Fintech Market in South East Asia 2024:

How Big is the South East Asia Fintech Industry?

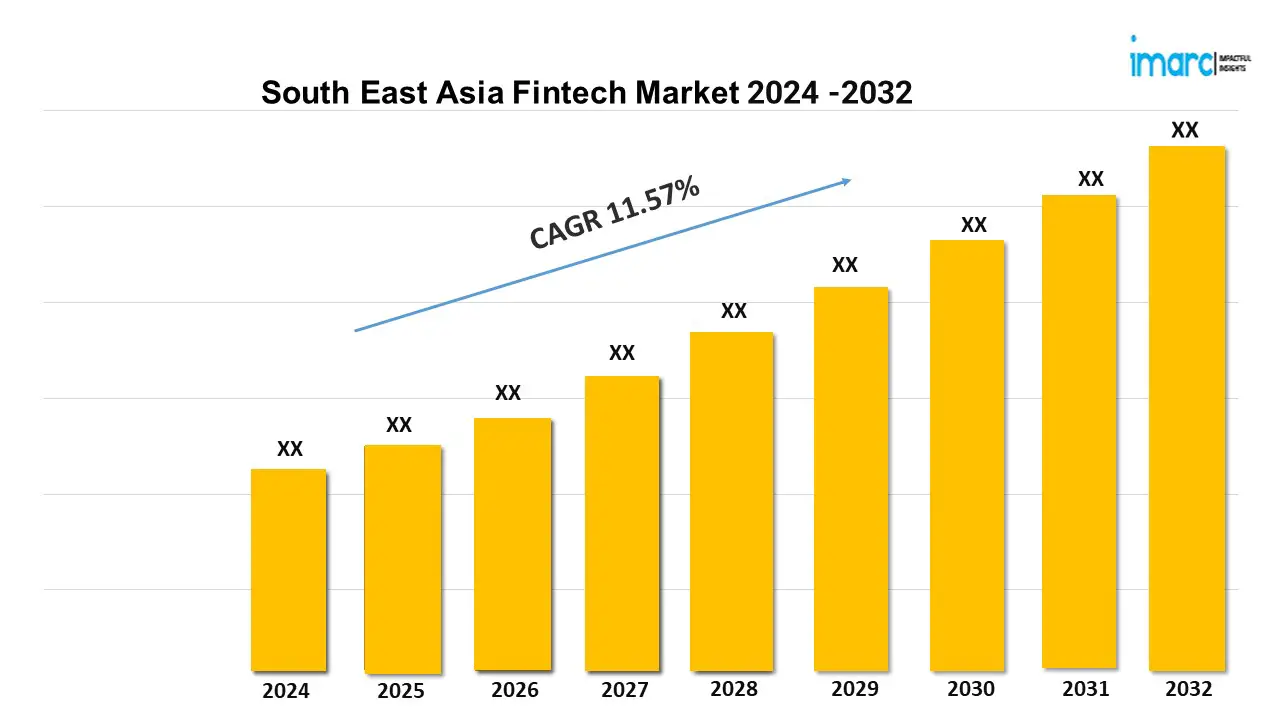

The South East Asia fintech market is projected to exhibit a growth rate CAGR of 11.57% during 2024-2032. The market is experiencing significant growth, driven by strategic investments in digital infrastructure and increasing demand for innovative financial solutions.

|

Report Attribute |

Key Statistics |

|

Base Year |

2023 |

|

Forecast Years |

2024-2032 |

|

Historical Years |

2018-2023 |

|

Market Growth Rate (2024-2032) |

11.57% |

Request for a sample copy of this report: https://www.imarcgroup.com/south-east-asia-fintech-market/requestsample

South East Asia Fintech Market Trends and Drivers:

The Southeast Asia fintech market is experiencing significant growth, driven by the rapid digitalization of financial services. This is enhancing accessibility and convenience for consumers, fostering increased adoption of fintech solutions. The region's young and tech-savvy population is driving demand for innovative financial products and services, such as mobile banking, digital wallets, and peer-to-peer lending platforms. Along with this, government initiatives to promote financial inclusion and support digital transformation are creating a conducive environment for fintech development.

Additionally, the rise of e-commerce and online shopping is fueling the need for secure and efficient digital payment solutions. The increasing penetration of smartphones and internet connectivity is further accelerating the adoption of fintech applications. Strategic investments and partnerships between traditional financial institutions and fintech startups are fostering innovation and expanding the market reach. These factors collectively contribute to the dynamic growth of the fintech market in Southeast Asia.

South East Asia Fintech Market Scope and Growth Analysis:

The Southeast Asia market offers a broad scope for growth across various segments, including payments, lending, insurance, and wealth management. In addition, the increasing demand for seamless and secure digital payment solutions is a significant growth driver, with mobile payments and digital wallets gaining widespread popularity. The rise of alternative lending platforms is providing greater access to credit for individuals and small businesses, enhancing financial inclusion. The market is also witnessing growth in insurtech, with digital platforms offering more accessible and personalized insurance products.

Concurrently, the adoption of blockchain technology and cryptocurrencies is opening new avenues for fintech innovation. The regulatory environment is evolving to support fintech development, with governments implementing policies to ensure consumer protection and market stability. Strategic collaborations between fintech firms and technology providers are driving technological advancements and market expansion.

South East Asia Fintech Market Report Segmentation:

The market report offers a comprehensive analysis of the segments, providing a detailed South East Asia fintech market report which includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

Top Players Analysis:

The report provides a detailed analysis of the competitive environment. It covers various aspects such as market structure, positioning of key players, top strategies for success, a competitive dashboard, and a company evaluation quadrant. Furthermore, the report includes comprehensive profiles of all major companies.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=20370&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145