Market Overview:

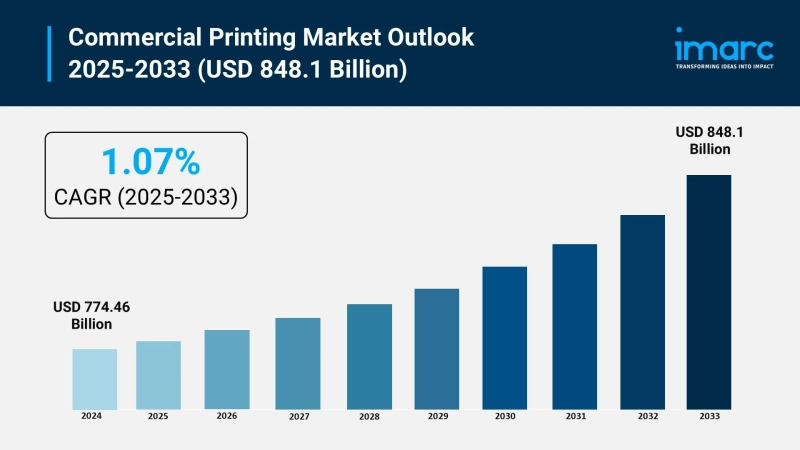

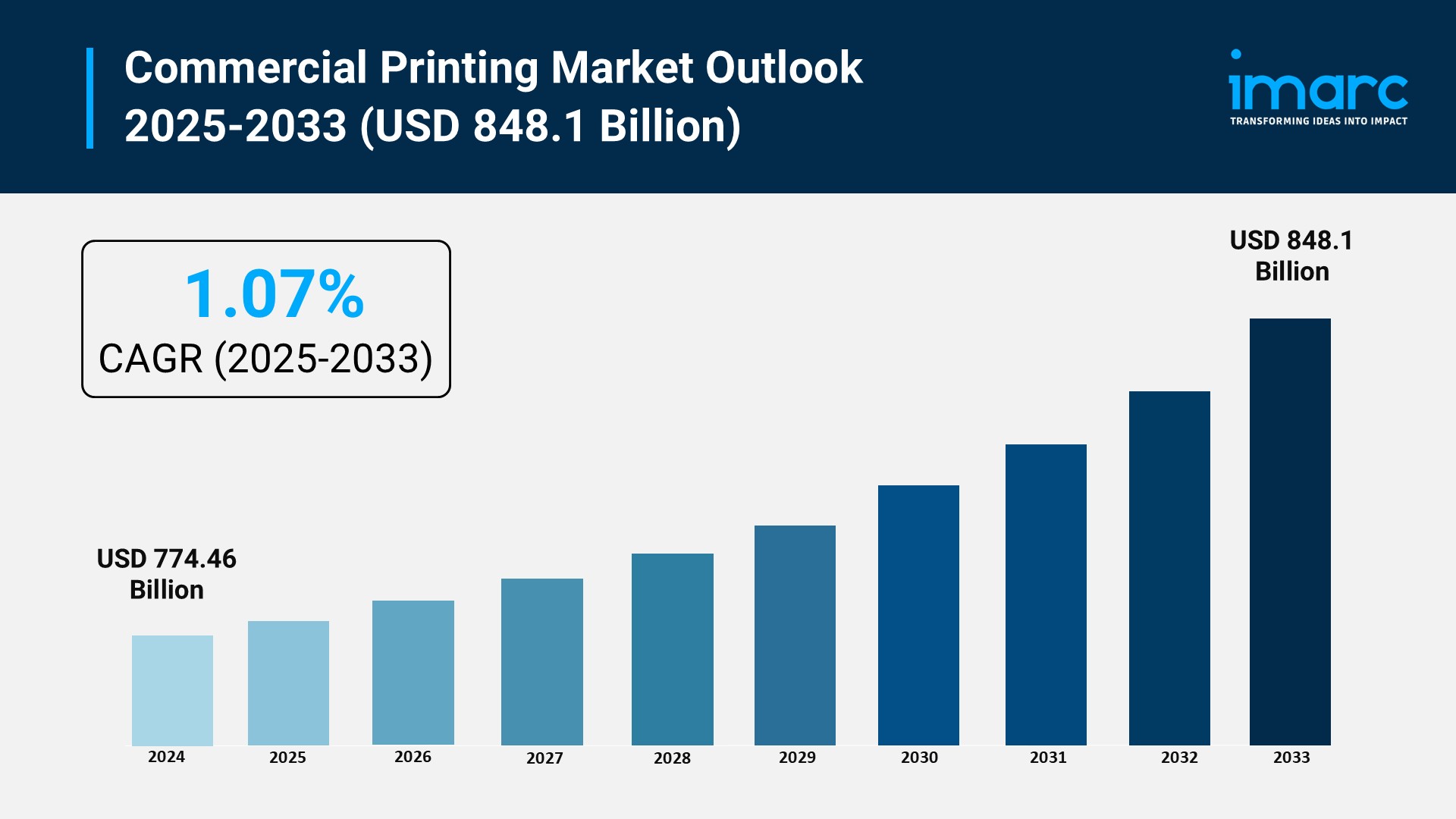

According to IMARC Group's latest research publication, "Commercial Printing Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global commercial printing market size reached USD 774.46 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 848.1 Billion by 2033, exhibiting a growth rate (CAGR) of 1.07% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Commercial Printing Market

- AI adoption in commercial printing jumped from 24.7% in September 2023 to 40% in March 2024, with another 23.5% of planning implementation within the year.

