Mergers and acquisitions deals have seen substantial growth in the last few years. In fact, the year 2018 saw a record $4.1 trillion worth of M&A deals being closed globally. Mergers and acquisitions in India have also witnessed similar growth trends. The primary reason behind this phenomenon is that companies look at mergers and acquisitions as a more viable growth option to organic growth. Companies looking at expanding or transforming their portfolios, take the M&A route to accomplish their growth plan quickly and in a cost effective manner. Though the volume may have increased significantly over the years, not all deals are successful, or may have fallen short of expectations.

Acquirers who have little or no experience in such deals, such as small and medium enterprise, start-ups, and even some larger corporations should gain insights from the experience of more seasoned deal makers to improve their chances of success. To achieve this, they must have the right people at every stage of the mergers and acquisitions process.

Irrespective of the size of the organization or the experience it may have in making such deals, there are five key stakeholder roles that must be included in all M&A transactions. You must also understand that no two deals are alike and, therefore, no fixed formula for success. Companies in different sectors have different requirements, different companies have different goals, their strength and weaknesses are different, and so on. Also, the complexities of each deal type are different and, therefore, companies should be flexible with the five key stakeholders approach to M&A transaction.

The five key roles in mergers and acquisitions process have been discussed below.

C-Suite and the Investment Committee

C-suite is the group of senior most executives from different functional areas of an organization. C-suite derives its name from the designation of the top executives, such as, chief operating officer, chief financial officer, chief information officer, etc. apart from the c-suite members the investment committee comprises other top executives. C-suite is the most important and influential group in an organization and play a strategic role in its functioning. They are the final decision making authority and are accountable for the performance of an organization.

The responsibility of the investment committee is to ensure that the right people are appointed for specific roles and that teamwork and discipline is maintained throughout the M&A process. It is the job of the investment committee to ensure that there is collective focus on long term value creation while evaluating any deal. Role of the investment committee is far more crucial in the initial stages of the process where in a coherent strategy is formulated and a unified vision for the company is established. Later on they assume more of a supervisory role.

Business Unit Leadership

Business unit is mainly responsible for the operations of the newly acquired entity, and, therefore, their role becomes critical in the final stages of the process and after a transaction is complete. However, it is important that they are involved early so that they can blend their experience with strategic compulsions. The business unit should be involved in the due diligence and integration stage as they can provide their valuable inputs. In smaller and medium-sized enterprise, it could be a challenging proposition to appoint a business unit exclusively dedicated to the operations of the acquired business because of manpower constraints. Key personnel might have to don multiple hats to accomplish the task.

Corporate Development

The corporate development team is the most actively involved through every step of the merger and acquisition companies in India. Organizations that frequently look for acquisitions, maintain a dedicated corporate development team that is tasked with the job of identifying potential targets, conducting due diligence and prepare for formal bidding. Another key aspect of their role is to project their company as the best possible acquirer. The team regularly interact with the target and gain extensive knowledge about them, which they pass on to the top management for deliberation. They provide valuable inputs in planning and executing M&A strategy.

Transaction Lead

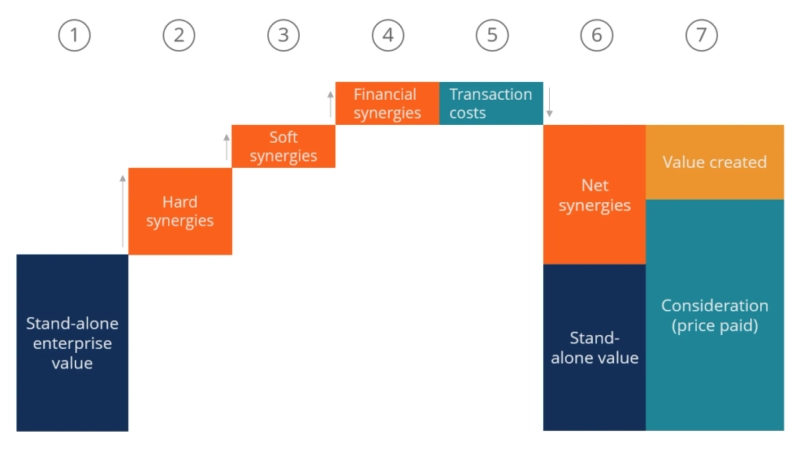

Acquisitions are generally made to achieve operational synergies and create value for the stakeholders. Though the role of the transaction lead is significant at the end stages of the process that involve deal closure and integration of the acquired company with the existing business, it is important that the transaction lead be involved from the early stages of the deal. Since the objective is to achieve synergies, involving the transaction lead early on can help him/her understand the risks, challenges, and opportunities associated with the deal. An ideal candidate would be someone with prior experience of M&A or someone with exceptional cross-functional management skills.

External Advisors

The role of external advisors can never be undermined in mergers and acquisitions transactions. Internal capabilities notwithstanding, the external advisors play a pivotal role in the M&A process. The external advisors have extensive experience in executing such deals. These external advisors are typically from the financial and legal sectors. They assist the acquirer in identifying potential targets and conducting due diligence. Mergers and acquisitions in India generally do not happen without the help of external advisors. Their roles in the M&A process is extremely critical as they provide unbiased professional advice to their clients.