A loan refers to the amount that the borrower receives from banks or other financial institutions in exchange for the commitment to repay the principal amount and the interest rates. The loan is basically of two types: [caption class="snax-figure" align="aligncenter" width="1140"][/caption] Secured Loan- It refers to a loan that is offered in exchange for collateral. So, if the borrower is unable to pay back the loan amount, the lender is not at risk as he can take possession of assets that have been pledged in return for the loan amount. Unsecured Loan- It is a risky loan amount. If the borrower is at default, the lender has no right to take any asset in return. The repayment of a loan should be taken seriously as it not only affects your loan liability and interest accrued but also affects your credit history. The financial implications of the default can be anything from higher interest components to declaring bankruptcy. Below mentioned are some of the ways in which delay in repayment can impact you: Delayed repayment of a loan can significantly impact your credit score. The repayment history can directly affect the credit score. To sanction the loan amount instantly, the borrower must have at least 750 credit scores out of 900. The more you delay in repaying back, the more your credit score will be affected. In case you are using a credit card for making certain payments, you must make sure that you have a proper plan and sufficient repaying capacity to pay the amount at the end of your billing period. In addition, the credit card stands at the top in terms of interest rate on the outstanding amount, so try to avoid this high cost. In case of the borrower's demise, the unpaid debt repayment burden may fall on their heirs. So, while applying for a loan, always ensure whether you have the income capacity to pay back the loan amount timely or not? Therefore, timely repayment of a loan allows you to build a good credit history and improve the ailing credit health. Therefore, if you wish to have a good credit history, make all your loan repayments on time. Why is Loan Repayment Important?

Severe Impact on Credit Score

Penal Interest Rate

Family Members may Inherit Unpaid Debt.

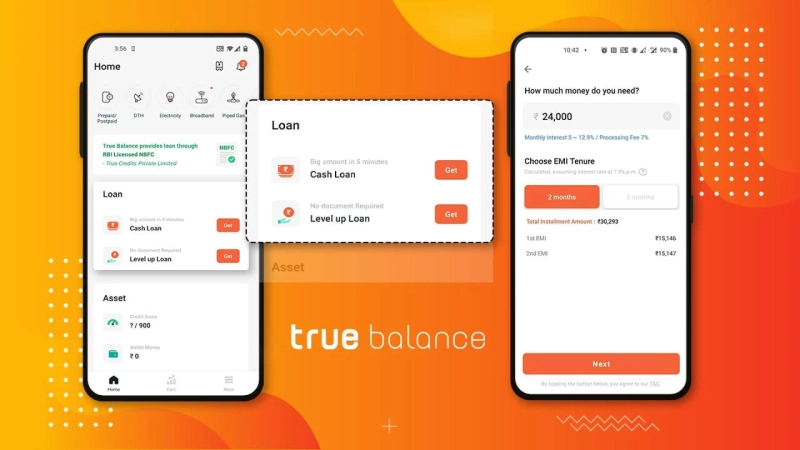

You can apply for an instant loan via the TrueBalance website. It focuses on the users that are underbanked or not served by traditional financial systems and helps that borrower's to avail loans quickly and at a low personal loan interest rate. Moreover, the loan amount of INR 50,000 can be repaid in 3 to 6 months which is a positive point for the borrower. For more details, you can visit the TrueBalance website!