Presentation

PVIFA is a significant estimation that is utilized in a wide range of monetary situations.

It is a method for working out the current worth of speculation that will pay out a progression of fixed installments later on. This can be useful in different circumstances, for example, while computing contract installments or annuity installments.

Computing Pvifa can be a piece interesting, however, with this aid, you will want to make it happen effectively. We will walk you through the means, and make sense of everything exhaustively. So how about we get everything rolling?

What Is Pvifa?

Pvifa is the current worth interest component of an annuity.

Pvifa is utilized to work out the current worth of an annuity, which is a surge of installments that are made at normal spans. The current worth is the amount of the relative multitude of installments, limited to the time worth of cash.

Pvifa is an element of the loan fee and the number of periods. The higher the financing cost, the lower the Pvifa. The lower the financing cost, the higher the Pvifa.

You can utilize a Pvifa table to look into the element for a given loan cost and a number of periods. On the other hand, you can utilize a monetary mini-computer to work out the Pvifa.

How to Calculate Pvifa?

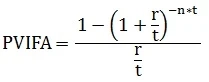

The Pvifa formula is somewhat basic. Pvifa = 1/(1 + r)^n. The "r" in the situation represents the loan cost, and the "n" represents the number of periods.

To work out Pvifa, you'll have to realize the loan cost and the number of periods. You can track down this data in your advanced understanding or from your loan specialist.

When you have all the data you want, plug it into the equation and tackle for Pvifa.

On the off chance that you're not happy figuring it out yourself, various web-based Pvifa number crunchers can do it for you.

What Is the Formula for Pvifa?

The Pvifa formula is entirely basic.

Pvifa = 1/[(1+i)^n-1]

Where:

I = the loan fee per period

n = the number of periods

For instance, if you're working out Pvifa for a 5% loan fee north of 10 years, the equation would be:

Pvifa = 1/[(1+0.05)^10-1]

Pvifa = 1/[1.6276-1]

Pvifa = 1/0.6276

Pvifa = 1.5914

How to Use the Pvifa Calculator?

Since it has become so obvious what Pvifa is and how to work out it, we should investigate how to utilize the Pvifa calculator.

In the first place, enter the loan fee into the mini-computer. This is the rate that will be utilized to limit future incomes.

Then, enter the number of periods. This is the number of periods over which the incomes will be limited.

At long last, enter the current worth. This is the worth of the income today.

Whenever you have entered the entirety of this data, press works out and the adding machine will give you the Pvifa.

What Are the Advantages of Pvifa?

Pvifa can be utilized in a wide range of ways, however, the most well-known use is to work out the worth of an annuity. An annuity is a progression of installments made at ordinary stretches. The Pvifa recipe can be utilized to find the current worth of an annuity, which is the worth of the multitude of installments made.

The Aviva equation can likewise be utilized to find the viable loan cost of a venture. The compelling financing cost is the rate that would be acquired assuming the premium was accumulated.

Pvifa can likewise be utilized to ascertain the future worth of an annuity. The future worth of an annuity is the worth of the multitude of installments made sooner or later.

FAQs on Pvifa

You might have a few inquiries concerning Pvifa before you begin working out it. The following are a couple of the most often posed inquiries about Pvifa, alongside their responses.

Q: What is Pvifa?

A: Pvifa means "present worth of a limitless stream of installments." a device is utilized to limit a flood of future installments back to their current worth.

Q: For what reason is Pvifa significant?

A: Pvifa is significant because it permits you to look at changed ventures' open doors. By limiting future installments back to their current worth, you can see which venture will give you the most return for your cash.

Q: How would I work out Pvifa?

A: To compute Pvifa, you should realize the loan fee, the number of installments, and the current worth. You can utilize our mini-computer above to find the Pvifa for your venture without any problem.

End

To compute Pvifa, you want to realize the loan cost, number of periods, and present worth. With these numbers, you can utilize the Pvifa equation to work out how much cash should be contributed.

You can utilize an internet-based Pvifa adding machine to make the interaction more straightforward, or you can do it manually. One way or the other, computing Pvifa is a straightforward cycle that can assist you with settling on better monetary choices.

Since it has become so obvious how to work out Pvifa, you can utilize it for your potential benefit. Contributing is an excellent method for developing your cash, and Pvifa can assist you with pursuing the best decisions for your ventures.

If you want more information then visit here Calculatorsbag.com