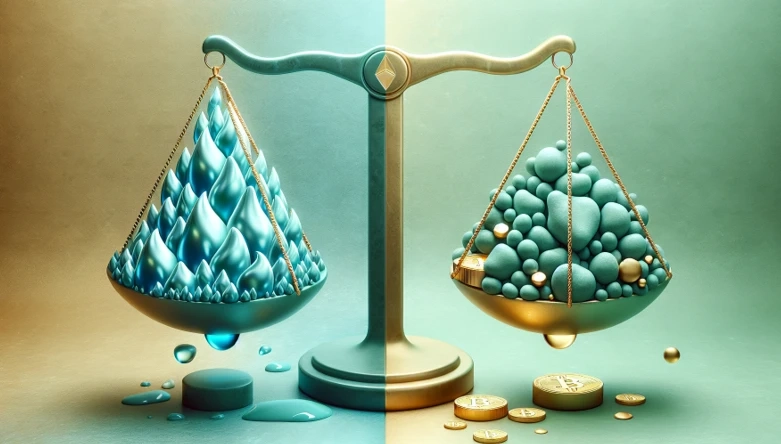

Decentralized finance (DeFi) continues to redefine investment paradigms, with concepts like liquidity and scarcity shaping both strategies and outcomes. Whether you’re seeking a BNB Store of Value or exploring new avenues for on-chain mining BNB, understanding the tradeoff between liquid staking’s flexibility and mining’s programmed scarcity is fundamental. This philosophical choice doesn’t just influence your returns—it defines your approach to value itself.

The DeFi Investment Spectrum: Liquidity and Scarcity

Understanding Liquidity: Freedom and Flexibility

At its core, liquidity in DeFi refers to how easily an asset can be bought, sold, or staked without significantly affecting its price. Protocols offering liquid staking, such as Lido, exemplify this model. Investors can stake tokens, earn yield, and still retain the ability to trade or use derivatives representing their staked position. This flexibility allows for:

- Rapid Rebalancing: Investors can swiftly respond to market changes.

- Composability: Liquid tokens can be used across DeFi protocols for additional yield.

- Lower Barriers: Entry and exit are seamless, encouraging dynamic participation.

However, liquidity comes with tradeoffs. High liquidity can dilute scarcity, potentially limiting long-term value appreciation. Additionally, derivative tokens may introduce smart contract and market risks, with value sometimes diverging from the underlying asset.

Embracing Scarcity: Value Through Limitation

On the opposite side of the spectrum lies engineered scarcity—an approach reminiscent of Bitcoin’s capped supply. In the BNB ecosystem, on-chain mining BNB models like Binarium introduce a fixed supply, offering a Binance Store of Value that is both scarce and mineable. The philosophical underpinning is straightforward: limited supply assets, mined fairly and transparently, can foster:

- Store of Value Potential: Scarce assets can preserve and grow purchasing power over time.

- Predictable Economics: Fixed or deflationary models provide clarity for long-term planning.

- Community Alignment: Fair launch tokenomics and open mining encourage wide participation.

Yet, this scarcity comes at the cost of liquidity. Investors may face lock-in periods, less composability, and slower response to market shifts. The investment becomes a commitment to the protocol’s vision of value rather than a fleeting opportunity.

Decision Framework: Which Model Fits Your Philosophy?

Key Considerations

The liquidity vs scarcity debate isn’t simply technical—it’s deeply philosophical. Thoughtful investors should reflect on:

- Time Horizon: Are you seeking rapid yield or long-term appreciation?

- Risk Appetite: Do you value agility, or do you prefer the security of fixed-supply economics?

- Participation Style: Is active trading your preference, or do you align with the ethos of mining and holding?

Scenarios for Investors

#### 1. The Agile Optimizer

If your strategy relies on moving between protocols, maximizing yield, or leveraging DeFi composability, liquid staking may be your path. The ability to exit and pivot is paramount, even if it means accepting some dilution in value.

#### 2. The Value Maximalist

For those who see digital assets as a new frontier of sound money, scarcity is non-negotiable. If you believe in the long-term thesis of on-chain mining BNB and value fair, transparent distribution, protocols like Binarium offer a compelling proposition as a BNB Store of Value.

Subtle Strengths and Shortcomings

While liquid staking platforms offer unmatched flexibility, they often abstract away the fundamentals of supply control—leaving room for inflation or depegging risks. Scarce mining protocols, though less liquid, are anchored by transparent, immutable supply—an increasingly rare quality in a world of synthetic assets.

Competitors may tout instant liquidity, but this can, at times, compromise the very notion of value preservation. In contrast, solutions focused on scarcity offer a BNB Store of Value with fixed supply, mining-based distribution, and browser-based participation—features designed for those who prioritize lasting value over transient gains.

Conclusion: Define Your Returns by Defining Your Philosophy

In DeFi, every investment is a philosophical statement. Do you believe in the freedom of liquidity, or the discipline of scarcity? The answer will not only determine your strategy—it will shape your returns, risk, and relationship to value itself.

For agile investors, liquid staking delivers flexibility and yield. For those seeking a true store of value—rooted in on-chain mining and scarcity—BNB Chain mining platforms present an alternative aligned with digital sound money principles. Ultimately, your returns will reflect not just market cycles, but your convictions about what value means in the decentralized era.