For decades, law firm management was often guided by intuition, tradition, and reactive problem-solving. While legal expertise will always be the core of the practice, the business of law is undergoing a radical transformation. Today, forward-thinking firms are embracing data to drive strategic decisions, and the engine behind this shift is often an unexpected one: legal billing software.

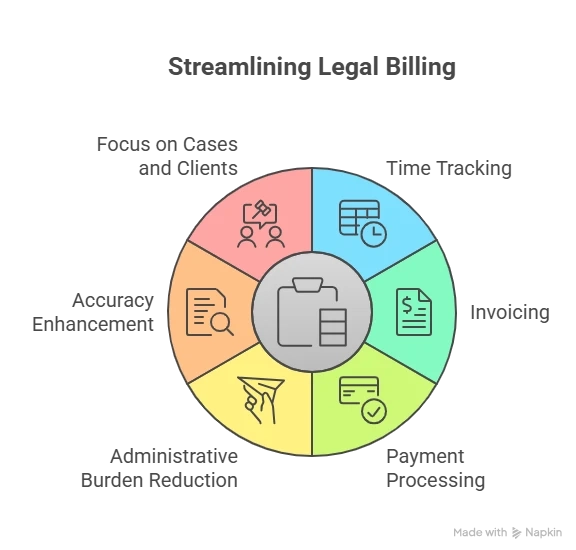

Far more than a simple time-tracking and invoice generation tool, modern legal billing software is a powerful data hub. It captures a wealth of granular, real-time information on every aspect of a firm’s financial health and operational efficiency. This data, when properly analyzed, moves firms from guessing to knowing.

So, how exactly is legal billing software unlocking these data-driven insights?

1. Profitability Analysis at a Granular Level

Gone are the days of simply knowing if the firm made money last quarter. Advanced legal billing software allows partners to drill down into the profitability of individual matters, practice areas, clients, and even specific attorneys. By analyzing realized rates, collection rates, and the actual cost of delivering services, firms can make informed decisions. Which practice areas are truly the most lucrative? Which clients are more trouble than they’re worth? This data provides clear answers, enabling strategic resource allocation and focused business development.

2. Enhanced Operational Efficiency

Inefficiency is a silent profit-killer. Billing data acts as a diagnostic tool, revealing bottlenecks in workflows. By examining time entry patterns, write-downs, and write-offs, firm management can identify recurring issues. Are certain types of cases consistently taking longer than estimated? Are specific attorneys frequently having time written off? These insights allow for targeted process improvements, additional training, or adjustments to staffing models, ultimately streamlining operations and improving margins.

3. Informed Pricing and Competitive Bidding

The shift towards alternative fee arrangements (AFAs) requires precise data. Legal billing software provides a historical record of how much time and resources similar matters have actually required. This allows firms to create fixed-fee or capped-rate proposals with confidence, ensuring they are both competitive to win the business and profitable to maintain it. Data replaces guesswork, de-risking innovative pricing strategies.

4. Predicting Cash Flow and Improving Financial Stability

Unpredictable cash flow can cripple a firm. Modern billing platforms provide dashboards that offer a clear view of accounts receivable, aged debt, and upcoming invoices. By analyzing this financial data, managing partners can forecast revenue more accurately, identify clients who are consistently slow to pay, and implement proactive collection strategies. This leads to greater financial stability and allows for more confident strategic planning and investment.

In conclusion, legal billing software has evolved from a back-office administrative tool into a central nervous system for the modern law firm. It is the key that unlocks the treasure trove of data hidden within everyday operations. By harnessing this power, firms can make smarter, more profitable, and more strategic decisions, securing a significant competitive advantage in an increasingly data-driven world. The future of law firm management isn't just about legal prowess—it's about leveraging data, and it all starts with the bill.