United Arab Emirates Red Meat Market Trends & Summary

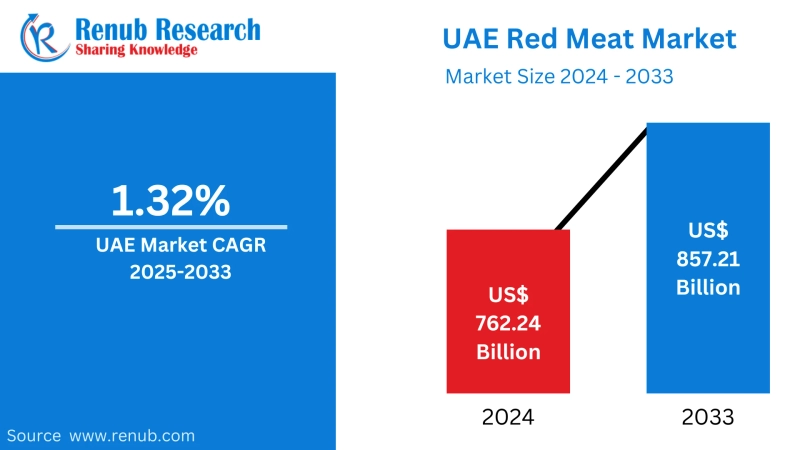

The United Arab Emirates' (UAE) red meat market is projected to reach USD 857.21 billion by 2033, up from USD 762.24 billion in 2024, representing a compound annual growth rate (CAGR) of 1.32% from 2025 to 2033. This growth is driven by several factors, including rising urbanization, high tourism levels, a rich culinary culture, government support for food security, changing dietary preferences, and an increasing demand for premium, halal, and sustainably sourced meat products.

United Arab Emirates Red Meat Market Overview

The red meat sector is a significant component of the UAE's broader food market, fueled by rising demand for a variety of meat products. As one of the fastest-growing economies in the region, the UAE has experienced a consistent increase in both population and tourism, driving higher demand for red meat. Consumers in the UAE increasingly favor premium meat options, such as beef and lamb, influenced by a blend of Western culinary trends and traditional Middle Eastern cuisine. The growing expatriate population has also diversified tastes, leading to heightened demand for high-quality and varied meat options.

However, despite the strong demand for red meat, the UAE faces challenges in local meat production, relying heavily on imports from countries like Australia, New Zealand, and Brazil. The government is focused on ensuring food security through initiatives that promote sustainable farming practices and the establishment of key meat storage facilities. There is also a noticeable shift towards halal-certified products that align with the cultural and religious preferences of the majority Muslim population. The industry stands poised for future growth, enhanced by advancements in online retail, packaging, and transportation, which increase access to premium red meat for a broader range of consumers in the UAE.

The robust tourism and hospitality industry is a major driver of demand, significantly impacting the red meat market. With approximately 13,000 restaurants and cafes in Dubai alone as of 2023, the city has become a culinary hub in the MENA region. As of 2022, expatriates made up 88.52% of the UAE's population (8.92 million), leading to a diverse culinary landscape that caters to various global tastes and preferences. This cosmopolitan environment has fostered the evolution of both traditional Middle Eastern meat dishes and international cuisine, particularly in the upscale restaurant sector.

Growing consumer awareness and changing preferences are leading to a significant shift in the meat market towards premium and high-quality products. A recent survey found that 84% of UAE consumers are actively trying to reduce their consumption of artificial additives, reflecting a strong preference for premium, natural beef options. As a result, the demand for premium, organic, and grass-fed meat varieties has risen sharply, prompting suppliers and retailers to enhance their offerings in this market segment. Price dynamics also influence consumption trends; in 2022, beef remained approximately 29% less expensive than mutton, reinforcing its position as a more cost-effective protein source.

Request a free sample copy of the report: https://www.renub.com/request-sample-page.php?gturl=united-arab-red-meat-market-p.php

Trends in the United Arab Emirates Red Meat Market

Adoption of Strategies to Enhance Livestock Commercialization Will Boost Production

From 2021 to 2022, beef production in the UAE grew at a rate of 4.98%. This increase in supply can largely be attributed to a rise in the number of cattle and buffaloes slaughtered for meat. In 2020, a total of 74,638 cattle were slaughtered for beef production in the UAE, which rose by 2.94% in 2021 to 76,833 cattle. As local production has increased, the country has reduced its imports of live cattle. In 2021, the trade value of live cattle imports was USD 5.88 million, reflecting a significant decrease of 65.7% from USD 17.76 million in 2020.

