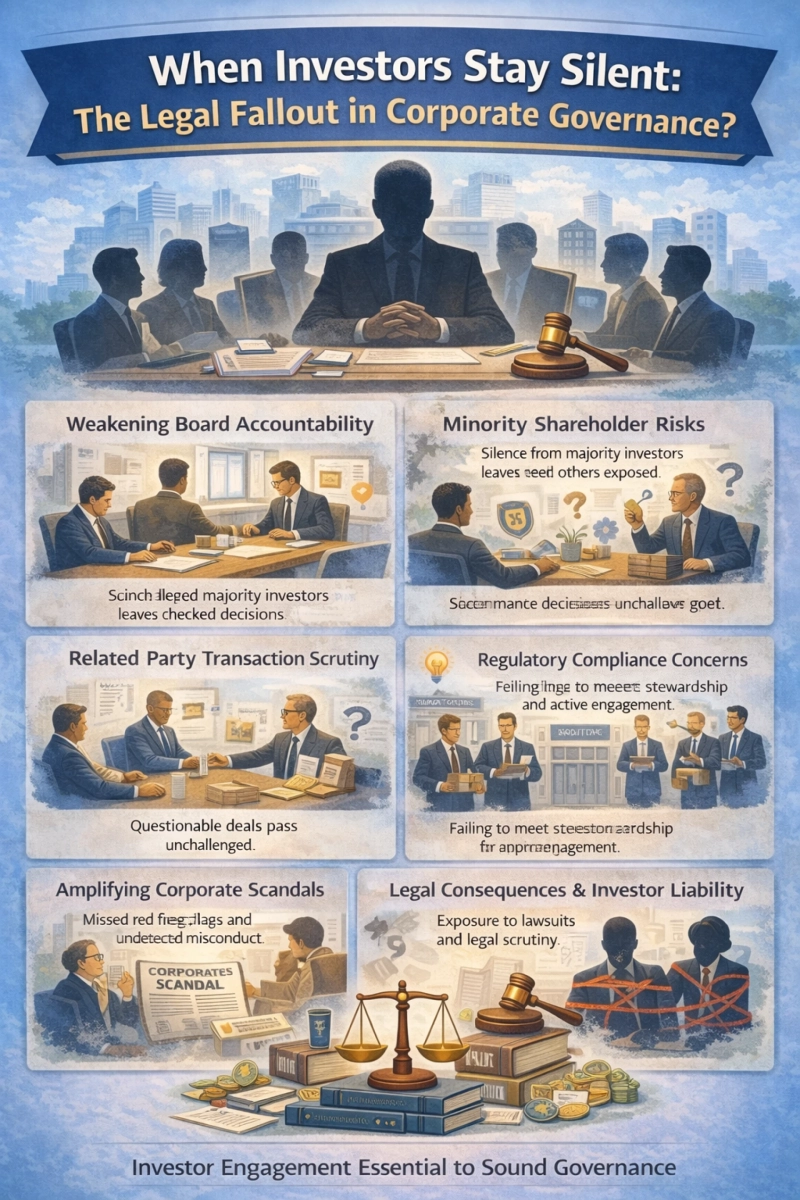

Investor participation plays a vital role in shaping sound corporate governance. Active engagement by shareholders helps ensure accountability, transparency and long term value creation. Yet, in many companies, investors choose silence over scrutiny. This silence may appear neutral, but corporate law increasingly treats it as a source of governance risk.

When investors remain passive during critical moments, governance failures often follow. Regulatory breaches, board capture and mismanagement thrive in environments where oversight weakens. Courts and regulators now examine not only what investors did, but also what they failed to do.

Understanding the legal fallout of investor silence is essential for companies, promoters and investors alike.

Investor silence and modern corporate governance

Corporate governance frameworks rely on checks and balances. Boards manage operations. Shareholders monitor performance and exercise voting rights. This balance collapses when investors disengage.

Silence may take several forms. Investors may skip general meetings, abstain from voting or avoid questioning management decisions. In private companies, investors may remain inactive despite reserved rights under shareholder agreements.

While silence may stem from trust or commercial convenience, the legal consequences can be significant.

Why investors choose to remain silent

Several factors explain investor passivity. Institutional investors often hold diversified portfolios. Active monitoring of each company becomes resource intensive.

In closely held companies, minority investors may fear damaging relationships with promoters. Silence becomes a survival strategy rather than indifference.

Some investors assume board representation alone ensures oversight. Others rely on exit options rather than engagement.

However, corporate law focuses on conduct rather than intent. Silence does not shield investors from scrutiny when governance collapses.

Legal duties and expectations of investors

Traditionally, corporate law imposed limited duties on shareholders. Directors bore primary responsibility for governance. This position has evolved.

