Zomato India: Tracking 1M+ Reviews to Help Chains Improve Menu Pricing

Overview

In India’s rapidly evolving dining and food delivery market, customer reviews are more than feedback—they’re pricing intelligence.

With millions of active users, Zomato hosts detailed reviews across dine-in and delivery formats. These reviews often contain customer sentiment around price fairness, portion size, value for money, and competitive comparisons.

At Datazivot, we analyzed over 1 million Zomato reviews across 50 Indian cities to help mid-sized and national restaurant chains optimize menu pricing using review-driven intelligence.

Client Profile

- Industry: Casual Dining & Delivery-First Restaurant Chains

- Platform Focus: Zomato India (dine-in + online delivery)

- Review Volume Analyzed: 1,000,000+

- Cities Covered: Mumbai, Delhi, Bengaluru, Hyderabad, Pune, Chennai, Ahmedabad, Lucknow, Kolkata, Jaipur, and more

- Service Provided: Review scraping, NLP-based sentiment analysis, pricing sentiment clustering, competitor benchmarking

Objective

The restaurant chains wanted to:

- Detect menu items priced “too high” based on review sentiment

- Map value-perception gaps city-by-city

- Adjust pricing for low-margin or over-priced SKUs

- Understand if portion-size matched price expectations

- Benchmark against nearby restaurants on price-to-value

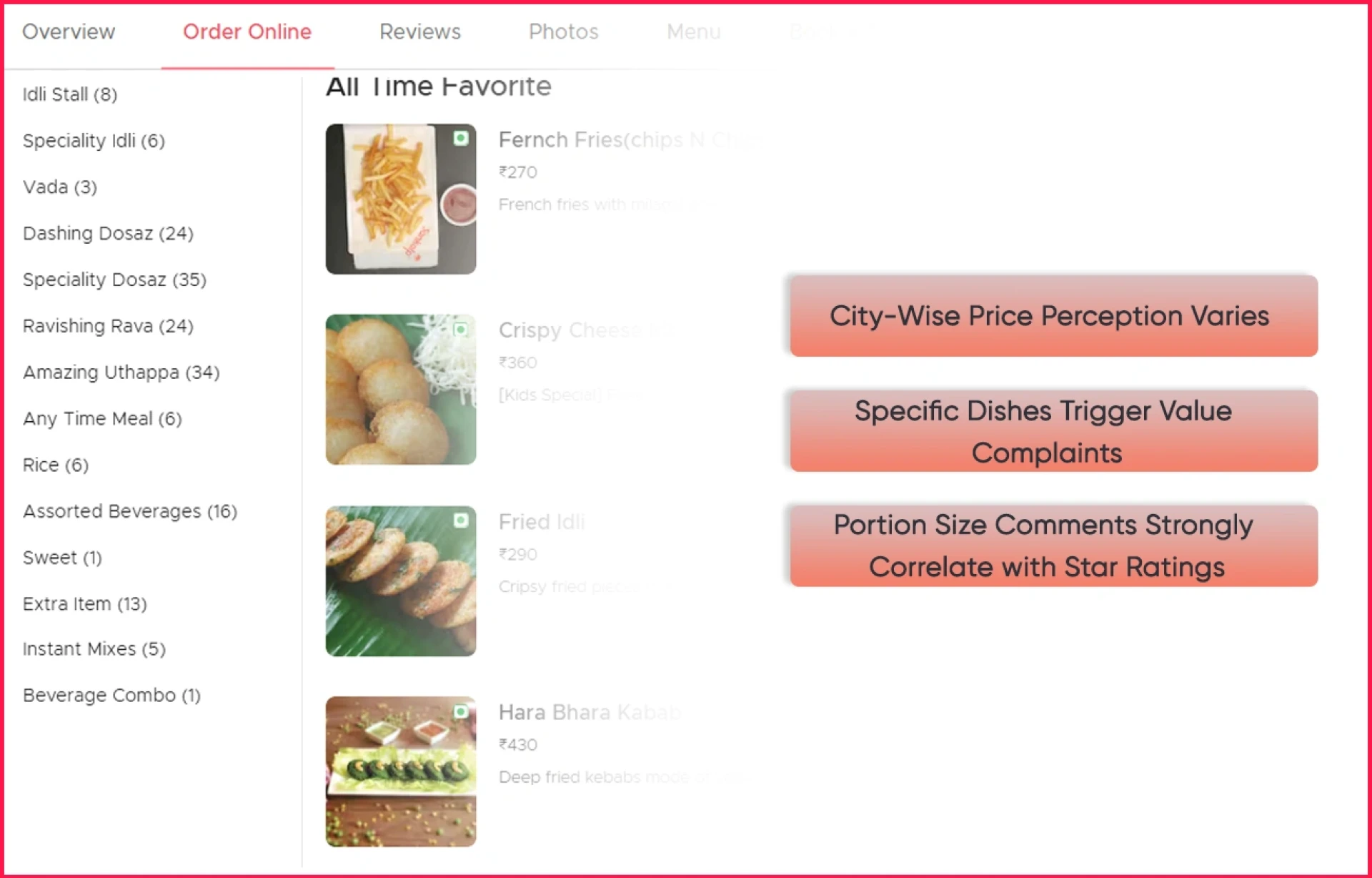

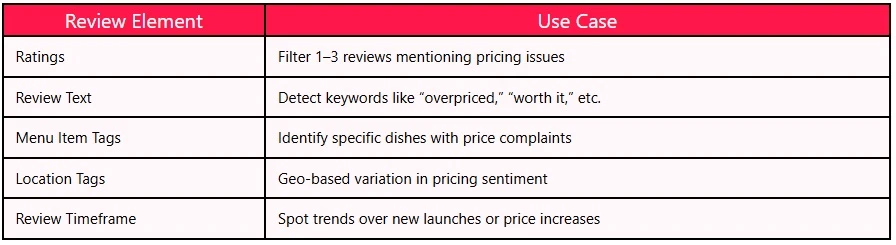

What Datazivot Analyzed from Zomato Reviews

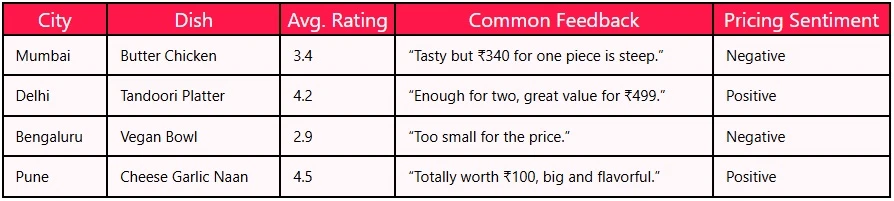

Sample Data Extracted by Datazivot

Key Findings from 1M+ Zomato Review Sentiment Analysis

1. City-Wise Price Perception Varies

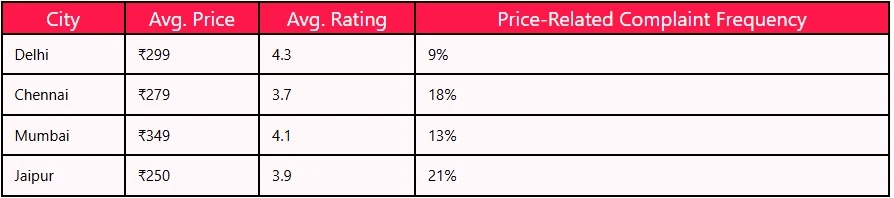

- Bengaluru & Chennai were more price-sensitive on single-item meals

- Mumbai & Delhi had higher acceptance of premium pricing if portion justified

- Tier-2 cities like Lucknow, Indore demanded better combo pricing

2. Specific Dishes Trigger Value Complaints

- “Paneer Tikka,” “Pasta Alfredo,” “Biryani Half” frequently cited as overpriced

- Sides like “Extra Mayo,” “Garlic Bread” seen as unjustified add-ons above ₹100

3. Portion Size Comments Strongly Correlate with Star Ratings

- Most 2-star reviews included “small quantity,” “not filling,” or “barely enough”

