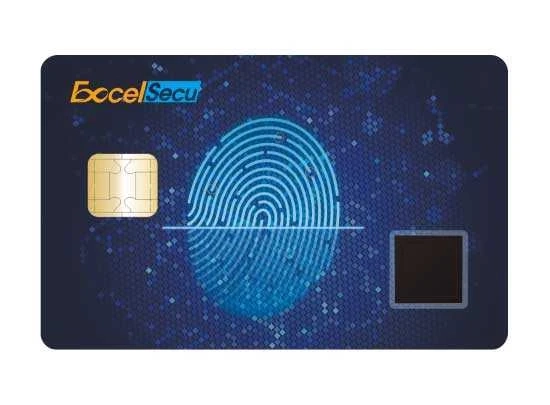

Biometric technology is getting popular in the smartphone market due to its incredible benefits. As an alternative to traditional PIN, most people choose biometric technology for higher security. It is also used with innovative on-card thumbprint detecting schemes in the payment card sector. In addition, the Internet of things is implemented in many sectors, including hospitality, retail, healthcare, manufacturing, and much more. IoT Payment offers improved security and a convenient payment experience for the user. So, you don’t want to worry about fraud detection while using the IoT method. Here we provide some reasons for using biometric payment cards:

What you can expect from the Biometric payment method

The user should touch an inbuilt fingerprint sensor when paying money with this card. If your fingerprint matches successfully, you can make payment smoothly without entering your PIN.Entering PIN can take more time, but the biometric system is an instant procedure that helps you save time. Consumers will complete a quick transaction that increases sales in the retail business.The enterprise-level biometric algorithm is highly secure, so you don’t worry about losing critical information. Individuals can set up this card easily from the comfort of their homes. Therefore, you no need to visit the bank to set up the procedure.The biometric card offers convenient transactions, meaning you can securely make payments from anywhere around the world. It encourages maximum worth contactless purchases at the retail store that boost profits. In addition, biometric payment cards are thin and robust that consume lower power. This type of card doesn’t need a battery to operate.Recently, many people have used contactless payment cards and gained more benefits. Banks can reduce the fraud action of the payment card by implementing this technology. This method can charge a low transaction fee compared to debit or credit.