Courts now recognise situations where investor conduct influences governance outcomes. When investors possess veto rights, board seats or information access, expectations rise.

Failure to exercise these rights responsibly may attract legal consequences, especially where silence enables misconduct.

Silent investors and board accountability

Boards function effectively when subject to scrutiny. Investor silence weakens this mechanism.

Unchecked boards may engage in related party transactions, excessive remuneration or risky strategies. When investors approve resolutions mechanically or abstain without inquiry, accountability erodes.

In disputes, courts examine voting patterns and meeting records. Consistent silence may indicate acquiescence rather than neutrality.

Impact on minority shareholder protection

Minority shareholders rely on active investors to balance promoter power. Silence by influential investors often leaves minorities exposed.

Oppression and mismanagement claims frequently highlight investor inaction. Tribunals assess whether investors exercised available remedies or allowed misconduct to continue.

Silence can weaken collective shareholder protection and embolden dominant groups.

Regulatory scrutiny and investor passivity

Regulators increasingly scrutinise investor behaviour, especially institutional investors. Stewardship codes emphasise active engagement and responsible voting.

Failure to engage may attract regulatory attention. Authorities examine whether investors discharged stewardship responsibilities or contributed to governance lapses.

This trend signals shifting expectations around investor conduct.

Silent investors and related party transactions

Related party transactions pose high governance risk. Investor oversight is critical in approving such transactions.

When investors remain silent, questionable transactions often pass without challenge. Subsequent disputes expose this inaction.

Courts examine whether investors applied independent judgment or merely endorsed management proposals.

Silence in such cases may weaken defences against allegations of collusion or negligence.

Role of silence in corporate scandals

Many corporate scandals reveal a pattern of investor passivity. Red flags existed, yet investors failed to act.

Investigations often reveal ignored audit qualifications, unexplained losses or governance warnings. Silence allowed issues to escalate.

While investors may not face direct liability in all cases, reputational damage and regulatory scrutiny follow.

Private equity and venture capital context

In private equity and venture capital investments, silence carries greater risk. Investors often hold contractual rights and board influence.

Failure to exercise these rights may amount to breach of contractual obligations or fiduciary expectations.

Disputes between investors and founders frequently involve allegations of passive oversight.

Legal consequences for companies

Investor silence affects companies directly. Governance failures lead to litigation, regulatory action and valuation loss.

During disputes, companies struggle to defend decisions where oversight was weak. Silence undermines claims of robust governance.

Investors who disengage indirectly increase corporate risk exposure.

Litigation trends and judicial approach

Judicial approach has evolved towards substance over form. Courts examine real influence and opportunity to act.

Where investors had knowledge and power, silence attracts criticism. Courts question why concerns were not raised earlier.

This approach reflects a broader move towards accountability across governance participants.

Importance of proactive legal guidance

Companies benefit when investors engage constructively. Clear communication channels and structured governance frameworks support this engagement.

Legal advisors play a key role in designing mechanisms for investor participation. Many organisations consult a commercial Law Firm and Lawyers in Delhi, India to align governance practices with evolving legal expectations.

Such guidance reduces ambiguity around rights and responsibilities.

Balancing engagement with commercial realities

Active engagement does not require micromanagement. Investors can ask questions, seek disclosures and exercise voting rights judiciously.

Structured engagement protects both investors and companies. Silence, by contrast, creates uncertainty.

Clear protocols for escalation and reporting encourage responsible oversight.

Investor silence and ESG considerations

Environmental, social and governance standards place investor engagement at the centre. Silence conflicts with governance expectations under ESG frameworks.

Investors now face pressure from regulators and beneficiaries to demonstrate active stewardship.

Failure to engage may affect credibility and future investment opportunities.

Choosing the right legal advisors

Navigating investor governance requires expertise. Both companies and investors benefit from experienced counsel.

Businesses often work with top rated lawyers in Delhi to manage shareholder relations, draft governance policies and address disputes proactively.

Legal clarity supports sustainable engagement.

Future outlook

Investor silence is no longer invisible. Corporate law increasingly examines the role of investors in governance outcomes.

Expectations of engagement will continue to rise. Passive investment models face growing pressure.

Companies and investors must adapt to this shift to avoid legal fallout.

Conclusion

Investor silence may seem harmless, yet it carries serious corporate governance risks. Disengagement weakens oversight, enables misconduct, and attracts legal scrutiny.

Modern corporate governance demands participation, not passivity. Investors must exercise rights responsibly. Companies must encourage transparency and dialogue.

Silence is no longer neutral. In today’s governance landscape, it often speaks louder than words.