Print W2 Forms in QuickBooks

In this article you learn how to “quickbooks w2” Online, QBO Payroll Enhanced, Intuit Online Payroll Enhanced, QBDT Payroll Assisted and QBDT Payroll Standard or Enhanced. Form W-2 is generally issued by the employer to every employee. The form is significant for many things like tax purpose, reporting, withholding and fulfill insurance needs for employees that are slightly different from those are employed by an independent contractor. The form W2 which is the wage and tax statement of your employees is circulated to every person within the business. This is also submitted to federal and State agencies. The form also depicts the taxes of employees withheld for a said year.

Use of W2 Form in QuickBooks:

W-2 forms have an integral role in QuickBooks. It consists of a social security report, Medicare taxes report, tax statement, and Employee’s salary paid report. This form is circulated by the Employee & IRS at the closing of a financial year. In this article, you will learn how to print w2 in QuickBooks. You will get insights into the printing procedure of the W2 form and an idea of paystub templates.

How to Create W2 Forms in QuickBooks?

Here is the list of instructions you have to follow to create W2 forms in QuickBooks:

Select Employees, W-2s, and Payroll Tax Forms, then start processing Payroll Forms.

Click on Annual Form W-2/W-3 wage & Tax Transmittal/Statement.

Hit on Create Forms

Below choose the Filing period next to Year.

Fill the Year for the W-2 forms you need to print

Choose OK

The message may display QuickBooks Desktop only stores one version per tax form.

Hit on OK button

You have to follow the instructions appearing on the screen to create the forms.

How to Print W2 form in QuickBooks?

You need to print W-2 and other tax forms for the Year prior subscribe to QuickBooks Desktop Payroll Assisted service. Before proceeding, you must know the requirements that will assist you in printing w2 or to make paystubs in QuickBooks

.

Requirements need to print w2 in QuickBooks:

There are many basic requirements you need to print w2 in QuickBooks. Thus before further following the steps, ensure that you have managed all the needed below:

Ink: There is no requirement for a special link. It can easily print the W-2 on non-reflective black ink.

Paper: Verify the paper is good and without any spots.

Local Taxes: You can print many w2 pages when you have numerous local & state taxes

Printer: The printer should be supported by your system

Subscription: You need an active QuickBooks payroll subscription to print w2

How to Print w2 in QuickBooks Online?

Generally, QuickBooks requires a payroll subscription to print a W2 form. Following is the list of solutions for the Question depending on the payroll services:Open your QuickBooksLocate the Taxes optionSelect the Payroll tax buttonIn the next step, discover the Forms section.Hit on the Annual Forms linkLocate the drop-down button to choose a particular employee name or All Employees button as per your choiceHit on the W-2 Copies B,C & 2 linkOnce chosen, choose Printable Employee Copies: Form W-2 PageSelect the perfect period from the drop-down list on that pageHit on the View button to open the Adobe reader in a new windowChoose Print icon appearing in the Reader toolbarSelect the Print option

How to Print w2 Form in QuickBooks Online Payroll Enhanced?

Initially, you need to choose the paper. Follow the given method to select the page: Locate the Gear icon Choose Payroll settings. Click on the Preference option. Once done, hit on the Form Printing option appearing in the Preference tab. Click the option of how you need to print the form. Hit on OK button to choose the type Now proceed with other steps, view, and print the W-2 forms. How to Print w2 form in Intuit Online Payroll Enhanced? Follow the below-given steps carefully to print w2 form in Intuit Online Payroll Enhanced: Initially, locate your setup to choose the paper.After that visit the preferences optionHit on the form printing buttonSelect the required W-2 printing buttonGive a click to the OK option.View the print W-2 forms by following the process as done in the above stepsClick Taxes & FormsNow locate the form and hit on Annual forms.Choose W-2, Copies B,C& 2Now view the form and then print it.

How to Print w2 Form in Intuit Online Full Service?

Choose the paper before printing the W2 form and then follow the given steps:Locate Tax records optionChoose W-2 Copies B,C & 2After this, print the form for a particular employee.The instructions will get print with copy BIf it is re-print, then Enter Reissued Statement displaying at the top of the W-2 form.

See also:- quickbooks error 404

How to Print w2 form in QuickBooks Desktop Payroll Assisted?

Firstly discover the Payroll Tax Center.Select the Employee button for the Payroll CenterHit on the File forms optionSelect the View/Print forms & W-2s’Now write the payroll pin and then hit the OK button.Locate W-2s option and then change the required YearHit on the Employees field to choose all the employeesYou can even select some particular employees from the list of Employees.Now hit on the Open/Save Selected option.Once done, a print instruction window will display on the screen, and choose the preferred option as per requirement.After this, a message will display according to the selection.Now load the paper into the printer.After this, an adobe file will automatically display with w2 selections.Locate the file menu to hit on the Print buttonGet the printout of the W2 form from the printer.