Use Case

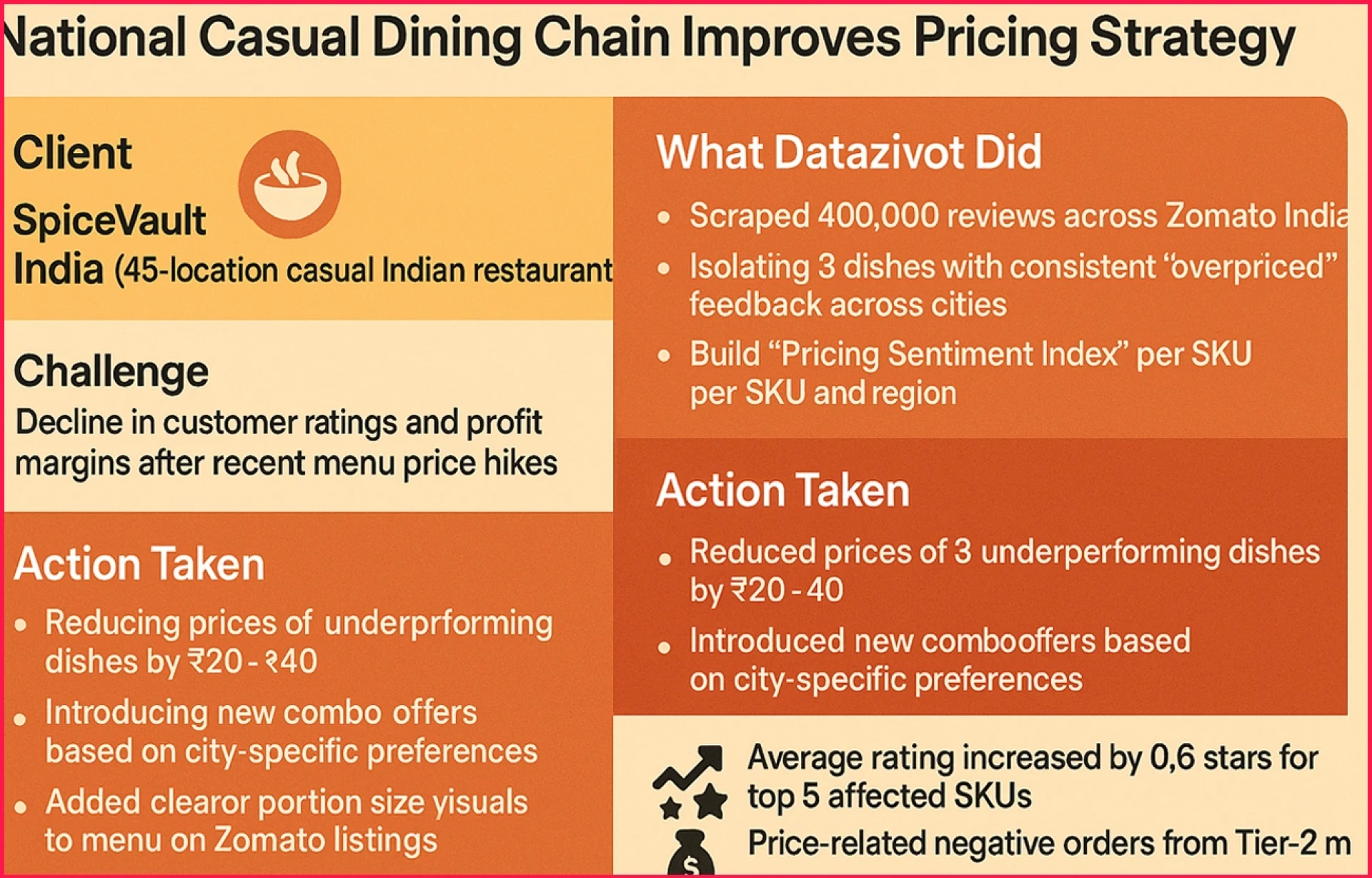

National Casual Dining Chain Improves Pricing Strategy :

