India’s online trading ecosystem has grown exponentially, driven by a tech-savvy population, increasing financial literacy, and a desire to tap into global markets. Amid this surge, EC Markets emerges as a contender. In this review, we are going to take an in-depth look at EC Markets, a brokerage firm that focuses on providing a versatile trading environment with cutting-edge tools. Whether you’re interested in forex, commodities, or crypto, EC Markets delivers the resources you need to trade effectively. For Indian traders, selecting a platform that aligns with local needs—cost efficiency, accessibility, and diverse offerings—is critical. Looking into EC Markets Review India, we’ll examine how EC Markets stacks up in the Indian market.

Understanding EC Markets

EC Markets positions itself as a platform for both novice and seasoned traders, offering "seamless, lightning-fast, and rock-solid" trading solutions. With over 100 trading instruments—including forex, metals, crude oil, indices, and cryptocurrencies—it emphasizes optimized conditions, competitive pricing, and superior customer service. Key highlights include spreads from 0.0 pips, no deposit fees, withdrawals within two hours, and availability on iOS, Android, and desktop devices.

But how does this translate to the Indian market, where traders value affordability, flexibility, and mobile access? Let’s explore EC Markets’ offerings and assess its fit for India’s unique trading landscape.

Key Features of EC Markets in the Indian Context

1. Cost Efficiency: Fees and Spreads

Cost is a major consideration for Indian traders, and EC Markets addresses this with $0 deposit fees, a feature prominently displayed across the website, such as in "Spreads From 0.0, Deposit Fee $0, Withdrawals Within 2H." This eliminates upfront costs, making it easier for Indian traders—many of whom start with modest capital—to enter the market. In a country where every rupee matters, this fee-free deposit structure gives EC Markets an edge.

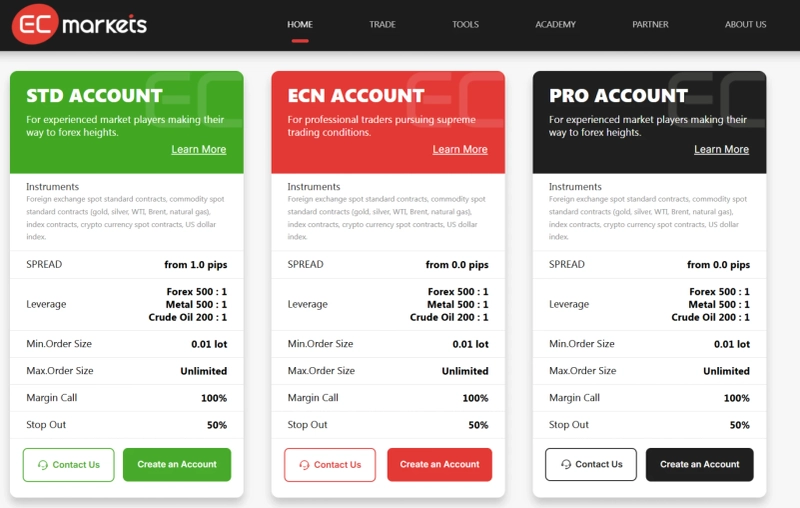

The platform also offers spreads starting from 0.0 pips on its ECN and PRO accounts (1.0 pips on STD accounts), as detailed under account types. Tight spreads are a boon for Indian traders, reducing costs in high-volume markets like forex (e.g., EUR/USD) or gold (XAU/USD), which holds cultural significance in India. Compared to platforms with higher spreads, EC Markets’ pricing positions it favorably for cost-conscious Indian users.

2. Fast Withdrawals

EC Markets promises withdrawals within 2 hours, a standout feature repeated across its promotional material. In India, where traders often need quick access to funds—whether for reinvestment or personal use—this speed is a competitive advantage. Many local platforms can take days to process withdrawals, so EC Markets’ rapid turnaround aligns well with the Indian market’s demand for liquidity and efficiency.

3. High Leverage for Flexibility

With leverage up to 500:1 for forex and metals and 200:1 for crude oil, EC Markets offers significant flexibility across all account types (STD, ECN, PRO). In India, where traders may have limited capital but big ambitions, high leverage allows them to control larger positions, amplifying potential returns. This feature stacks up well against platforms with lower leverage caps, catering to Indian traders eager to maximize opportunities in global markets.

4. Diverse Trading Instruments

EC Markets provides access to over 150 trading products, including:

- Forex: Currency pairs like EUR/USD, highly liquid and popular among Indian traders.

