 2 billion euros (around USD 2.1 billion) to foster Thyssenkrupp's green steel plant in Duisburg. Meanwhile, in February 2023, Nippon Steel inked a deal with Teck Resources Limited to acquire equity and royalty interest in Elk Valley Resources Ltd.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.