In the modern landscape of digital transactions, credit cards have become a staple in our wallets and lives. Yet, beneath the surface of these seemingly simple transactions lies a complex framework governed by credit card interchange rates. These rates, while not often in the spotlight, have a profound impact on businesses, consumers, and the financial ecosystem as a whole.

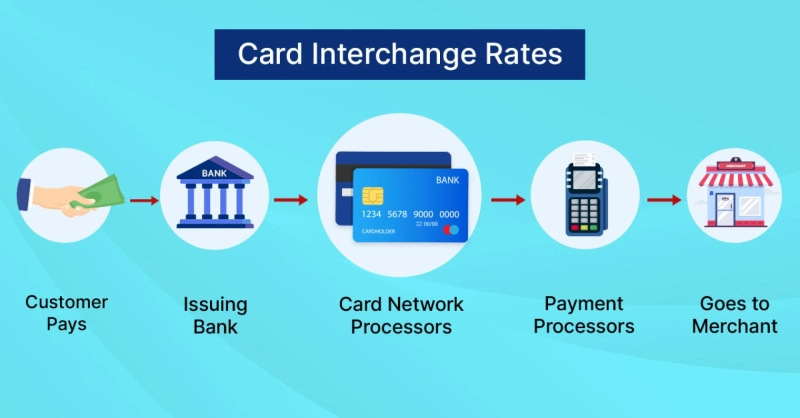

In essence, interchange rates are the fees that facilitate the movement of money between a merchant's bank and a cardholder's bank during a credit card transaction. These fees encompass a multitude of services, including authorization, transaction processing, fraud protection, and maintaining the payment network infrastructure. The interchange rates are not uniform; they vary based on factors such as the type of card, the industry of the merchant, the method of transaction, and the level of risk involved.

For businesses, these rates can be a double-edged sword. On one hand, credit cards can expand customer bases and streamline payments, but on the other hand, high interchange rates can cut into profit margins, especially for businesses with low transaction volumes or high-value goods. This financial consideration can influence pricing strategies and even the decision to accept credit cards as a payment method.

Consumers may not directly encounter interchange rates, but they indirectly bear their effects. Merchants often incorporate these fees into their pricing structures, potentially leading to slightly higher costs for products and services. Furthermore, interchange rates play a role in shaping credit card rewards programs and benefits, impacting the perceived value of using particular cards.

The discourse around interchange rates is not a silent one. Industry players, regulators, and experts often debate the fairness and transparency of these rates. Some argue for more stringent regulation to ensure a level playing field for businesses, while others contend that interchange rates are reflective of the costs of maintaining a secure and efficient payment network.

In the face of ever-evolving technology, interchange rates are not immune to change. The rise of digital wallets, contactless payments, and even cryptocurrencies introduces new dimensions to the equation. Additionally, as concerns over data security and privacy intensify, the importance of a well-regulated payment ecosystem becomes increasingly evident.

Credit card interchange rates may operate behind the scenes, but their impact is far-reaching. They shape how businesses operate, influence consumer spending, and are a fundamental element of the financial framework we navigate daily. Gaining insight into these rates provides a deeper understanding of the intricate dance that transpires with every swipe or chip insertion.