The worlds of commerce and finance have embraced online models. That's great news for thousands of businesses and financial institutions. Prospective customers and applicants can sign up for accounts from all over the world. As obviously beneficial as that is, the massive amount of business done online comes with an unfortunate byproduct—it attracts fraudsters. One of the most common and insidious forms of online fraud is new account fraud or new account opening fraud. The best way to protect your business from new account opening fraud is by understanding what it is and finding the most effective tools to combat it. Here's everything you need to know.

The Threat of New Account Fraud

New account fraud is a major online threat. For instance, identity theft crimes, including new account fraud, can cost organizations billions of dollars each year. Essentially, new account opening fraud involves fraudsters opening fraudulent accounts with personal information they have stolen. With these accounts, bad actors can steal and launder money, steal products and services, and gain sensitive information. In addition to the significant financial damage it can inflict upon a business and its consumers, it is a reputational disaster as well. That's why it's well worth considering an advanced detection solution.

The Types of New Account Fraud

There are two primary ways in which cybercriminals perpetrate new account fraud. The first is familiar and destructive—identity theft. Fraudsters usually gain access to personal information through data breaches and social engineering scams like phishing. Stolen information is also commonly bought, sold, and traded with other cybercriminals, often via the dark web. The other type of new account fraud is just as dangerous for your organization—the creation of synthetic identities. Synthetic identities tend to take bits of someone's actual information and flesh it out with information that is stolen from others, randomized, or simply invented. There are even formulas fraudsters can use to generate information, like social security numbers, that improve their chances of successfully committing fraud.

How Can You Protect Your Business From New Account Fraud?

Protecting your business from new account opening fraud combines some common-sense approaches and sophisticated tools. For instance, employees should be trained to handle sensitive information and to recognize social engineering threats like phishing and spoofing. That includes best practices for email, phone use, and your business' online presence. Sophisticated fraud rings are even able to send text messages to employees asking for passwords and other information—texts that are signed with their manager or CEO's name. Therefore, training your team members to recognize the evolving threat of cybercrime is crucial.

Tools for Combatting New Account Fraud

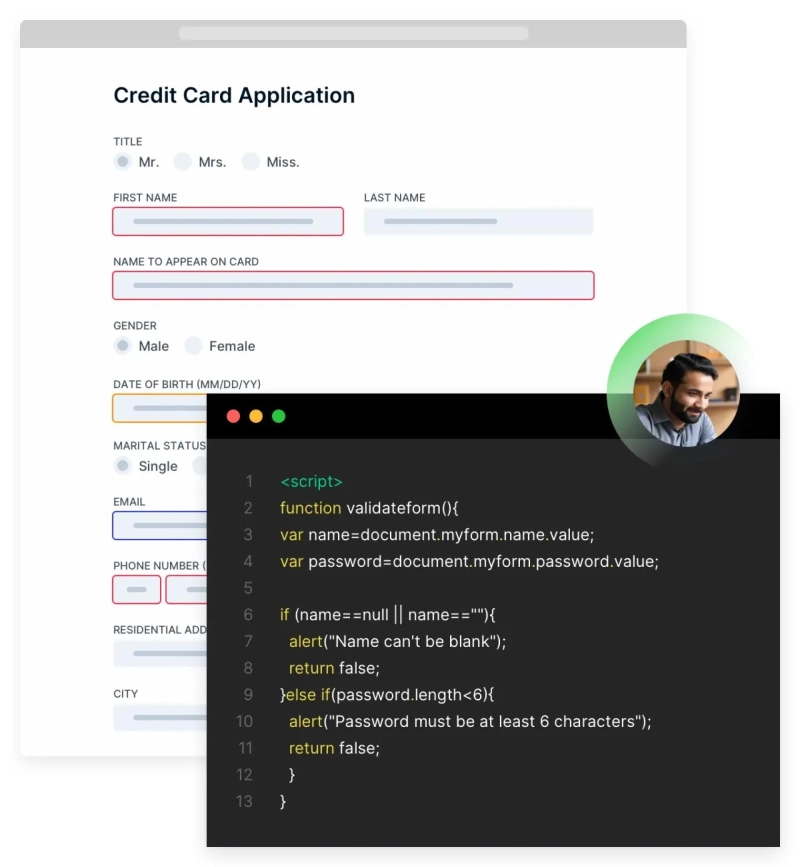

With the huge amount of personal and sensitive information available online, detecting fraud rings and cybercriminals from gaining access to that information can feel like facing a hurricane with an umbrella. However, there is one part of the new account fraud process that those fraudsters are required to deal with—applications. That's why the most effective new account fraud prevention and detection tools and technologies use behavioral analytics to monitor applicant behavior as they interact with forms on your website. Fraudsters attempting to sign up for new accounts are certain to behave differently than legitimate applicants. Sophisticated behavioral analytics technology can identify those abnormal behavior patterns and notify you of new account fraud before it even begins.

About NeuroID

Digital growth is about more than simply standing out. In addition to your competition, the web is also rife with bad actors who work every day to exploit vulnerable organizations. As a result, you need to employ cutting-edge software for superior new account opening fraud detection. That's where NeuroID and its suite of sophisticated cybercrime detection tools can offer the solutions you need. Using the power of behavioral analytics, NeuroID offers identity verification software to help you combat fraud rings and other bad actors. The wide availability of compromised PII has created a digital identity crisis, so NeuroID uses pre-submit data instead to catch fraudsters early and engage your step-up verification. With crowd-level detection and identity monitoring from NeuroID, your organization can thwart digital threats and enjoy secure growth.

Choose the tools to protect your business from new account fraud at https://www.neuro-id.com/

Original Source: https://bit.ly/3Ni83FF

What Is New Account Fraud, and How Can Your Business Identify It?