- Client: SpiceVault India (45-location casual Indian restaurant)

- Challenge: Decline in customer ratings and profit margins after recent menu price hikes

What Datazivot Did:

- Scraped 400,000 reviews across Zomato India

- Isolated 8 dishes with consistent “overpriced” feedback across cities

- Built “Pricing Sentiment Index” per SKU and region

Action Taken:

- Reduced prices of 3 underperforming dishes by ₹20–₹40

- Introduced new combo offers based on city-specific preferences

- Added clearer portion size visuals to menu on Zomato listings

Results:

- Average rating increased by 0.6 stars for top 5 affected SKUs

- Price-related negative reviews dropped by 41%

- 18% increase in monthly orders from Tier-2 markets

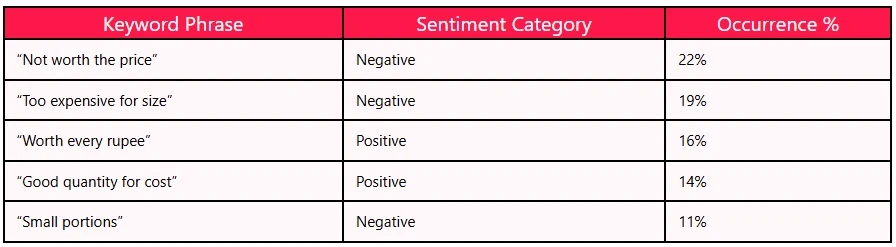

Top Keywords Flagged for Pricing Issues

City-Level Pricing Benchmark Example: Biryani Dishes

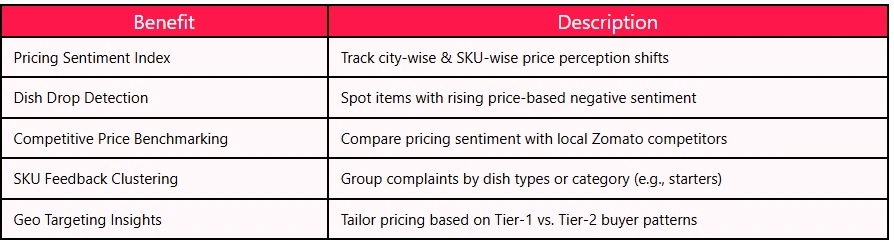

Benefits Delivered by Datazivot’s Review-Based Pricing Analysis

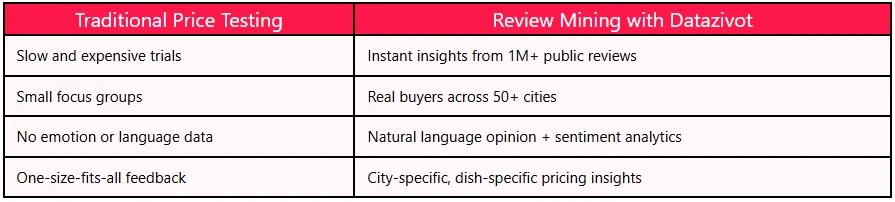

Why Zomato Reviews Beat Traditional Price Testing

Conclusion

Don’t Guess Menu Prices - Listen to Your Customers

Your customers are already telling you what’s too expensive, what’s worth it, and what they’ll never reorder again.

With Datazivot, Zomato reviews become more than ratings—they become pricing intelligence tools.

- Detect overpricing before churn

- Refine pricing based on location and SKU sentiment

- Improve value perception and boost orders

- Strengthen profit margins without sacrificing trust

Want to Optimize Menu Pricing Using Zomato Reviews?

Contact Datazivot for a free pricing sentiment analysis across your Zomato listings—city-wise, dish-wise, and competitor-benchmarked.

Originally published at https://www.datazivot.com/zomato-india-tracking-1m-reviews-improve-chain-menu-pricing.php