Local beef producers face challenges competing with imported premium beef varieties, which are priced 150% to 180% higher than standard quality beef. Consumers in the UAE prioritize quality over cost for many products. The food service sector is willing to pay a premium for these imported varieties due to high consumer demand.

Cattle farming in the UAE has encountered difficulties in scaling, primarily due to limited water resources, arable land, and high production costs. In 2021, the cattle population in the UAE was recorded at 112,370. The Ministry of Climate Change and Environment is focusing on strategies to commercialize livestock to enhance its contribution to the national economy and mitigate food shortages. This can be achieved by developing and implementing integrated strategies for livestock protection and development, enhancing biosecurity measures, establishing disease prevention and monitoring programs, and improving inspection and control standards on local farms and points of entry.

Market Observing Growing Demand for Premium Beef Due to Rising Disposable Incomes

In 2022, the price of beef in the United Arab Emirates increased by 0.96% compared to the previous year, reaching USD 3,762 per ton. Beef prices are influenced by consumption patterns during specific times of the year, such as festivals, and by increasing tourism in the region.

The rising demand for high-quality beef varieties has also impacted pricing. Premium types of beef, such as Australian A5 Wagyu, Japanese Wagyu, and Kobe beef from Japan, are very popular and are typically available only in high-end restaurants due to their elevated prices and superior quality. In 2021, the cost of high-grade Japanese Wagyu beef reached as much as USD 441 per pound, with steak cuts priced at up to USD 300. The demand for these premium beef varieties from Japan has led to a significant increase in imports, with frozen beef imports from Japan rising by 126% in 2021 compared to 2020.

For the past eight years, the UAE has consistently been among the top 20 most lucrative export destinations for Australia's beef. Supported by increasing exports, the price of beef in Australia rose to USD 442 per 100 kg in October 2022, reflecting a week-over-week increase of 5.3% and a year-over-year increase of 5.1%. Historically, India and Brazil have dominated the UAE's beef import quantities due to the price-sensitive nature of the business. However, the last decade has seen rapid economic growth driven by urbanization, rising disposable incomes, and expanding tourism, leading to a surge in demand for premium beef grades and cuts.

Request customization in the report: https://www.renub.com/request-customization-page.php?gturl=united-arab-red-meat-market-p.php

United Arab Emirates Red Meat Market News

- February 2023: Saudi-based Tanmiah Food Company and US-based Tyson Foods Inc. have renewed their partnership originally established in 2022. This renewed collaboration aims to leverage growth opportunities in Saudi Arabia and the wider Middle East.

- July 2022: Tanmiah Food Company and Tyson Foods entered into a strategic partnership to expand meat production capacity. This investment is expected to help Tanmiah Food Company meet the growing demand for protein in the Middle East and other international markets.

- December 2021: Tanmiah Food Company’s wholly-owned subsidiary, Gulf Brand Fast Food Co., signed a master franchise and development agreement with Popeyes, an international quick-service restaurant chain. This partnership aims to diversify the product offering by providing high-quality food options, including the Popeyes Chicken Sandwich made from fresh and locally sourced chicken.

United Arab Emirates Red Meat Market Segments

By Type

- Lamb

- Beef

- Pork

- Mutton

- Others

By Form

- Canned

- Fresh/Chilled

- Frozen

- Processed

By Distribution Channel

- Convenience Stores

- Online Channels

- Supermarkets and Hypermarkets

- Others

Key Players Analysis

All key players are covered from four perspectives:

- Overview

- Key Personnel

- Recent Developments

- Revenue

Key Players:

- Albatha Group

- BRF S.A.

- Freshly Frozen Foods Factory LLC

- JBS S.A.

- Najmat Taiba Foodstuff LLC

- Siniora Food Industries Company

- Tanmiah Food Company

About the Company:

Renub Research is a Market Research and Consulting Company. We have more than 15 years of experience especially in international Business-to-Business Researches, Surveys and Consulting. We provide a wide range of business research solutions that helps companies in making better business decisions. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our wide clientele comprises major players in Healthcare, Travel and Tourism, Food Beverages, Power Energy, Information Technology, Telecom Internet, Chemical, Logistics Automotive, Consumer Goods Retail, Building, and Construction, Agriculture. Our core team is comprised of experienced people holding graduate, postgraduate, and Ph.D. degrees in Finance, Marketing, Human Resource, Bio-Technology, Medicine, Information Technology, Environmental Science, and many more.

Contact Us:

Company Name: Renub Research

Contact Person: Rajat Gupta

Phone No: (D) +91-120-421-9822 (IND)

Email: rajat@renub.com

The Savola Group