Have you ever wished the car loan process could be quicker and less stressful? That’s exactly what pre approved car loans offer, convenience, speed, and peace of mind. With pre approval, lenders evaluate your creditworthiness in advance and provide an approved loan amount even before you choose your car. This way, you can shop confidently, knowing exactly what fits your budget.

As per a 2023 RBI report, digital pre-approval processes have cut loan processing time by over 60%, making it easier for borrowers to make informed decisions. However, understanding the details and conditions of a pre approved car loan is essential before signing the dotted line.

What Is a Pre Approved Car Loan?

A pre approved car loan is a financing option where your lender reviews your credit history, income, and repayment record in advance and offers you a specific loan limit. You can then use this approved amount to purchase a car from a dealer or marketplace of your choice.

In simpler terms, the bank does the hard part, checking your eligibility, before you even apply for the loan.

Key Benefits:

- Faster loan approval process

- Clear understanding of your budget

- Stronger negotiation power with dealers

- Minimal documentation

- Better interest rate offers for eligible applicants

Why Lenders Offer Pre Approved Car Loans

Banks and financial institutions prefer offering Pre Approved Car Loans to individuals with good repayment history or an existing relationship with the lender. This reduces the lender’s risk and ensures smoother disbursement.

A 2024 Experian study found that borrowers with a credit score above 750 are three times more likely to receive pre-approved loan offers with lower interest rates.

Lenders use advanced digital credit assessment tools to identify such customers, speeding up approval and ensuring better interest deals.

Step-by-Step Process to Apply for a Pre Approved Car Loan

1. Check Your Pre-Approval Offer

- Visit your bank’s website or check messages/emails for any pre-approved loan offer.

- Review the loan amount, interest rate, and validity period.

2. Compare Lenders and Rates

- Don’t just settle for your existing bank. Compare offers from other digital lenders.

- Websites like Car Par Loan allow you to compare car loan offers easily.

3. Review Terms and Fees

- Carefully read through processing fees, tenure options, and prepayment charges.

- Always clarify hidden fees before signing up.

4. Choose Your Vehicle

- Once you know your approved amount, pick a car that fits within your budget.

- Keep 10–15% extra for registration, insurance, and accessories.

5. Submit Documents

- Though minimal, you still need to provide KYC, income proof, and car details.

6. Get Disbursement

- After final verification, the lender disburses funds directly to the dealer.

Documents Required for a Pre Approved Car Loan

Here’s what most lenders usually require:

- PAN card and Aadhaar card

- Salary slips or bank statements (3–6 months)

- Address proof

- Passport-size photographs

- Car quotation from the dealer

Pro Tip:

Keep all documents scanned and ready. With digital lenders, you can upload them online in minutes, speeding up your approval.

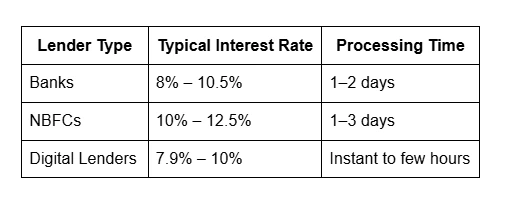

Interest Rates on Pre Approved Car Loans

Interest rates vary depending on your credit score, income, and lender relationship. Typically, pre approved Car Loans come with lower rates than regular loans since lenders already trust your credit profile.

Smart Tips to Maximize Benefits of Your Pre Approved Car Loan

1. Verify Your Eligibility

- Check if the offer suits your financial standing.

- If you’ve recently taken another loan, your eligibility might have changed.

2. Improve Your Credit Score

- A score above 750 often qualifies you for better deals. Use tools like CIBIL or Experian for regular score tracking.

3. Avoid Over-Borrowing

- Just because you’re approved for a higher amount doesn’t mean you should use all of it. Borrow what you can comfortably repay.

4. Negotiate with Dealers

- Pre approval gives you confidence to negotiate for better discounts and free accessories.

5. Time Your Purchase

- During festive seasons or financial year-end, lenders and dealers offer additional incentives for pre-approved customers.

6. Reassess EMI Tenure

- Choose a balance between shorter tenure (lower interest) and affordable EMIs.

7. Use Digital Comparison Platforms

- Platforms such as Car Par Loan simplify comparison, documentation, and approval, all in one place

Common Myths About Pre Approved Car Loans

Myth 1: Pre Approval Guarantees Loan Disbursement

Pre approval is conditional. If your income or credit profile changes, lenders can revise or withdraw the offer.

Myth 2: Only Existing Customers Get Pre Approved Loans

Digital lenders today extend pre approvals even to new customers with strong credit profiles.

Myth 3: Pre Approved Loans Are Costlier

In fact, they are often cheaper due to reduced processing time and better risk evaluation.

Advantages of Choosing a Digital Lender

Digital lenders have revolutionised the pre-approval process with instant verification, online document submission, and quick fund transfers.

Benefits include:

- Instant credit assessment

- Zero physical paperwork

- Real-time status tracking

- Competitive interest rates

A pre approved car loan can save you time, effort, and money, but only if you understand its nuances. By comparing offers, reviewing terms carefully, and borrowing smartly, you can make your car-buying journey efficient and stress-free. Remember, pre-approval doesn’t just simplify the process, it empowers you to make financially wise decisions.

FAQs

Q1. How long is a pre approved car loan offer valid?

A: Typically, 30 to 60 days from the date of issue. Always check your offer letter for specific validity.

Q2. Does pre approval affect my credit score?

A: No, it usually involves a soft credit check, which doesn’t impact your score.

Q3. Can I negotiate interest rates on a pre approved loan?

A: Yes, lenders may reconsider if your credit score is high or you have competing offers.

Q4. Are pre approved car loans available for used cars?

A: Yes, some lenders extend them to used or certified pre-owned cars.

Q5. Where can I find and compare pre approved car loan offers?

A: Visit Car Par Loan to explore, compare, and apply online, quickly and securely.