In the realm of financial stability and risk mitigation, the insurance industry plays a pivotal role, and Spain's insurance sector stands as a testament to its vitality. With a rich history and a forward-facing approach, Spain General Insurance Market the insurance industry in Spain has established itself as a robust and evolving entity that safeguards individuals, businesses, and assets alike.

A Historical Glimpse into Spain's Insurance Landscape

Steeped in tradition, Spain's insurance industry dates back to the 19th century when the first insurance companies were founded. These early pioneers laid the foundation for an industry that would adapt, Spain General Insurance Market expand, and diversify over the years. As Spain modernized and embraced economic globalization, the insurance sector too evolved to meet the changing needs of its populace.

Key Players and Market Dynamics

The insurance landscape in Spain is characterized by a blend of domestic and international players, each contributing to a competitive market that offers a range of insurance products and services. Leading Spanish insurance companies such as Mapfre, Mutua Madrileña, and Santa Lucía have emerged as household names, Spain General Insurance Market catering to various segments including life, health, auto, property, and liability insurance.

In recent years, market dynamics have been influenced by factors such as regulatory changes, advancements in technology, and shifting consumer preferences. The digitization of insurance services has streamlined processes, allowing for greater accessibility and convenience for policyholders. Additionally, Spain General Insurance Market Spain's growing aging population has driven demand for pension and retirement-focused insurance products.

Navigating Regulatory Framework

The insurance industry in Spain operates within a well-defined regulatory framework established by the Dirección General de Seguros y Fondos de Pensiones (DGSFP). This regulatory body oversees licensing, solvency requirements, and consumer protection, Spain General Insurance Market ensuring that insurers maintain financial stability and adhere to ethical business practices.

Insurance Penetration and Growth Trends

Insurance penetration, a measure of the percentage of the population covered by insurance, has witnessed steady growth in Spain. As financial literacy spreads and awareness of the importance of insurance deepens, more individuals and businesses are recognizing the need for comprehensive coverage. The evolving landscape of risks, Spain General Insurance Marketincluding cyber threats and environmental uncertainties, has further propelled the demand for specialized insurance solutions.

Emerging Trends and Innovations

Innovation is a driving force within the insurance sector, and Spain is no exception. Insurtech startups are reimagining traditional insurance processes by harnessing technologies such as artificial intelligence, data analytics, and blockchain. These innovations streamline underwriting, Spain General Insurance Marketclaims processing, and customer interactions, enhancing overall efficiency and user experience.

Sustainable Practices and Social Responsibility

With growing global awareness of sustainability, the insurance industry in Spain is incorporating environmental and social considerations into its operations. Insurers are increasingly offering products that support renewable energy initiatives, address climate-related risks, Spain General Insurance Market and promote social welfare. This alignment with sustainable practices not only contributes to the greater good but also enhances the industry's reputation.

Looking Ahead: Opportunities and Challenges

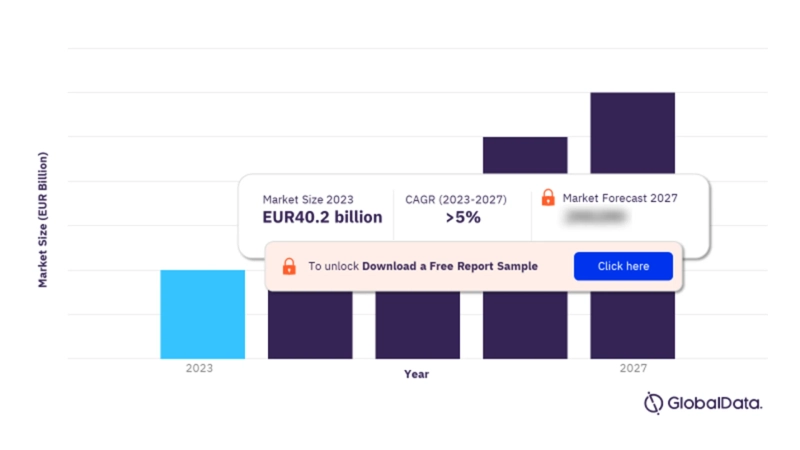

The insurance industry in Spain stands at a crossroads of opportunities and challenges. As the digital age continues to reshape consumer behavior, insurers must remain agile in adapting to evolving preferences and expectations. The emergence of non-traditional competitors, Spain General Insurance Market regulatory changes, and global economic uncertainties are all factors that necessitate strategic foresight and robust risk management. To gain more information about the Spain general insurance market forecast, download a free report sample