- HP launched HP Print AI in 2024, the first intelligent printing platform with Perfect Output technology, enabling automated quality control and reducing print errors by 80%.

- AI-driven solutions enhance prodprinters uction planning and control, quality management through computer vision for defect detection, and predictive maintenance to minimize machine downtime.

- Commercial printers use AI for workflow automation, reducing operational costs and improving turnaround times by up to 40%, while optimizing resource allocation through smart scheduling algorithms.

- Over 40% of commercial printers incorporate AI-driven solutions to improve efficiency and accuracy, utilizing machine learning for demand forecasting and personalized marketing materials.

Download a sample PDF of this report: https://www.imarcgroup.com/commercial-printing-market/requestsample

Key Trends in the Commercial Printing Market

- Digital Printing Technology Advancement: Digital printing now accounts for 35% of the market, driven by demand for shorter print runs, customization, and quicker turnaround times. HP's PageWide Advantage 2200 Series and Indigo 100K Digital Press enable high-quality, cost-effective production for publishing, direct mail, and commercial printing applications.

- E-Commerce Packaging Boom: The global e-commerce market reached USD 26.8 Trillion in 2024, projected to hit USD 214.5 Trillion by 2033 at a CAGR of 25.83%. Online retailers require customized packaging, labels, and promotional materials, fueling demand for flexible, on-demand printing services across packaging segments.

- Sustainable Printing Practices Rise: Approximately 30% of commercial printers offer sustainable printing services using recycled paper, vegetable-based inks, and energy-efficient processes. The U.S. sustainable printing market grows at 5.5% CAGR from 2024 to 2030, driven by FSC and SGP certifications.

- Print-on-Demand Services Expand: POD eliminates excess inventory and storage costs, with businesses seeking variable data printing for personalized marketing. This scalable model supports customized products without overproduction risk, particularly for publishers and direct-to-consumer brands.

- Hybrid Workflow Solutions Gain Traction: Heidelberg and Canon formalized a December 2024 partnership to co-market sheet-fed inkjet engines alongside offset lines, enabling hybrid workflows that combine flexo white layers with variable inkjet color for medium-volume commercial printing.

Growth Factors in the Commercial Printing Market

- Packaging Industry Expansion: Packaging captured 36.4% market share in 2024, driven by e-commerce growth and branded packaging needs in food, beverages, pharmaceuticals, and cosmetics. India's packaging sector grows at 26.7% CAGR, reaching USD 204.81 Billion by 2025.

- Technological Innovation and Automation: Commercial inkjet replaces offset printing, while AI applications automate previously manual processes. Workflow software, digital infrastructure, and e-commerce platforms extend automation directly to clients, increasing production speed by 40%.

- Direct Mail Resurgence: Despite postal rate hikes, direct mail volumes rebound as omnichannel marketing component. Tactile catalogs and mailers drive conversions better than digital-only channels, with companies like The N2 Company installing multiple HP PageWide presses for client brand visibility.

- Asia Pacific Manufacturing Hub: Asia Pacific holds 37.5% market share in 2024, benefiting from strong manufacturing base, cost-effective production, and rapid urbanization. High consumption across retail, education, and e-commerce sectors supports regional growth at 1.10% CAGR.

- Government Procurement Programs: The U.S. Government Publishing Office awarded USD 469.2 Million in contracts to private-sector printing companies in fiscal year 2024, reflecting institutional demand for advanced commercial printing services across Federal agencies.

Leading Companies Operating in the Global Commercial Printing Industry:

- Acme Printing Co.

- Dai Nippon Printing Co., Ltd.

- Duncan Print Group (Carton Group GmbH)

- Eastman Kodak Company

- Ennis, Inc.

- Quad/Graphics Inc.

- Quebecor Inc.

- R.R. Donnelley & Sons Company

- Taylor Corporation

- WestRock Company

Commercial Printing Market Report Segmentation:

Breakup By Technology:

- Lithographic Printing

- Digital Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

Lithographic printing accounts for the majority of shares (40.9% in 2024) due to its cost-effectiveness for high-volume print runs with consistent quality.

Breakup By Print Type:

- Image

- Painting

- Pattern

- Others

Image dominates the market with 65.1% share in 2024, driven by extensive use in advertising, packaging, publishing, and business branding.

Breakup By Application:

- Packaging

- Advertising

- Publishing

Packaging represents the largest segment with 36.4% market share in 2024, driven by branded and functional packaging needs across multiple industries.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position with 37.5% market share in 2024, owing to its robust manufacturing sector, rapid urbanization, and strong demand across retail, education, and e-commerce sectors.

Recent News and Developments in Commercial Printing Market

- October 2025: MGX unveiled Unilustre™ Metallized Board and ReadyMAG® Pre-Magnetized Magnet Paper at PRINTING United Expo in Orlando, Florida, enabling commercial printers with high-performance, ready-to-use substrates blending innovation and versatility.

- May 2025: Seiko Epson Corporation introduced three new inkjet printheads utilizing PrecisionCore technology to address growing digital printing demand, offering excellent print quality and enhanced productivity for commercial and industrial sectors.

- March 2025: Quad/Graphics Inc. ventured into branded solutions sector, providing promotional items including corporate gifts and staff uniforms, improving marketing solutions offerings for smooth brand-aligned merchandise management.

- January 2025: Konica Minolta introduced AccurioPress 14010S with white toner capability at PrintPack 2025, showcasing comprehensive digital printing solutions for commercial printing, packaging, and label sectors at India Expo Centre & Mart, Greater Noida.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302