Applying for a credit card online is a simple process. You look up different issuers, choose the one that matches your requirements and fill out the application form. Once you submit your application along with the required documents, the financial institution analyses and verifies your profile before approving the same. Once you’ve done all the needful, you need to wait for approval, which can be irksome. To placate this, keeping a tab on the status of your application is essential to ensure you get all the updates.

Knowing how to check your credit card status is vital. This article will explore different methods to check your application status, including online portals and customer service.

Why You Should Always Keep Tabs on Your Application Status

Checking your credit card application status is a vital step in the process that you don't want to overlook. Regularly checking your status lets you know where you stand in the approval process. This information is important to plan better in the future. Applying for multiple credit cards at once leads to multiple hard inquiries that reflect in your credit report, making you look like a hungry borrower. When you know your application is rejected, you can then apply with other financial institutions. You can protect your credit score by waiting until you receive a response before applying for additional credit. Due to this, it is important to keep an eye on your application and stay informed about its approval.

Top Ways to Check Your Credit Card Application Status

There are several ways to track your credit card. Let us discuss the most common methods below.

Email ConfirmationAfter submitting your credit card application, credit card companies will send you an email confirmation. This email will include a reference number or application number that you can use to track the status of your credit card application.

Directly Tracking on the Issuer’s WebsiteIf you have not received an email confirmation or prefer to check the status of your credit card application directly with the issuer, go to their website. Look for the "Check Application Status" or "Application Status" link. Then, enter your application number and any other required information, like your mobile number or pan number, to get an update on the same.

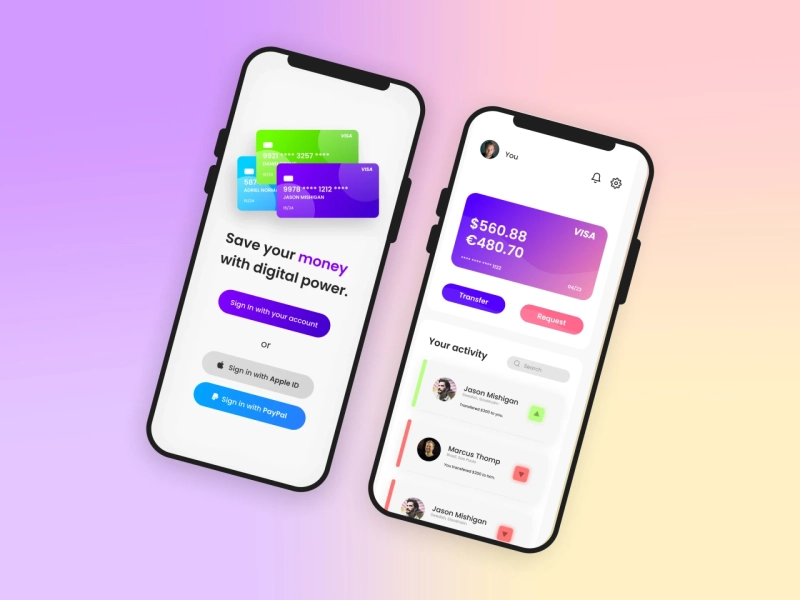

Using the Issuer’s App to Track Your ApplicationUsing your issuer’s app is a convenient way to track the status of your card, manage your account, and keep your credit card activity up-to-date. Many credit card issuers, like OneCard, have their own mobile apps that allow you to view your account information, including your application status. Once you've downloaded the app and registered, you should be able to navigate to a section that displays your credit card application status.

Contacting Customer Service for an UpdateCall the credit card company's or bank’s customer service number if you prefer speaking to someone directly. Be sure to have your application number and other relevant information handy when you call. Customer service will be able to provide you with an update on your credit card application status.

Get Quick Help with Chat SupportMany credit card issuers offer live chat support through their website or credit card app. This can be a convenient option if you prefer not to wait on hold on the phone or if you need assistance outside of typical customer service hours.

Conclusion

Another reason to keep an eye on your credit card application status is to avoid surprises. You can keep checking your email, visiting the credit card company's website, using a credit card app, or giving customer service a call. If rejected, you can then apply for a credit card with another issuer. Remember to not apply for multiple credit cards at once as this can hurt your credit score.