To grow your business, you need consistent improvement in all your processes. As many organizations have learned the hard way, a sudden influx of web traffic or applications can be indicative of fraud ring activity or bot attacks. How does your organization separate legitimate customers from risky users and potential bad actors? Even if you can identify them, how can you ensure your digital detection strategies don’t come at the cost of turning away legitimate business? When you can identify the telltale signs of fraud, you can improve your business’s ability to react without denying genuine users. Read on to learn about some of the most common types of fraud and how your business can adapt to these evolving threats.

New Account Fraud

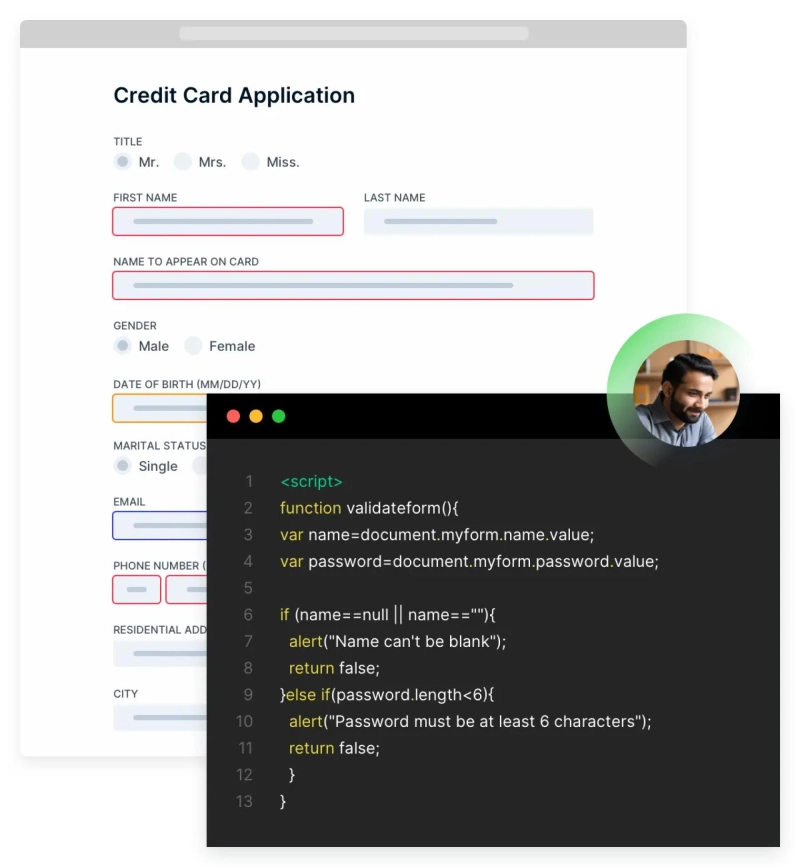

Just like it sounds, new account opening fraud occurs when a bad actor successfully defeats your organization’s identity verification processes and opens a new account. An example would be a fraudster creating an account at a financial institution to max out credit lines before they disappear. The fraudster could create an account by registering with a synthetic identity, a stolen identity, or even a version of their own identity. Unless you’re equipped with robust fraud detection technology, this fraud can be difficult to detect, especially if the fraudster behaves normally for an extended period of time after opening the account.

Account Takeover Fraud

With massive troves of compromised PII available online, it’s no wonder account takeover fraud has become so common. In this type of fraud, a bad actor uses stolen credentials to take control of an account that a genuine user legitimately established. In truth, nearly any online account can be taken over through phishing, keylogging malware, or session hijacking. This type of fraud is difficult to detect unless your organization is looking for abnormal behavior from users.

New Tools to Monitor Anomalies

Fraud detection tools that rely upon PII verification are frequently defeated by fraudsters using synthetic identities or even their own legitimate credentials. Increasingly, organizations that successfully detect fraud in time to intervene use behavioral analytics. This form of fraud detection passively analyzes users’ behavior to see, for example, if a user is taking abnormally long to fill in application details that should come to mind quickly for an authentic user, like their name or email address. That sort of risky behavior can be a key indicator of fraud.

Direct Risky Users to Step-Up Verification

When a user hesitates over form fields that should be an easy answer for a real person or can’t seem to remember their phone number, that’s a sign that your organization is being targeted by a bad actor. Instead of relying on post-submit data—like static PII—your business can successfully detect and defeat fraud attempts through behavioral analytics. By monitoring pre-submit digital body language, this superior ID verification technology offers enhanced fraud detection, referring risky users to your step-up verification in real-time. This type of detection offers an outstanding degree of accuracy, reducing false positives and helping your business grow.

About NeuroID

The growth of your business starts with trust: the ability to conduct business confidently and securely in our ever-changing digital world. But with the Digital Identity Crisis in full effect, how do you strike the right balance between growth and security? NeuroID stands for the future of identity authentication online. They use groundbreaking technology to passively analyze behavior, discerning between genuine users and bad actors, including fraud rings and bots. These aren’t the same outdated, easily-fooled PII-based measures you may have seen before—NeuroID analyzes digital body language to offer cutting-edge fraud detection. NeuroID visualizes crowd activity at scale and makes critical judgments in real time, rapidly referring risky users to your organization’s step-up verification so you can detect fraud before it starts.

Get next-level fraud detection with NeuroID at https://www.neuro-id.com/

Original Source: https://bit.ly/3Aalr8N

Types of Account Fraud and How to Detect Them