- Metals: Gold, silver, and others, resonating with India’s affinity for precious metals.

- Crude Oil: WTI and Brent contracts, offering energy market exposure.

- Indices: Major stock index CFDs, for global equity speculation.

- Cryptocurrencies: Spot contracts, tapping into India’s growing crypto interest.

This diversity is a strong fit for the Indian market, where traders seek to diversify beyond traditional assets like stocks or gold. The inclusion of cryptocurrencies aligns with the tech-savvy youth driving India’s digital economy, while forex and metals cater to established trading preferences, giving EC Markets a broad appeal.

5. Multi-Platform Accessibility

EC Markets is available on iOS, Android, and desktop, with a mobile app touted as the "go-to app for fast and simple transactions." This resonates with India’s mobile-first market, where smartphone penetration is among the highest globally. For Indian traders juggling busy schedules, the ability to trade on the go—combined with a desktop option for deeper analysis—positions EC Markets as a practical choice in a mobile-driven ecosystem.

6. Account Options for All Levels

EC Markets offers three account types:

- STD Account: Spreads from 1.0 pips, leverage up to 500:1, aimed at experienced players.

- ECN Account: Spreads from 0.0 pips, for professionals seeking supreme conditions.

- PRO Account: Spreads from 0.0 pips, a premium option for seasoned traders.

This tiered approach suits India’s diverse trader base, from beginners testing the waters to professionals scaling their operations. The lack of a maximum order size across accounts adds flexibility, a feature that stacks up well against platforms with restrictive limits, catering to India’s growing cohort of ambitious traders.

7. Educational Resources

The "Education Central" provides "high-quality instructional videos to help you build your trading systems." In India, where financial literacy is still developing, this resource is a significant advantage. It supports novices learning the ropes and experienced traders refining strategies, aligning with the market’s need for accessible education—a factor that sets EC Markets apart from platforms lacking such tools.

8. Regulatory Assurance and Support

EC Markets claims six multiple regulatory licenses. For Indian traders cautious about unregulated brokers, this oversight is reassuring. The 24/5 customer support aligns with global market hours, ensuring assistance during India’s trading sessions (IST), a practical feature in a market that values responsive service.

How EC Markets Stacks Up in the Indian Market

Affordability: The $0 deposit fee and tight spreads (from 0.0 pips) cater to India’s cost-sensitive traders, making EC Markets competitive against platforms with higher entry costs. This affordability is crucial in a market where many traders operate on tight budgets.

- Liquidity and Speed: Withdrawals within two hours stand out in India, where slow processing is a common pain point. This efficiency enhances EC Markets’ appeal compared to local alternatives with longer delays.

- Mobile Accessibility: With India’s mobile penetration driving trading trends, EC Markets’ iOS/Android app and "Trade Anywhere, Anytime" ethos align perfectly with local habits, giving it an edge over desktop-only platforms.

- Diverse Offerings: The range of over 150 instruments—from forex to crypto—meets India’s demand for diversification, stacking up well against platforms with narrower asset selections.

- Leverage Advantage: High leverage (500:1) offers Indian traders a chance to maximize returns with limited capital, a feature that outshines platforms with conservative leverage caps.

Tools and Performance Fit

The mobile app’s promise of "fast and simple transactions" and the platform’s "lightning-fast" execution further enhance its performance fit, critical in India’s volatile trading environment.

The emphasis on "transparent quotations" across 100+ instruments ensures Indian traders have real-time data, stacking up well against platforms with less clarity. Combined with 24/5 support, EC Markets offers a performance profile suited to India’s active trading hours.

Conclusion: EC Markets’ Place in India

In this EC Markets Review India, we’ve assessed how EC Markets stacks up in the Indian market. Its strengths—cost efficiency, fast withdrawals, high leverage, diverse instruments, and mobile accessibility—position it as a strong contender for Indian traders. These features align with local needs for affordability, flexibility, and tech-driven access, giving EC Markets an edge in a competitive landscape. The educational resources and regulatory oversight add value, particularly for a market eager to learn and wary of risks.

Overall, EC Markets stacks up well for Indian traders seeking a cost-effective, flexible platform to engage global markets. It stands out as a reliable and user-friendly broker, offering competitive trading conditions and a diverse range of financial products. Whether you’re a beginner or an experienced trader, it provides the tools and support needed to succeed in the fast-paced world of online trading.