A digital loan or online loan refers to the process where all loan procedures starting from registration, approval to disbursal of loan even the recovery, take place remotely, typically through mobile apps. The loan amount offered to the borrowers during a financial emergency via financial institutions like banks, NBFCs, and digital-only lenders through a loan app. The entire loan availing process is done online. All you have to do is download the loan app from the Google Play Store, submit the required documents online and apply. Digital loans have gained huge popularity in the past few years, and the industry has been growing ever since then.

Some of the reasons are listed below:

- Digital lending is the most cost-effective solution.

- Many borrowers prefer online loans over the traditional ones as people now want to stay at a safe distance and keep everything touchless.

- With digitalization, people of all age groups are becoming tech-savvy; hence it becomes easier and more convenient to transact online.

- Digital loans require zero to minimal paperwork.

While availing of a digital loan, you must choose the details regarding the lender wisely so that you are not overcharged or taken advantage of during uncertain times. The online loan app can help you manage your excess expenses within a few minutes. With the increase in benefits and demand for loan apps, various lenders are now offering instant personal loans to borrowers. But, some of them are illegal and charge a huge sum of money from the borrower. Below are some of the loopholes that you must stay aware of before applying for an instant personal loan from any particular lender. Keep scrolling through to know the details:

Hidden Fees

Many online loan apps do not disclose their contact details or the fees. They usually lure customers by making the monthly payments affordable. Therefore, it is advisable to check all the terms and conditions before applying for an instant personal loan from any digital lender.

Privacy and Data Security

Keeping personal data secure is extremely important. Various mobile apps ask for your permission to access your personal data like gallery, contacts etc. Therefore, you must always pay attention to the loan apps before giving any access.

Unauthorised Lenders

To protect the borrowers from scammers or fraud apps, RBI started regulating all the reliable

loan apps. As a result, you must apply for an instant personal loan from the app that is registered with RBI and follows its rules and regulations.

Here is the checklist that can help you identify an untrustworthy digital lending app:

- Absence of loan agreement

- Loan agreement not signed by RBI registered entity

- No minimum KYC required

- Very short loan repayment tenure period

- Processing fees demands in advance

- No income verification

- Present limited deal

Conclusion:

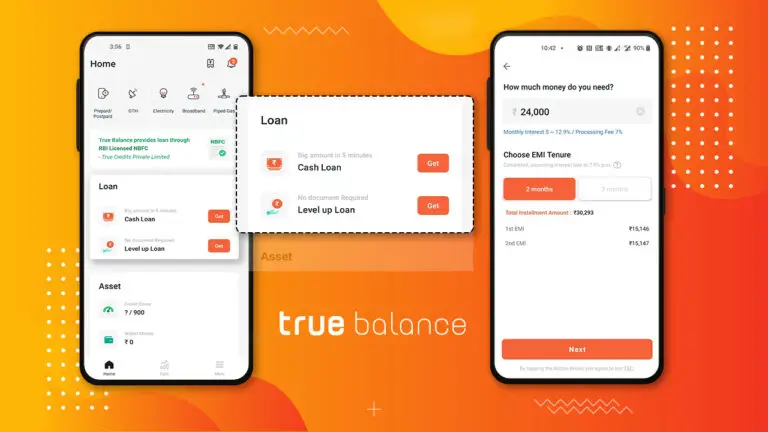

You can apply for a personal loan from the TrueBalance loan app that is available on the Google Play Store. It is a 100% reliable and safe online loan app that offers an amount of up to ₹50,000 without any collateral backup in return. You can easily avail of an instant personal loan at any hour of the day as its services are 24*7 hours available. Stay safe from all the frauds during uncertain times and avail a hassle-free loan through the TrueBalance online loan app!