Imagine someone asks you, “What’s the cornerstone of your business?” Would your organization’s digital ID verification system be the first thing that comes to mind? Probably not. However, deft utilization of the online marketplace has become a critical component of business growth. As threats like fraud rings and bot attacks continue to multiply and become more sophisticated, you might be surprised at just how vital your ID verification system has become. In fact, it’s so crucial that you can’t afford to rely solely on post-submit data such as PII. Instead, tools based on behavioral intelligence are changing the ID verification game by emphasizing pre-submit data to enhance fraud detection. Here’s everything you need to know.

Fraud-Based Threats Are Evolving

Everyone would like to believe that after decades of cat-and-mouse games between security firms and bad actors, the internet has finally settled into a safe, uniform space. As you well know, that simply isn’t the case. Fraudsters continually scheme and conspire to target vulnerable organizations online. They use a variety of surprisingly effective methods, including new account fraud and account takeover fraud, to achieve their end goals. The estimated number of fraudsters worldwide continues to rise, but using cutting-edge tools to defend against these threats can help your business detect risks and strive toward continued growth.

Compromised PII is Widely Available

It’s no secret that anyone can access and purchase stolen PII. Bad actors use these credentials to commit new account fraud by opening an account in the name of an oblivious third party or outright forging synthetic identities by combining PII from different users. Whether it’s through phishing, session hijacking, or other means, credential theft is widely carried out to obtain PII that can then be used to commit fraud. PII-based fraud is particularly effective against post-submit ID verification systems because such systems examine only the submitted PII to determine whether a user is genuine.

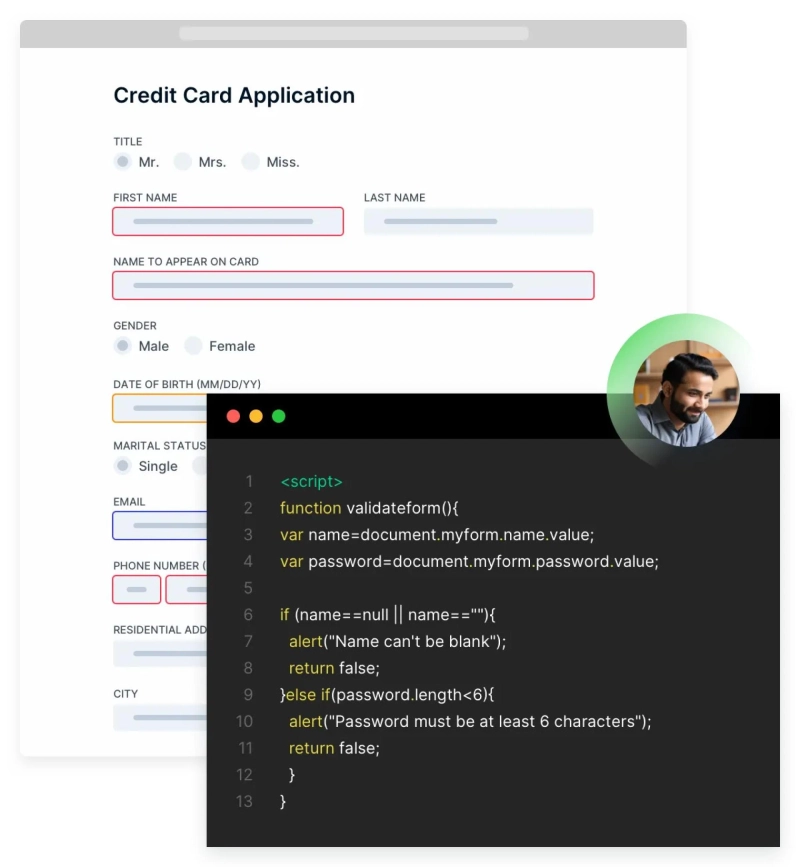

Synthetic IDs Can’t Hide Digital Body Language

Creating synthetic identities is an exceptionally successful means of defeating PII-reliant verification systems. These systems are susceptible to such fraud because of a fundamental flaw. They look backward, considering only the information given by fraudsters. That means bad actors inherently have an advantage. However, a synthetic identity can’t hide what’s known as digital body language. Each user’s taps, swipes, clicks, and keystrokes can indicate whether they’re a genuine customer or a fraudster. By observing this behavior and flagging risky users in real-time, behavioral analytics tools offer superior new account fraud detection.

Behavioral Analytics Looks Over the User’s Shoulder

The top pre-submit verification strategy is known as behavioral analytics. By examining digital body language, behavioral analytics offer a more dynamic, real-time picture of each user to rapidly identify risky activity and immediately direct these users to your system’s step-up verification. By achieving early identity orchestration through precise, expedient prescreening, you can get clear, session-level insights and instant decision-making. Instead of giving fraudsters the opportunity to pick your organization’s digital locks, take advantage of behavioral analytics and get ahead of any fraud ring before they even come knocking on your door.

About NeuroID

The growth of your business starts with trust: the ability to conduct business confidently and securely in our ever-changing digital world. But with the Digital Identity Crisis in full effect, how do you strike the right balance between growth and security? NeuroID stands for the future of identity authentication online. They use groundbreaking technology to passively analyze behavior, discerning between genuine users and bad actors, including fraud rings and bots. These aren’t the same outdated, easily-fooled PII-based measures you may have seen before—NeuroID analyzes digital body language to offer cutting-edge fraud detection. NeuroID visualizes crowd activity at scale and makes critical judgments in real time, rapidly referring risky users to your organization’s step-up verification so you can detect fraud before it starts.

Get innovative behavioral analytics tools from NeuroID at https://www.neuro-id.com/

Original Source: https://bit.ly/3AWamcN

Why Your ID Verification Systems Should Rely on Pre-Submit Data