In this comprehensive analysis, we delve into the intricacies of UK commercial insurance distribution, exploring the diverse landscape of insurance providers, intermediaries, and digital disruptors that shape the industry. With a focus on understanding the key players, distribution channels, and emerging trends, this article serves as an invaluable resource to navigate the competitive world of commercial insurance in the UK.

The UK Commercial Insurance Market

The UK's commercial insurance market is a dynamic ecosystem that caters to the diverse needs of businesses across various sectors. From small enterprises to multinational corporations, insurance solutions safeguard against risks and provide financial protection. As businesses adapt to changing landscapes, the insurance industry, too, undergoes constant transformation, fueled by technology and evolving customer demands.

Key Players and Their Roles

Insurance Providers: These are the cornerstone of the commercial insurance market, offering a wide range of policies tailored to different industries and risk profiles. Their financial strength, underwriting expertise, and claims management capabilities are critical factors that businesses consider when selecting an insurance partner.

Intermediaries and Brokers: Acting as the bridge between businesses and insurance providers, intermediaries and brokers play a pivotal role in the distribution process. They assess clients' insurance needs, offer expert advice, and negotiate policy terms on behalf of businesses, ensuring they receive optimal coverage.

Digital Disruptors: In recent years, technology-driven startups have entered the market, offering innovative and customer-centric insurance solutions. Utilizing digital platforms, data analytics, and artificial intelligence, these disruptors aim to streamline the insurance buying process and enhance overall customer experience.

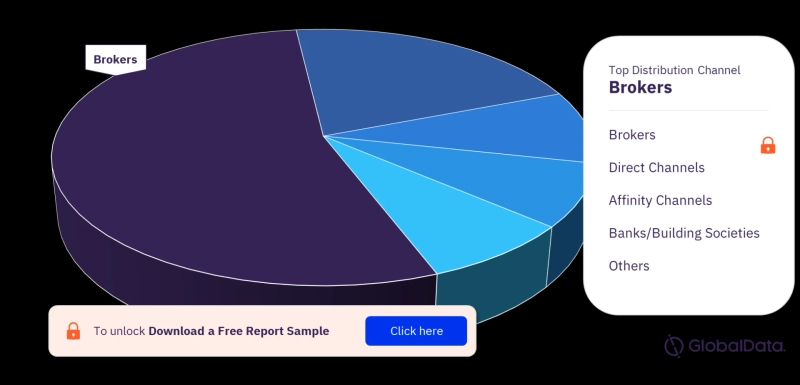

Understanding Distribution Channels

Distribution channels are the pathways through which insurance products and services reach businesses. In the UK commercial insurance market, various channels are utilized, each catering to specific client segments and preferences.

Direct Sales Channel

This channel involves insurance providers directly selling their policies to businesses without intermediary involvement. It offers convenience and speed, appealing to businesses seeking a streamlined purchasing process.

Brokerage Channel

Intermediaries and brokers operate within this channel, providing personalized insurance solutions and expert advice. Their in-depth industry knowledge and negotiation skills make them an essential part of the distribution landscape.

Digital Distribution Channel

Digital disruptors leverage technology to offer user-friendly platforms where businesses can compare, customize, and purchase insurance policies. This channel targets tech-savvy clients looking for simplicity and efficiency.

Emerging Trends and Innovations

The UK commercial insurance distribution landscape is witnessing several emerging trends and innovations that are reshaping the industry:

1. Insurtech Advancements

The integration of technology, such as blockchain and telematics, is revolutionizing underwriting and claims management processes. Insurtech startups are leading the way in creating faster, data-driven, and cost-effective insurance solutions.

2. Personalization and Customization

Businesses now seek tailored insurance policies that cater to their unique needs. Insurers are responding by offering customizable coverage options that provide flexibility and targeted protection.

3. Data-Driven Decision Making

The abundance of data allows insurers to make informed decisions, enhance risk assessment, and optimize pricing strategies. Advanced data analytics help identify emerging risks and opportunities for process improvement.

4. On-Demand Insurance

The rise of on-demand insurance enables businesses to purchase coverage for specific periods or events, providing greater cost control and flexibility.