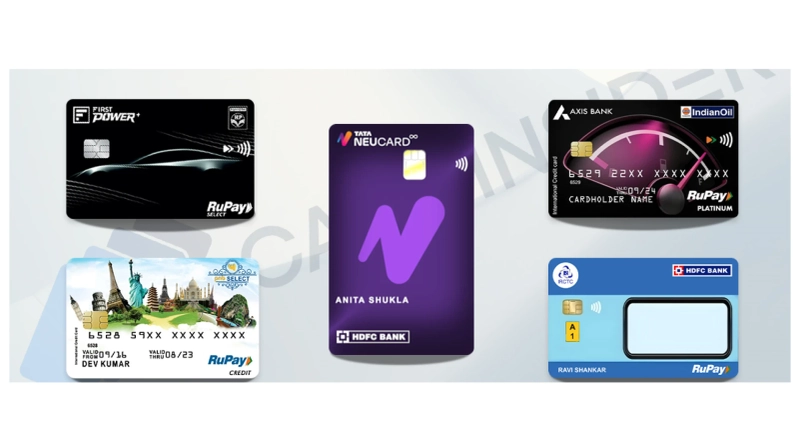

As the financial landscape in India continues to evolve, RuPay credit cards have carved a niche for themselves by offering a variety of options to cater to the diverse needs of consumers. In 2023, RuPay credit cards are set to make waves with their appealing features and benefits. Let's explore some of the top RuPay credit cards that are catching the attention of Indian consumers this year.

RuPay Platinum Credit Card: This card is a favorite among those who enjoy dining out and shopping. It offers attractive rewards on restaurant bills and retail purchases, making it an excellent choice for individuals who like to indulge in culinary experiences and retail therapy. Additionally, it provides access to airport lounges, adding a touch of luxury to your travels.

RuPay Select Credit Card: Designed for frequent travelers, the RuPay Select Credit Card comes packed with travel-related perks. Cardholders enjoy complimentary airport lounge access, comprehensive travel insurance coverage, and exclusive rewards on flight bookings and hotel stays. For those constantly on the move, this card is a valuable asset.

RuPay Classic Credit Card: If you are new to the world of credit cards and are looking to build your credit history, the RuPay Classic Credit Card is an excellent starting point. It offers essential features like fuel surcharge waivers and cashback on everyday expenses, helping you establish a positive credit profile.

RuPay NRO Credit Card: Specifically tailored for Non-Resident Indians (NRIs), this card simplifies financial transactions in India. It offers international acceptance, currency conversion facilities, and personalized services to meet the unique requirements of NRIs managing their finances from abroad.

RuPay Platinum Contactless Credit Card: In an era where contactless payments are gaining prominence, this card seamlessly combines the benefits of a RuPay Platinum card with the convenience of contactless technology. It's an excellent choice for modern consumers who prefer fast, secure, and hassle-free transactions.

When selecting the best RuPay credit card for your financial needs, consider your spending habits, lifestyle, and preferences. Each card comes with its unique set of features and rewards, so it's essential to compare them carefully. Additionally, be sure to review the eligibility criteria and associated fees to make an informed decision.

In 2023, RuPay credit cards continue to redefine financial convenience, offering a wide array of options to cater to the diverse financial goals and aspirations of Indian consumers. Whether you're a food aficionado, a frequent traveler, a newcomer to credit, or an NRI looking for seamless financial management, there's a RuPay credit card ready to elevate your financial journey.