For Title and Escrow agencies, managing multiple transactions, stakeholders, and communication threads can be overwhelming without the right systems in place. Today’s clients expect consistent updates, proactive outreach, and timely responses, especially when dealing with something as important as a property transaction.

That is why the role of CRM for escrow companies has become indispensable. A centralized CRM solution allows Title and Escrow professionals to streamline client communications, reduce errors, and build stronger, trust-based relationships at scale.

Why Communication is a Competitive Advantage

In the world of real estate closings, poor communication can cost more than time—it can erode client trust, delay transactions, and impact referrals. Whether it is a buyer, seller, realtor, or lender, each party relies on the Escrow team for clarity, updates, and next steps.

A robust CRM solution for Title and Escrow agencies ensures that all team members stay informed and aligned. From task management to automated alerts, a CRM helps keep clients in the loop and ensures no message or milestone is missed.

Key CRM Features That Elevate Escrow Client Communication

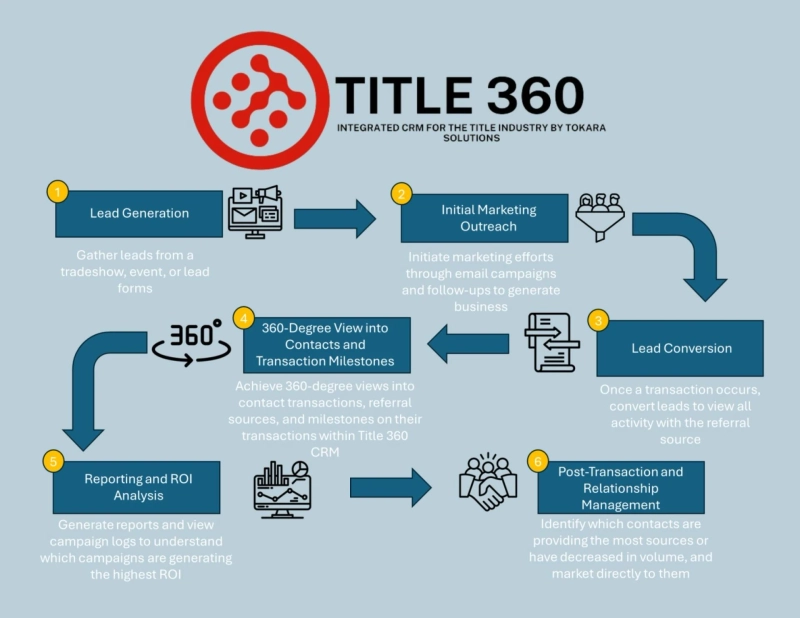

Here is how an industry-tailored CRM—like Title 360—enhances communication throughout the escrow lifecycle:

1. Centralized Contact & Communication History

Rather than searching through emails or sticky notes, a Title and Escrow CRM software consolidates all client interactions, documents, and task statuses in one place. Every conversation is logged, making it easier to follow up and maintain continuity—even if someone else takes over the file.

This is especially useful for growing teams or multi-branch agencies where multiple people may interact with the same client.

2. Automated Notifications & Reminders

Missed deadlines or lack of updates can trigger anxiety for clients. CRM platforms offer automated reminders and alerts when key actions occur—such as when a file is opened, a closing date is approaching, or documentation is overdue.

Using CRM for escrow companies, your team can proactively reach out before clients even ask for updates. This level of attentiveness sets your agency apart from competitors.

3. Templates for Consistent Messaging

CRMs allow teams to create branded templates for commonly sent emails or SMS messages—such as welcome emails, document checklists, or reminders to schedule a signing.

By standardizing your outreach with a CRM solution for Title and Escrow agencies, you ensure every client receives a polished, professional experience while saving time for your staff.

CRM Consulting for Title and Escrow Companies: Why It Matters

Choose the right CRM for title and escrow business is only half the battle. To maximize the value of your software investment, many agencies benefit from CRM consulting for Title and Escrow companies. Consultants help tailor the CRM to your specific workflows, compliance needs, and client communication preferences.

Whether it is configuring automations, setting up integrations with tools like Qualia, or training your team, CRM consultants streamline onboarding and ensure your solution is aligned with your business goals.

Mobile Access for On-the-Go Responsiveness

In this industry, work does not only happen at a desk. Whether attending a closing, networking with realtors, or working remotely, mobile access is necessary.

Modern title and escrow CRM software offers full-feature mobile apps and offline access, so your team can check client updates, send follow-ups, or log activity wherever they are. That means faster response times and fewer missed opportunities.

Real-Time Insights That Power Better Communication

The best CRM solutions provide real-time dashboards and reports that highlight client trends, communication gaps, and referral partner engagement. With this data, you can:

- Prioritize outreach to your most active or at-risk clients

- Identify referral sources who may need a follow-up

- Spot communication bottlenecks before they affect closings

By using CRM for escrow companies, agencies transform communication from a reactive function into a proactive business asset.

Transform the Way You Connect with Clients

If your Title & Escrow team is still relying on scattered emails, spreadsheets, or outdated tools, now is the time to evolve. A purpose-built CRM solution for Title and Escrow agencies can elevate your client communication, reduce operational friction, and position your team as a true partner throughout the closing process.