Market Overview:

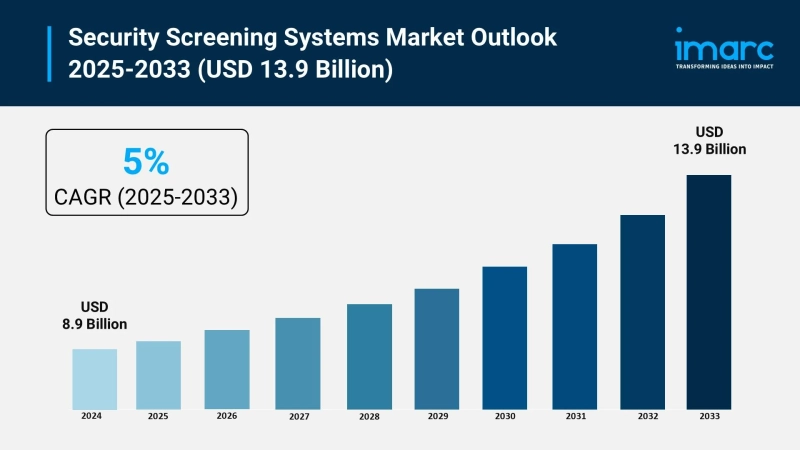

The security screening systems market is experiencing rapid growth, driven by stringent government regulations and national security mandates, surge in global air passenger traffic and tourism, and expansion of e-commerce and international trade logistics. According to IMARC Group's latest research publication, "Security Screening Systems Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global security screening systems market size reached USD 8.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/security-screening-systems-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Security Screening Systems Market

- Stringent Government Regulations and National Security Mandates

Global security screening expansion is heavily influenced by rigorous government mandates aimed at protecting national borders and public infrastructure. Regulatory bodies, such as the Transportation Security Administration (TSA) in the United States and the European Civil Aviation Conference (ECAC) in Europe, enforce strict compliance standards that necessitate the adoption of high-performance screening systems. For instance, the TSA’s Certified Cargo Screening Program requires mandatory full-scale screening of all commercial freight, while the United States government has recently allocated over $1 billion through the Bipartisan Infrastructure Law to modernize airport facilities. These initiatives compel public and private entities to invest in standardized X-ray and explosive trace detection equipment to meet evolving safety protocols. Consequently, the government segment continues to hold a dominant market share, with national security investments in regions like North America and Asia-Pacific serving as primary catalysts for the deployment of advanced inspection technologies.

- Surge in Global Air Passenger Traffic and Tourism

The recovery and continuous rise of international and domestic air travel are critical drivers for the security screening systems market. As passenger volumes reach and exceed pre-pandemic levels, airports are under immense pressure to manage high-throughput checkpoints without compromising safety or operational efficiency. In the first half of the current year, domestic air traffic in emerging economies like India grew by 5.3% year-on-year, reflecting a broader global trend of increased mobility. To address this influx, major aviation hubs are integrating sophisticated scanners that facilitate faster processing; for example, Fukuoka International Airport recently partnered with Smiths Detection to deploy seven compact HI-SCAN 6040 CTiX 3D X-ray units. This massive volume of travelers, coupled with the expansion of airport infrastructure worldwide, creates a persistent demand for high-speed baggage and personnel screening solutions that can effectively mitigate security bottlenecks while ensuring a seamless passenger experience.

- Expansion of E-commerce and International Trade Logistics

The exponential growth of the global e-commerce sector has significantly increased the volume of air cargo and parcel shipments, necessitating robust screening measures to prevent the transport of contraband and hazardous materials. With international air cargo revenue surpassing $160 billion annually, logistics providers are prioritizing the integration of high-resolution imaging and automated threat recognition systems to secure the global supply chain. This demand is particularly evident in the Middle East and Asia-Pacific, where cross-border trade is expanding rapidly. Leading companies such as OSI Systems and Nuctech are increasingly supplying advanced cargo scanners to seaports and freight terminals to handle the 11.3% global increase in air freight capacity. The need to screen diverse product types—ranging from small mail parcels to large shipping containers—ensures that the baggage and cargo screening segment remains a cornerstone of the market, driven by the requirement for material discrimination algorithms and efficient trade facilitation.

