Securing digital growth is essential for the success of any organization in this day and age. However, the online marketplace is full of fraud rings, bot attacks, and other threats that can cause significant damage to any business, regardless of size or industry.

Amid the cat-and-mouse game between bad actors and those in the account opening fraud detection industry, one variable presents a complex, ever-evolving challenge: the synthetic identity. And to make matters worse, there are different types of synthetic identities.

Like most of the nefarious means fraudsters use each day, the successful implementation of a synthetic identity relies in part on complacent targets. Businesses that depend on outdated software make attractive targets for fraud rings and other bad actors.

However, there are things you can do to protect your organization from the bad guys, even the sophisticated fraudsters using synthetic identities. Are you ready to learn about synthetic identities and how to avoid falling victim to them? Here’s how you can make it happen.

What Is a Synthetic Identity?

To start, think of a synthetic identity as a digital version of Frankenstein’s monster. Synthetic identities are profiles or IDs comprised of stolen PII from several different users. A single synthetic identity may use Jane Doe’s social security number and John Smith’s address. Individually, these credentials are verifiable, but their sum is a profile—a synthetic identity—which is not associated with any single, real person.

There are two types of synthetic identities to keep an eye out for. The first is known as a manipulated synthetic identity. To create a manipulated synthetic identity, a fraudster will use a real identity—maybe even their own—and make only specific changes to elements such as the social security number. Commonly, manipulated synthetic identities are used to hide poor credit history.

The second type of synthetic identity is referred to as “manufactured.” Here, fraudsters go beyond compromised PII by manufacturing fictional PII and mixing it with compromised credentials from real users. This type of synthetic identity is particularly difficult to detect because, in part, it is less likely to conflict with an existing, authentic identity. However, there are cutting-edge tools that can detect this type of new account opening fraud in real time.

How Do Fraudsters Use Synthetic Identities?

Synthetic identities pose problems for PII-based fraud detection systems. Because these systems evaluate only post-submit data, they essentially give bad actors the opportunity they need to pick your organization’s digital locks and gain access to the more sensitive areas of your site. This includes the services they need to carry out their plans.

Once they’ve used synthetic identities to gain access, fraudsters have a range of options. Individual cybercriminals should always be taken seriously, but your organization should be especially wary of the threats posed by sophisticated fraud rings. These cunning groups can use synthetic identities to open numerous accounts. Some even run the long game, building up credit over time before eventually maxing it out and leaving the targeted organization stunned.

What Should I Do to Protect My Organization?

Simply put, anyone who is serious about detecting fraudsters before they can strike needs to enhance their new account fraud prevention and detection systems with the latest tools. It should be clear to you by now that the PII-based systems of yesteryear aren’t up to the task. Bad actors have long been studying these systems and are well-versed in defeating them.

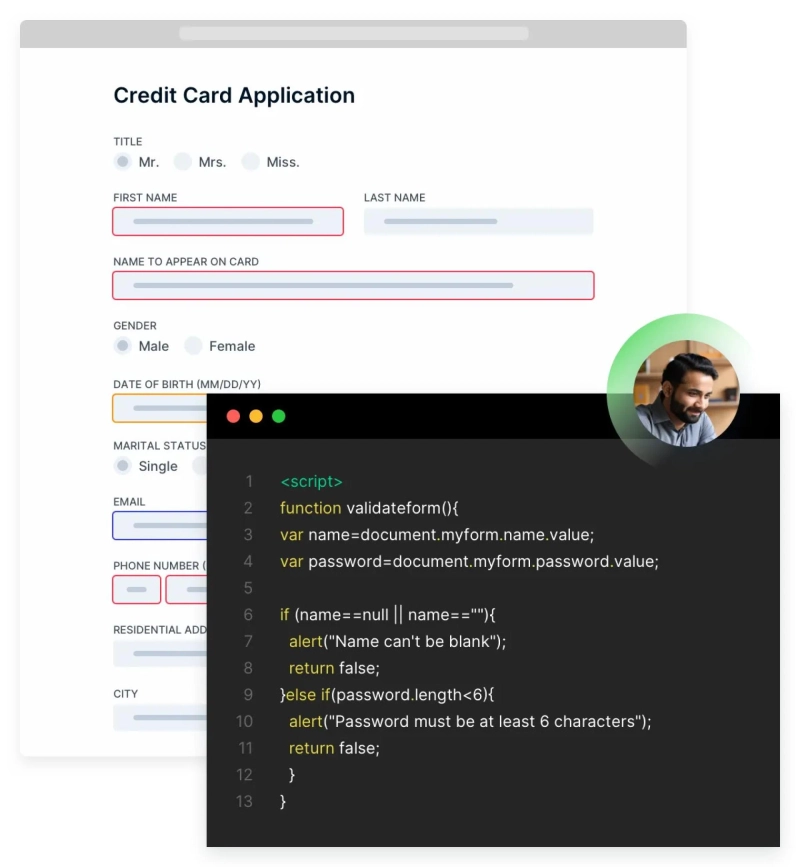

At a minimum, your new account fraud detection systems should employ behavioral intelligence tools that go beyond PII to provide real-time fraud detection. These tools read the digital body language of all your site’s users simultaneously, spotting the signs of fraud they can’t hide with synthetic identities and compromised PII.

About NeuroID

Securing growth in the digital space is critical for any modern organization, but you can’t reliably expand your user base and develop your platforms without robust fraud detection systems. For advanced tools powered by groundbreaking technology, turn to NeuroID. Instead of relying on compromised PII, NeuroID utilizes the strength of behavioral analytics to identify early warnings of fraud, allowing you to stop bad actors in their tracks. NeuroID passively reads a user’s digital body language as they interact with your site forms, alerting you to risky behavior and indicators of fraudulent activity. With this pre-submit data, NeuroID offers an effective solution to proactively detect fraud rings, synthetic identities, and more. Experience the NeuroID advantage for your organization today.

Detect fraud rings, synthetic identities, and other threats with NeuroID at https://www.neuro-id.com/

Original Source: https://bit.ly/3TXy2nv

Understanding Digital Threats: Synthetic Identities