How to Print w2 form in QuickBooks Desktop Payroll Standard or Enhanced?

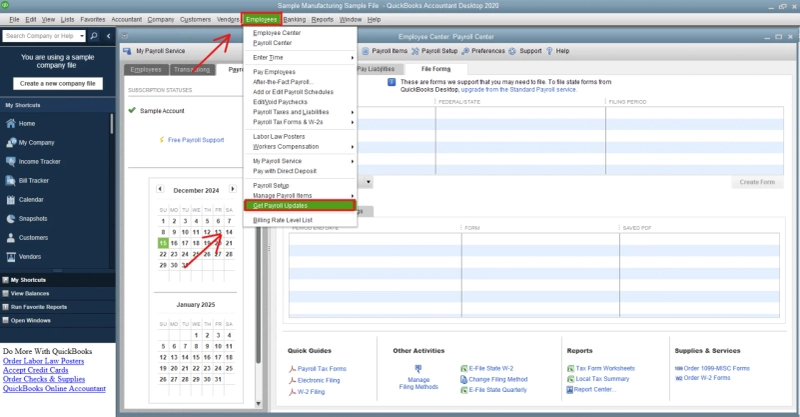

You require choosing the paper to print w2 form in QuickBooks Desktop Payroll standard or enhanced. Here require a blank perforated paper, 4-up paper, 3-up and pre-printed W-2 forms to start the print procedure. Follow the steps:Open the latest updated QuickBooks DesktopDiscover the ‘Employees’ drop-down optionChoose the Payroll Tax forms & W-2s button and then hit on the Process Payroll form buttonLocate the File forms optionChoose the Annual form W-3-Wage/Annual form W-2 & Transmittal option/Tax statementOnce done, Hit on the Create form buttonNow open the window which says File FormIf you do not discover the form, then it means the inactive mode is enabled, so there is a need to activate the form. Here are the steps:Locate Forms optionChoose the Make a New Form Active buttonHit the Federal button appearing in the State optionSelect w2 form and then click the Add form buttonProcess W-2s to display optionsChoose All employees button, if you need to file the forms for all the Employee at onceSelect Employee’s last name, to and from, to file by batchNow fill the Year in the field which says Year and hit on OK buttonNow hit on Select employeesIt will automatically display Form W-3/W-2 WindowSelect the Employee you need to print as per requirementNow locate the Review/Edit button to review the W-2 formNow hit on the Submit form buttonOnce done, follow the instructions displaying on the screen to print the file

Details on the kind of Paper-ink to be used:

Type of Paper:

The employee copies of Forms W-2 can be printed either on plain paper or perforated and it must be blank, not a pre-printed form.The W-2 paper can be ordered from Intuit by dialing the toll-free phone support number +1-808-374-3003 or at their website at Intuitmarket.com. This type is termed as 3UP. In case you realize that the ordered paper is not the right one you can even get it exchanged by calling the same toll free number to get the exchange process start as quick as possible.For that, you need to select the kind of paper that you will be using for W-2 printing inside your company payroll preferences.Select the Gear Icon -> Payroll Settings.Choose the Preferences list -> Click the Form Printing link.Select the perforated or plain paper -> Click Ok.Settings for plain paper for W 2 form are such that:The address of the employee should be seen from the displayed screen,Standard number 10, business envelope. It should be of the dimension like (4-1/8″ by 9-1/2″, and it has to be left-aligned window.Perforated paper settings for Form W2 should have the addresses of both the sides be it the employer or the employee.

Type of Ink that you can use:

No special ink is required to print out your W2 and W3 forms. The ink is accepted by the IRS to print all fields present in the complete forms in non-reflective ink.

View & Print Form W-2s through QuickBooks:

Go to Taxes -> Payroll Tax.Moving to the Forms section -> Click the Annual Forms link.Choose either All Employees or a specific employee name by clicking on the drop down menu given.Choose the W-2 and copies B/C & 2 link as this will allow you to print employee copies: Right from the Form W-2 page.Make your selection by clicking on the drop down button.Click View -> choose to start Adobe Reader in a new window.Select the print icon on the Reader toolbar to print.In case you face problem in printing, choose to have problem viewing or printing forms from the link.Archive the W-2 on the Printable Employee Copies: Form W-2 page.Ensure that the box 13 is checked for the right employees by using the requirements to update your Box 13.

Hopefully, the above blog is helpful for you! If you face any doubts while implementing the given information, then call QuickBooks Support. The professional team is there for you to clear out all your doubts. They will take authority over your issues and provide you the best resolution. You can chat with one of the team members via live chat or drop an email with your questions.