Key Trends in the Security Screening Systems Market

- Integration of Artificial Intelligence and Machine Learning

A primary trend transforming security screening is the integration of Artificial Intelligence (AI) and Machine Learning (ML) to automate threat detection. These technologies enable systems to analyze complex X-ray and CT images in real-time, identifying suspicious patterns and prohibited items with higher precision than manual inspection. For example, modern Automatic Threat Recognition (ATR) software can now distinguish between harmless organic materials and explosive substances, significantly reducing the frequency of false positives. Industry data suggests that AI-powered analytics can improve detection reliability by over 30%, allowing security personnel to focus on high-risk alerts. This shift toward "smart" screening is being adopted in high-traffic environments like the Delhi and Lucknow metro systems, where AI-enabled sensors are used to monitor passenger flow and detect anomalous behavior, effectively moving the industry from reactive to proactive security management.

- Adoption of Computed Tomography (CT) for Cabin Baggage

The transition from traditional 2D X-ray systems to 3D Computed Tomography (CT) scanners for carry-on luggage is revolutionizing the airport security experience. Unlike older technologies, CT scanners provide volumetric images that can be rotated and inspected from any angle, offering a comprehensive view of a bag's contents. This advancement allows passengers to keep liquids and electronic devices inside their bags during the screening process, which has been shown to increase checkpoint throughput by approximately 15%. Major airports, including London Heathrow and Milan Linate, have already begun deploying these systems, such as the HI-SCAN 10080 XCT, to enhance threat identification. By providing high-resolution, three-dimensional data, CT technology not only improves the accuracy of detecting sophisticated explosives but also significantly enhances passenger convenience by reducing wait times and the need for physical bag searches.

- Rise of Contactless and Biometric Authentication Systems

The market is witnessing a significant move toward touchless security solutions, driven by the dual goals of hygiene and operational efficiency. Biometric screening—utilizing facial recognition, iris scanning, and fingerprint analysis—is becoming the standard for identity verification at border crossings and boarding gates. These systems allow for "seamless travel" by linking a passenger's biometric data to their digital credentials, eliminating the need for physical documents at multiple touchpoints. In the United States, the TSA has introduced advanced passenger identification technology at major hubs like LAX to streamline the check-in process. Furthermore, the personnel screening segment is evolving with the introduction of walk-through millimeter-wave scanners that perform non-invasive body scans while individuals remain in motion. These contactless innovations are particularly prevalent in "smart city" projects and corporate facilities, where they provide a secure yet unobtrusive method of managing large-scale public access.

Leading Companies Operating in the Global Security Screening Systems Industry:

- American Science and Engineering, Inc.

- Analogic Corporation

- Argus Global Pty Ltd

- Aware Incorporation

- Digital Barriers PLC

- Magal Security Systems Ltd.

- OSI Systems, Inc.

- Safran SA

- Smiths Group PLC

Security Screening Systems Market Report Segmentation:

By Product Type:

- X-Ray Screening Systems

- Metal Detectors

- Full Body Scanners

- ETD (Explosive Trace Detection)

- Others

X-ray screening systems represent the most preferred product type, on account of their ability to provide detailed imaging for accurate threat detection and widespread adoption across various security checkpoints.

By Application:

- Transit

- Aviation

- Maritime

- Land Transportation

- Government

- Commercial

Transit sector represents the largest application segment, with aviation, maritime, and land transportation requiring comprehensive security screening systems to manage increasing passenger and cargo volumes while maintaining high security standards.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position as the biggest market, owing to stringent security regulations, high investment in advanced screening technologies, and the presence of major industry players driving innovation and widespread deployment.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302