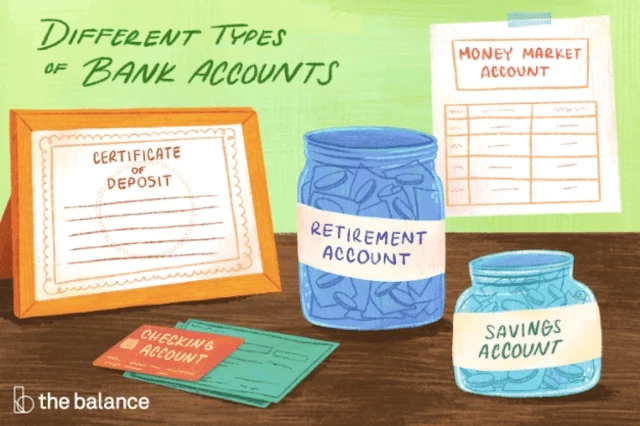

A savings account is a good way to put the money you don\'t want to spend directly, so it makes the money safe and available when you pay a small amount of money. There are various kinds of savings accounts and other accounts with a common role to play. Each variant and all banks or credit unions that sell such accounts are different, so the choices must be understood. A savings account is simply a place to store money. In its simplest form, You deposit, gain interest, and collect money if you need it. You can link yourself to your account as much as you want, but there are finite amounts of the number of days that you are able to withdraw or move money. In the UAE many banks like Mashreq offer convenient savings accounts for their customers. Mashreq bank not only offers a savings account for students but also known as the best bank in UAE for expats. There are some kinds of plans that pay interest when providing supplementary incentives if you need more than a regular or online savings plan. MMAs look like bank deposits and feel like them. You typically write checks against the account and can also invest the funds with a credit card; the key difference is that you can quickly access the currency. However, there are limitations as to any savings plan on how many withdrawals can be made per month. MMAs cost more interest than bank accounts, but you normally get more money to keep with them as well. 8 You are a decent bet for emergency spending since your cash is still easy to reach as you gain interest. Savings accounts are also equivalent to CD\'s, however, they cost more generally. The deal is, for instance, 6 months or a year and a half, you have to lock your money on a CD. You can borrow money early, but you\'re going to have to pay a levy, so CDs just make sense for cash storage that you won\'t use soon. Savings plans can be costly if you do not have a significant balance in your account with the general exception of online banking. Banking charges monthly operating expenses, usually, and small accounts pay little to no interest. This is a challenge for students who spend most time learning, not working. Any banks sell savings account for students that don\'t charge recurring charges. In a bank account, you can invest something or nothing, but sometimes it is useful to dedicate funds for a certain reason. You may want to save money for a new car, for your first home, for a holiday or even for your loved ones, for example, any banks sell savings plans tailored especially for these objectives. The biggest advantage of these accounts is social, as a single account is connected to something that you trust more often than not. In general, you can not earn more, even though some banks and credit unions provide benefits that promote daily savings. Mashreq Bank, for example, pays the highest interest rates.Savings Accounts Varies

Money Market Accounts

Certificates of Deposit

Savings Account For Student

Target-Focused Account Savings

Types Of Savings Accounts in UAE